Why It Pays to Keep an Eye on the Credit Cycle

by Ashish Shah, and Gershon Distenfeld, AllianceBernstein

Market sell-offs can be unsettling. But it’s important to keep them in perspective. The recent downturn in some credit markets is normal, given where we are in the credit cycle. It’s not evidence of a bursting bubble.

Credit cycles have distinct stages. During the expansionary period, easy access to credit helps boost earnings and prompts companies to take on debt. As those debt levels rise, so does credit risk. Asset values start to decline, causing lenders to get stingier. A rise in interest rates then usually leads to a period of contraction and balance-sheet repair and, eventually, a recovery phase.

How does this apply to what’s going on today?

Let’s look at the US high-yield market. In a recent blog, we explained why we expect defaults to rise this year—but not anywhere near as much as they did during the global financial crisis. Why? Because we don’t see this as another systemic crisis or evidence of a “high yield” bubble. This is simply what happens when the credit cycle moves from expansion into contraction.

For several years, default rates for high-yield bonds have hovered around historic lows. That was the result of rock-bottom interest rates that tempted more companies to borrow and more yield-starved investors to buy their bonds.

Another factor that drove defaults lower between 2010 and 2014 was the cleansing of the problem credits that ran into trouble following the global financial crisis.

US Energy in Contraction

Alas, nothing lasts forever. As corporate leverage rose, balance sheets started to deteriorate and lenders became more selective. Now that US interest rates have started to rise as well, many companies that binged on cheap credit no longer have such easy access to it.

High-yield energy and mining companies are already in the contraction phase of the cycle. They borrowed aggressively when commodity prices were high, only to find their margins squeezed and projects unprofitable when prices plunged. For some, bankruptcy is likely. In recent months, they’ve led the downturn in the broader US high-yield market.

Valuations in US High Yield More Attractive

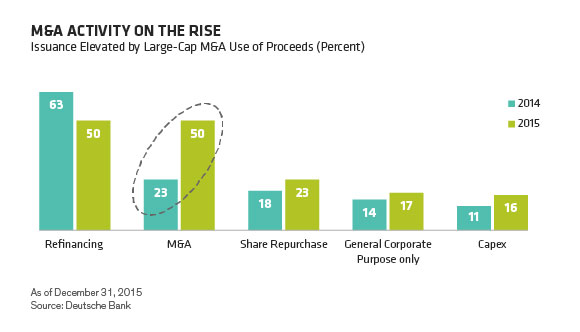

To make informed investment decisions in such volatile times, it helps to know where we are in the credit cycle. Stripped of energy-sector bonds, the US high-yield market is still in the expansion stage—but it’s getting closer to contraction. One of the clearest indicators of this is the rise in leverage to finance mergers and buyouts—a hallmark of late credit-cycle behavior (Display 1).

That doesn’t mean there aren’t values to be had in high yield. The recent volatility has pushed yields higher and left many bonds more attractively priced than they’ve been in years. For long-term investors, the beginning yield is a fairly good indicator of the sort of returns to expect over the next five years. Investors who do their credit homework and avoid the riskiest bonds may come out ahead in the long run.

Different Regions, Different Stages

What’s more, different sectors and different parts of the world are at different stages in the cycle (Display 2). Asian corporates are in contraction, but Latin American companies are in recovery mode and are repairing their balance sheets. US and European financials are in the recovery phase: leverage is decreasing, debt growth is stable and earnings before interest, taxes, depreciation and amortization (EBITDA) is on the rise.

With different markets and sectors at different stages, one of the most important things investors can do is diversify. Exposure to various regions and sectors expands the opportunity set and varies credit risk.

Volatility isn’t likely to fade any time soon. Understanding where we are in the credit cycle should help investors keep the recent turbulence in perspective—and make better decisions about which risks to take and which to avoid.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Head—Global Credit

Ashish Shah is Head of Global Credit and a Partner at AllianceBernstein. He is also a member of the Absolute Return portfolio-management team. Prior to joining the firm in 2010, Shah was a managing director and head of Global Credit Strategy at Barclays Capital, where he was responsible for the High Grade, High Yield, Structured Credit and Municipal Strategy Groups, and the Special Situations Research team. Prior to that, he served as the head of Credit Strategy at Lehman Brothers, leading the Structured Credit/CDO and Credit Strategy Groups and covering the cash bond, credit derivatives and CDO product areas for global credit investors. Before that, Shah served as North American CFO at Level 3 Communications from 1999 to 2000 and gained trading experience at Soros submanager Blue Border Partners and at Bankers Trust, where he ran US equity arbitrage from 1994 to 1999. He holds a BS in economics from the Wharton School at the University of Pennsylvania. Shah has long been committed to diversity issues and has led several key diversity-related initiatives across the firm. Location: New York

Director—High Yield

Gershon M. Distenfeld is Senior Vice President and Director of High Yield, responsible for all of AllianceBernstein’s US High Yield, European High Yield, Low Volatility High Yield, Flexible Credit and Leveraged Loans strategies. He also serves on the Global Credit, Canadian and Absolute Return fixed-income portfolio-management teams, and is a senior member of the Credit Research Review Committee. Additionally, Distenfeld co-manages the High Income Fund and two of the firm’s Luxembourg-domiciled funds designed for non-US investors, the Global High Yield and American Income Portfolios. He has authored a number of published papers and initiated many blog posts, including “High Yield Won’t Bubble Over,” one of the firm’s most-read blogs. Distenfeld joined the firm in 1998 as a fixed-income business analyst. He served as a high-yield trader from 1999 to 2002 and as a high-yield portfolio manager from 2002 until 2006, when he was named to his current role. Distenfeld began his career as an operations analyst supporting Emerging Markets Debt at Lehman Brothers. He holds a BS in finance from the Sy Syms School of Business at Yeshiva University and is a CFA charterholder. Location: New York

Related Posts

Copyright © AllianceBernstein