by Don Vialoux, Timingthemarket.ca

Editor’s Note: Next Tech Talk report will be released on Monday February 1st

Economic News This Week

November Case/Shiller 20 City Home Price Index to be released at 9:00 AM EST on Tuesday is expected to increase on a year-over-year basis to 5.8% from 5.5% in October.

January Consumer Price Index to be released at 10:00 AM EST on Tuesday is expected to increase to 96.8 from 96.5 in December

December New Home Sales to be released at 10:00 AM EST on Wednesday are expected to increase to 506,000 units from 490,000 units in November.

FOMC decision on the Fed Fund rate to be released at 2:00 PM EST on Wednesday is expected to maintain the Fed Fund Rate at 0.5%.

Weekly Initial Jobless Claims to be released at 8:30 AM EST on Thursday are expected to slip to 285,000 from 293,000 last week.

December Durable Orders to be released at 8:30 AM EST on Thursday are expected to slip 0.5% versus no change in November. Excluding Transportation, Orders are expected to slip 0.1% versus no change in November.

First estimate of Annualized Fourth Quarter Real GDP to be released at 8:30 AM EST on Friday is a gain of 0.9% versus a gain of 2.0% in the third quarter.

Canadian November GDP to be released at 8:30 AM EST on Friday is expected to increase 0.3% versus no change in October.

January Chicago PMI to be released at 9:45 AM EST on Friday is expected to improve to 45.0 from 42.9 in December.

January Michigan Sentiment Index to be released at 10:00 AM EST on Friday is expected to improve to 93.2 from 92.6 in December.

Earnings News This Week

The Bottom Line

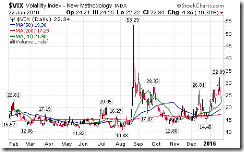

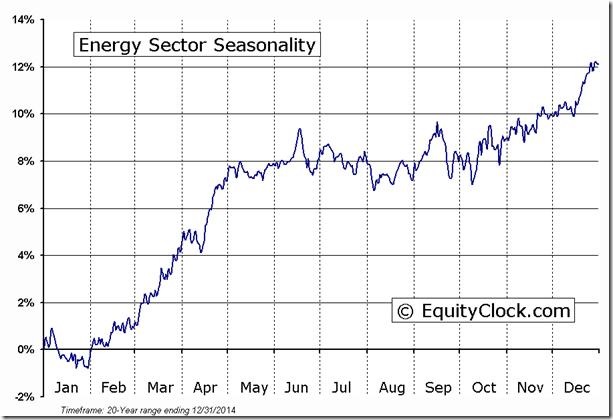

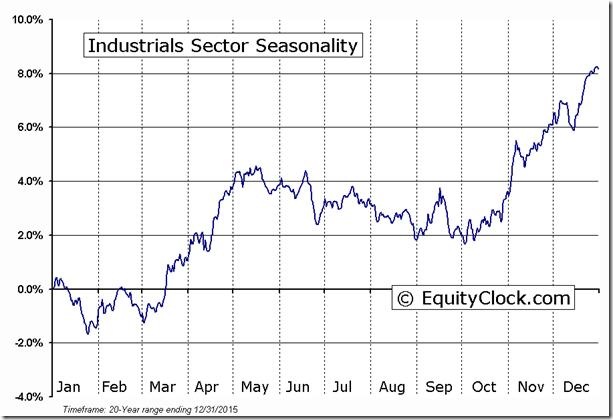

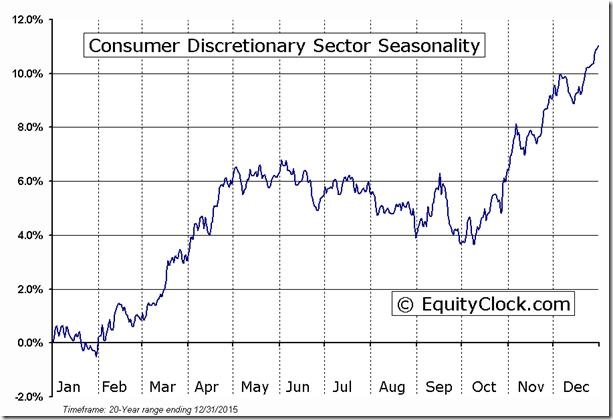

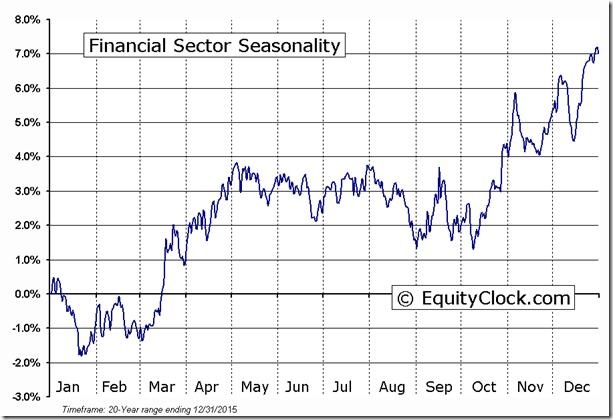

Early signs of a bottom in most equity indices, commodities and sectors appeared late last week thanks to a positive momentum spurt. Encouraging economic news and likely calming comments from the Fed this week could support additional strength. Offsetting will be difficult fourth quarter reports comparing year-over-year results impacted primarily by the elevated U.S. Dollar Index. Look for volatility to remain elevated. However, a steady decline in the VIX following a volatility spike is a bullish scenario that frequently leads to development of an intermediate (3-6 month) uptrend. More technical information is needed to confirm that an intermediate low has been reached. Meanwhile, now is a good time to line up equities to be purchased when favoured seasonal trades primarily in economically sensitive sectors (e.g. Industrials, Consumer Discretionary, Financials, Materials, Energy) when sufficient technical evidence becomes available. All resume a period of seasonal strength in late January. Seasonality charts for each sector are included near the end of this report.

Equity Indices

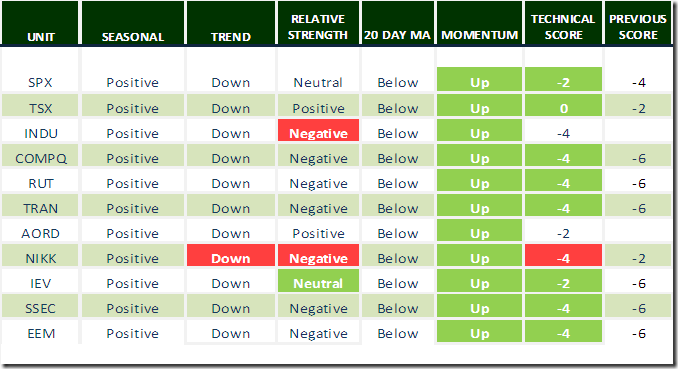

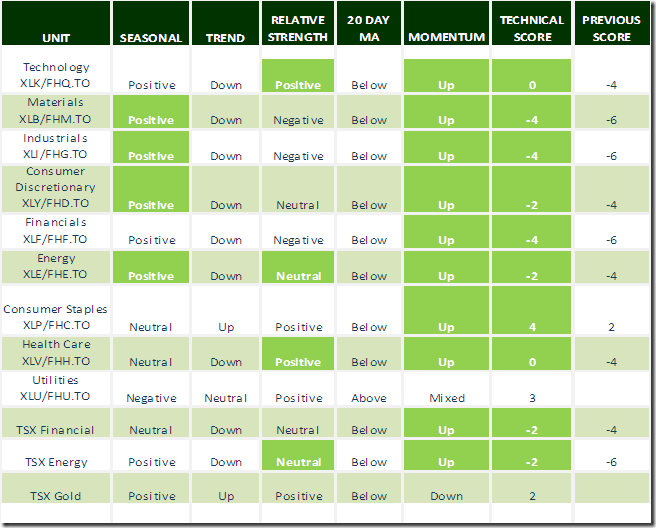

Technical scores for indices, commodities and sectors generally gained across the board on Friday thanks to a massive change in short term momentum indicators (Stochastic, RSI, MACD) from a downtrend to an uptrend.

Daily Seasonal/Technical Equity Trends for January 22nd 2016

Green: Increase from previous day

Red: Decrease from previous day

The S&P 500 Index surprisingly added 26.61 points (1.42%) last week despite greater than average volatility. Intermediate trend remains down. The Index remains below its 20 day moving average. Short term momentum indicators turned higher on Friday.

Percent of S&P 500 stocks trading above their 50 day moving average increased last week to 17.80% from 11.40% after reaching a low of 9.00%. Percent is intermediate oversold and showing early signs of bottoming.

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 24.80% from 21.40% after reaching a low of 19.20%. Percent is intermediate oversold and showing early signs of bottoming.

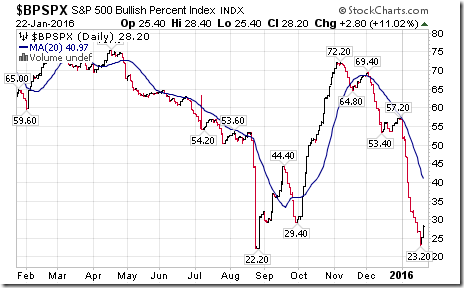

Bullish Percent Index for S&P 500 stocks improved last week to 28.20% from 26.80%, but remained below its 20 day moving average. The Index is intermediate oversold and showing early signs of bottoming.

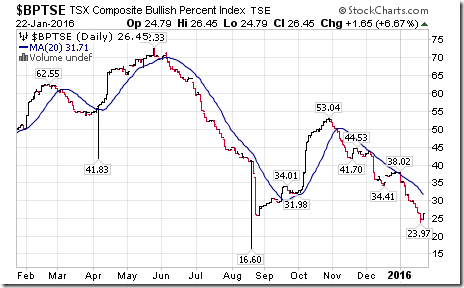

Bullish Percent Index for TSX stocks slipped last week to 26.45% from 28.10% and remained below its 20 day moving average. The Index remains intermediate oversold.

The TSX Composite Index gained 316.12 points (2.62%) last week. Intermediate trend remains down (Score: -2). Strength relative to the S&P 500 Index remains positive (Score: 2). The Index remains below its 20 day moving average. (Score: -1). Short term momentum indicators started trending higher on Friday (Score: 1). Technical score improved last week to 0 from -2.

Percent of TSX stocks trading above their 50 day moving average increased last week to 24.17% from 11.16% after reaching a low of 7.85%. Percent is intermediate oversold, but showing early signs of bottoming.

Percent of TSX stocks trading above their 200 day moving average increased last week to 21.67% from 17.36% after reaching a low of 13.64%. Percent is intermediate oversold and showing early signs of bottoming.

The Dow Jones Industrial Average gained 105.43 points (0.66%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed to negative from neutral. The Average remained below its 20 day moving average. Short term momentum indicators started to trend up on Friday. Technical score remained at -4.

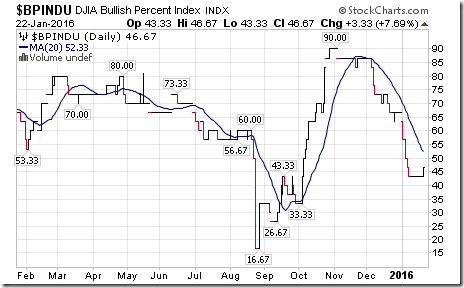

Bullish Percent Index for Dow Jones Industrial Average stocks increased last week to 46.67% from 43.33%, but remained below its 20 day moving.

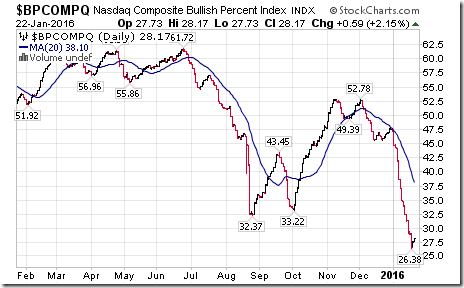

Bullish Percent Index for NASDAQ Composite stocks slipped last week to 28.17% from 29.08% and remained below its 20 day moving average. The Index remains intermediate oversold.

The NASDAQ Composite Index gained 102.76 points (2.29%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to -4 from -6.

The Russell 2000 Index gained 12.92 points (1.28%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to -4 from -6.

The Dow Jones Transportation Average added 89.48 points (1.34%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Average remains below its 20 day moving average. Short term momentum indicators turned higher on Friday. Technical score improved last week to -4 from -6.

The Australia All Ordinaries Composite Index gained 21.10 points (0.43%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains positive. The Index remains below its 20 day moving average. Short term momentum indicators are trending down and are oversold. Technical score remained at -2.

The Nikkei Average dropped 188.58 points (1.10%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed to negative from neutral. The Average remains below its 20 day moving average. Short term momentum indicators are mixed and oversold.

Europe 350 iShares added $0.92 (2.53%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index improved to neutral from negative. Units remain below their 20 day moving average. Short term momentum indicators started to trend higher on Friday. Technical score improved last week to -2 from -6.

The Shanghai Composite Index added 15.59 points (0.54%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index remains below its 20 day moving average. Short term momentum indicators are oversold and mixed.

Emerging Market iShares added $0.88 (3.09%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. Units remain below their 20 day moving average. Short term momentum indicators started to trend higher on Friday. Technical score improved to -4 from -6.

Currencies

The U.S. Dollar Index added 0.58 (0.59%) last week. Intermediate trend remains up. The Index remains its 20 day moving average. Short term momentum indicators are trending up.

The Euro slipped 1.19 (1.09%) last week. Intermediate trend remains down. The Euro remains below its 20 day moving average. Short term momentum indicators are mixed.

The Canadian Dollar jumped US 1.96 cents (2.85%) last week. Intermediate trend remains down. The Canuck Buck remains below it 20 day moving average. Short term momentum indicators are trending up.

The Japanese Yen dropped 1.25 (1.46%) last week. Intermediate trend remains neutral. The Yen fell below its 20 day moving average on Friday. Short term momentum indicators are trending down.

Commodities

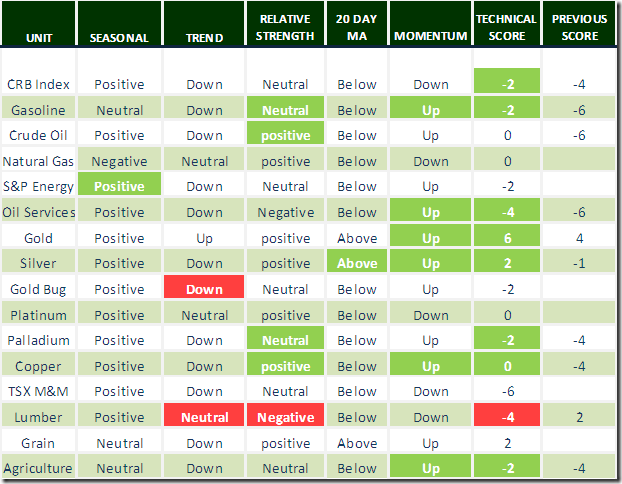

Daily Seasonal/Technical Commodities Trends for January 22nd 2016

Green: Increase from previous day

Red: Decrease from previous day

The CRB Index added 3.87 points (2.42%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains neutral. The Index remains below its 20 day moving average. Short term momentum indicators started to trend higher on Friday. Technical score improved last week to -2 from -4.

Gasoline gained $0.05 per gallon (4.76%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index improved to neutral from negative. Gas remains below its 20 day moving average. Short term momentum indicators started trending up on Friday. Technical score improved to -2 from -6.

Crude Oil gained $1.86 per barrel (6.12%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index turned positive on Friday. Crude remains below its 20 day moving average. Short term momentum indicators started to trend higher on Friday. Technical score improved last week to -2 from -6.

Natural Gas added $0.03 per MBtu (1.43%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index remains positive. “Natty” remains below its 20 day moving average. Short term momentum indicators are down. Technical score remained unchanged last week at 0

The S&P Energy Index added 7.83 points (1.91%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains neutral. The Index remains below its 20 day moving average. Short term momentum indicators started to turn positive on Friday. Technical score remained at -2.

The Philadelphia Oil Services Index added 2.93 points (2.15%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index remains below its 20 day moving average. Short term momentum indicators turned positive on Friday. Technical score improved last week to -4 to -6.

Gold added $7.50 per ounce (0.69%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains positive. Gold remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 6 from 4.

Silver added $0.12 per ounce (0.86%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains positive. Silver moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 2 from -1

The AMEX Gold Bug Index added 0.13 (0.12%) last week. Intermediate trend changed to down from neutral on a move below 102.96. Strength relative to the S&P 500 Index remains neutral. The Index remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score remains at -2.

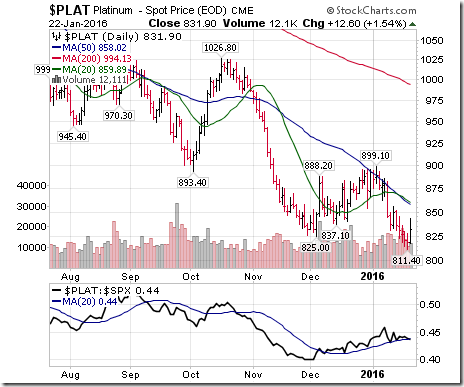

Platinum added 4.40 per ounce (0.53%) last week. Intermediate trend remains down. Relative strength remains positive. PLAT remains below its 20 day MA. Technical score remains at 0

Palladium gained $9.05 per ounce (2.00%) last week. Intermediate trend remains down. Relative strength improved to neutral from negative. PALL remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score: -2 from -4

Copper gained $0.06 per lb. (3.09%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed to positive from neutral. Copper remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 0 from -4.

The TSX Metals & Mining Index added 1.40 points (0.55%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score remained at -6.

Lumber dropped $10.30 (4.19%) last week. Intermediate trend changed to neutral from up on a move below 237.00. Relative strength turned negative. Lumber remains below its 20 day MA

The Grain ETN added $0.31 (1.01%) last week. Trend remains down. Strength relative to the S&P 500 Index remains positive. Units remained above their 20 day moving average. Short term momentum indicators are trending higher.

The Agriculture ETF added $0.26 (0.61%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains neutral. Units remain below their 20 day moving average. Short term momentum indicators turned higher on Friday. Technical score improved last week to -2 from -4.

Interest Rates

Yield on 10 year Treasuries added 1.5 basis points (0.74%) last week. Intermediate trend remains up. Yield remains below its 20 day moving average. Short term momentum indicators are trending up.

Conversely, price of the long term Treasury ETF slipped 0.41 (0.33%) last week. Units remain above their 20 day moving average.

Other Issues

The VIX Index slipped 4.64 (17.20%) last week after reaching a high of 32.09 on Wednesday. Intermediate trend remains up. The Index remains above its 20 day moving average.

Short and intermediate technical indicators for most indices, commodities and sectors are oversold and show early signs of bottoming.

Economic news this week is expected to be positive (Consumer confidence, New home sales, Chicago PMI, Michigan Sentiment). Focus is on the FOMC meeting on Tuesday. Best guess is the Fed will imply a postponement in another increase in the Fed Fund rate due to increasing volatility in world equity markets.

Earnings are a focus this week. This week is the biggest week for release of fourth quarter results including reports by 136 S&P 500 companies and 12 Dow Jones Industrial Average companies. Consensus for S&P 500 companies is a year-over-year decline of 6.0% in earnings per share and 3.5% in revenues. According to FactSet, 15% of S&P 500 companies have reported to date with 75% reporting higher than consensus earnings per share and 49% reporting higher than consensus revenues. In addition, 10 S&P 500 companies have issued negative first quarter guidance and one company has issued positive first quarter guidance.

According to FactSet, the earnings and revenue picture for S&P 500 companies in 2016 shows significant improvement. On a year over year basis, earnings per share are expected to increase 5.9% and revenues are expected to show a gain of 3.4%. Gains are backloaded as the year progress. Consensus estimates show quarter over quarter earnings results of -1.7% in the first quarter, +2.3% in the second quarter, +6.5% in the third quarter and 14.4% in the fourth quarter. Consensus estimates for revenues show +1.5% in the first quarter, +2.3% in the second quarter. +3.6% in the third quarter and +6.5% in the fourth quarter.

Sectors

Daily Seasonal/Technical Sector Trends for January 22nd 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following are examples:

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca