The Active Investing Advantage Depends on Three Fund Manager Traits During Bear Markets – Research

Excerpted from Capital Group

Selecting Managers Who Have Delivered Better Retirement Outcomes

To meet the financial challenges of retirement, investors will need investments that can provide a sustainable income stream while demonstrating relative resilience during market declines.

Downside capture ratio compares a funds return with an indexs during periods when the index return was negative. In other words, a lower downside capture ratio indicates that the fund did better in declining markets.

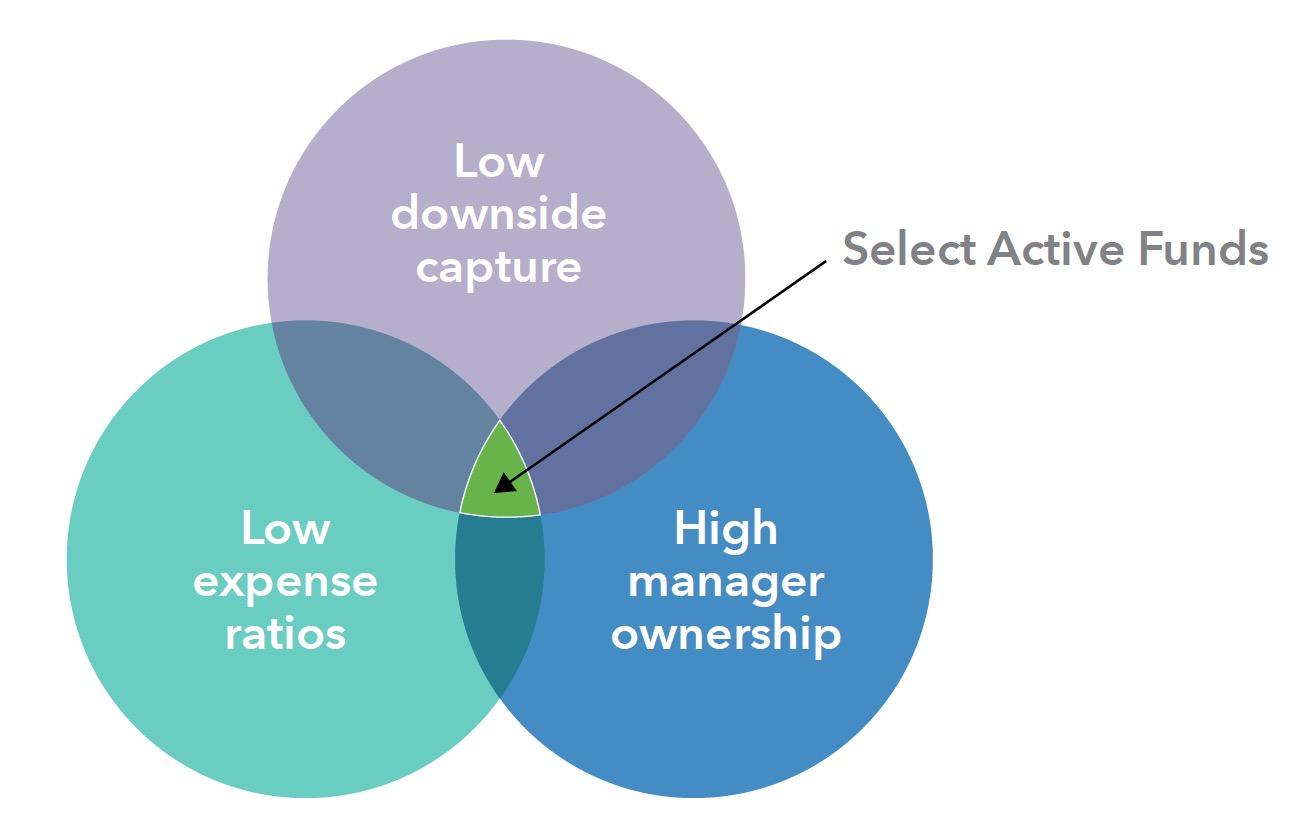

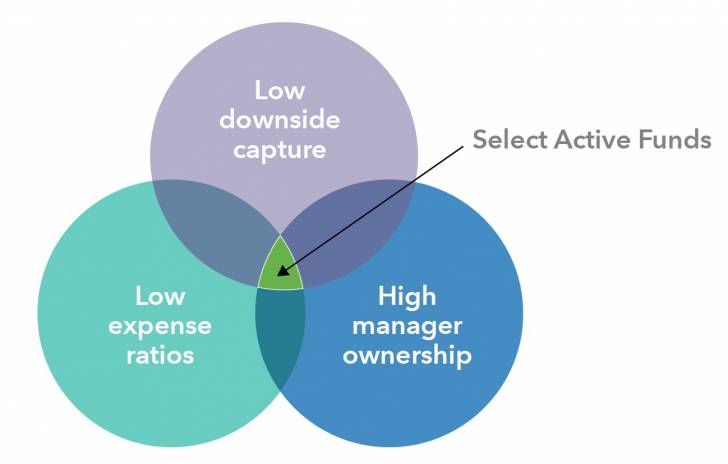

New research on mutual funds available in the U.S. found that actively managed funds sharing three traits low downside capture ratio, low expenses and high firm manager ownership consistently outpaced benchmark indices and the broader equity fund universe in the distribution phase.

Funds That Met Three Criteria Outpaced Indices and Active Peers in Our Research

Each trait added value on its own for our study, but the combination was particularly powerful in boosting results versus indices.

Source: Morningstar U.S. database of large-cap actively managed funds. Across each fund category, the research ranked the funds by downside capture, net

expense ratios and manager ownership.

Read/Download the complete report below:

Copyright © Capital Group