Albert Einstein

Jeffrey Saut, Chief Investment Strategist, Raymond James

“We can’t solve problems by using the same kind of thinking we used when we created them.”

. . . Albert Einstein

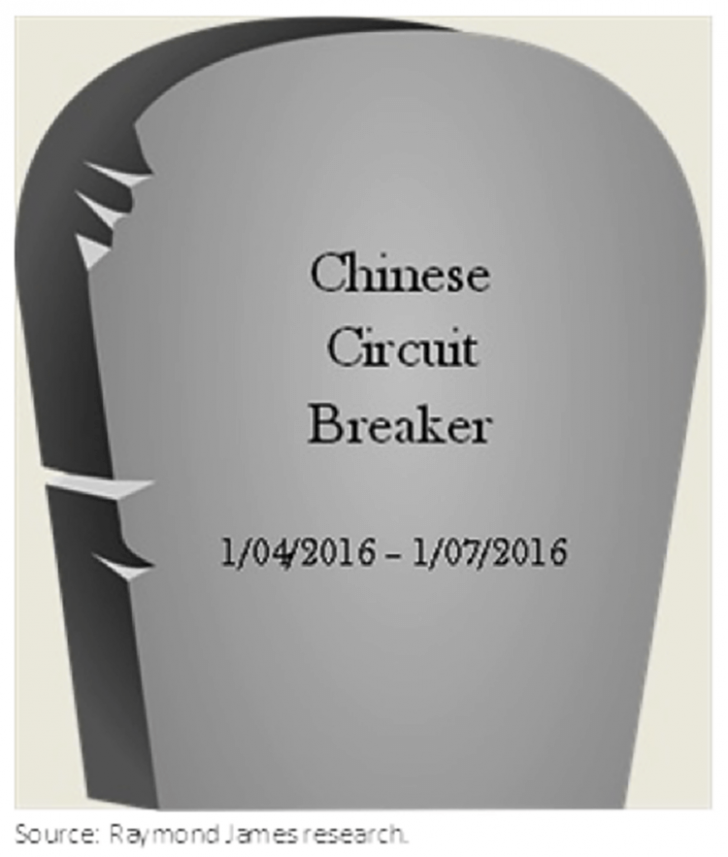

I thought about Einstein’s quote, “We can’t solve problems by using the same kind of thinking we used when we created them” when the Chinese abandoned their stock market circuit breakers system on Thursday (1-7-16) at 9:30 a.m. (EST) after just putting them in place on Monday (1-4-16). Said system halted stock trading for 15 minutes when the Chinese stock market declined 5% last Monday and after the quarter of an hour halt stocks reopened. When stocks reopened that day, the markets slid off ~7%, triggering another trading halt for the rest of the session. Evidentially, the Chinese realized “We can’t solve problems by using the same kind of thinking we used when we created them” pretty quickly, a lesson we should all probably learn. The Einstein quote also resonated with me while watching a stunning interview on CNBC with former Dallas Fed president Richard Fisher when he stated, "It’s not China, what the Fed did, and I was part of it, was front-loaded an enormous market rally in order to create a wealth effect . . . and an uncomfortable digestive period is likely now." See the interview here (second video) (http://www.zerohedge.com/news/2016-01-05/we-frontloaded-tremendous-market-rally-former-fed-president-admits-warns-no-ammo-lef).

It was three weeks ago today, when my call for a Santa rally didn’t play, that I resurrected a line from the movie Star Wars that I had used in a report on September 10, 2001, the day before the World Trade Center twin towers fell, which read, “I felt a great disturbance in the force . . . as if millions of voices suddenly cried out in terror and were suddenly silenced. I fear something terrible has happened.” The quip went on to read:

Clearly a line uttered by Obi Wan Kenobi in the movie Star Wars, but how appropriate given our sense that for the past few weeks that something is/was out of balance in the universe. Whether it is an Argentine default, another Long-Term Capital Management (LTCM) hedge fund debacle, a Japanese banking implosion, etc. is not really the point. The point is something is out of balance in the cosmos!

Fast forward because something felt out of balance in mid-December of 2015 and boy has that come to pass. Clearly, there is currently a cornucopia of “out of balance” news bashing the markets. Korea’s potential hydrogen bomb, slowing economic statistics here (Richard Fisher), Chinese conflagrations, saber rattling between Saudi Arabia and Iran, and the list goes on. But while most seers are focused on China as the causa proxima for the stock market’s recent rout, I remain more worried about Saudi Arabia’s clash with Iran after the Saudis’ execution of 47 Shias. As written last week:

Fast forward because something felt out of balance in mid-December of 2015 and boy has that come to pass. Clearly, there is currently a cornucopia of “out of balance” news bashing the markets. Korea’s potential hydrogen bomb, slowing economic statistics here (Richard Fisher), Chinese conflagrations, saber rattling between Saudi Arabia and Iran, and the list goes on. But while most seers are focused on China as the causa proxima for the stock market’s recent rout, I remain more worried about Saudi Arabia’s clash with Iran after the Saudis’ execution of 47 Shias. As written last week:

At the vortex of the crisis is not necessarily Saudi King Salman, but his 31-year old son (Saudi Arabia's Defense Minister Prince Mohammad bin Salman) who seems to be calling the “shots.” It was he that confronted Yemen, obviously forgetting Saudi Arabia’s stunning defeat by Yemen in the 1960s; and, maybe that’s why he is being called Prince Reckless. I think this has far more potential impact for the world than China’s 0.4 of a point decline (48.2 from 48.6) in PMI.

For whatever the “out of balance” reason, the equity markets have staged their worst start of the year EVER, bringing about cries, “So goes the first week of the year, so goes the month, and so goes the year (read: The January Barometer). For the week, the S&P 500 (SPX/1922.03) surrendered 5.96% and in the process broke below its December closing low of 2005.55. This is not an unimportant point because “The December Low Indicator” has a decent track record. Every year at this time I not only address The January Barometer, but “The December Low Indicator," which I learned from my mentor Lucien Hooper. It was back in the early 1970s, when I was working on Wall Street that I encountered Lucien. At that time Lucien, then in his 70s, was considered one of the savviest "players" in this business. While known for many market axioms and insights, the one that stuck with me was his "December low indicator." It seems like only yesterday we were sitting at Harry's at the Amex Bar & Grill having lunch when he explained it. "Jeff," he began, "Forget all the noise you hear about the January Barometer; pay much more attention to the December low. That would be the lowest closing price for the Dow Jones Industrial Average during the month of December. If that low is violated during the first quarter of the New Year, watch out!"

So, both The January Barometer and The December Low Indicator are on “sell signals.” In retrospect, maybe I was dead wrong in ignoring the Dow Theory “sell signal” that occurred on August 25, 2015 because the D-J Transportation Average (TRAN/6946.36) has traveled below its August closing low of 7466.97. If the D-J Industrial Average (INDU/16346.45) does the same, and closes below its respective August 25, 2015 closing low of 15666.44, I will be forced to honor these “sell signals.”

As for the “here and now,” last week I began suggesting that we could be in one of these “selling stampedes” that tend to last 17 – 25 sessions, with only 1.5- to three-day pauses/throwback rallies, before they exhaust themselves on the downside. In Friday’s closing verbal comments I also said that it was too soon to tell yet if this is such a stampede, but “Never on a Friday.” The reference was that once the markets get into one of these weekly downside skeins, they rarely bottom on a Friday. Nope, they typically give participants over the weekend to brood about their losses and then they show up the next Monday in “sell mode” leading to Turning Tuesday. I did add that maybe last Friday’s much better than expected employment report might prove my mantra wrong this time, but still “Never on a Friday” has saved me a lot of money over the years as it did once again last Friday. I will say that early this week we are set up for at least a 1.5- to three-session rally since the McClellan Oscillator is about as oversold as it ever gets; only ~23% of the stocks in the SPX are above their respective 200-day moving averages (DMAs), and just ~12% of the SPX’s stocks are above their 50-DMAs. So, the markets are “spring loaded” for at least a throwback rally attempt. In that attempt it will be important to measure the market’s internal metrics to determine if this is just a 1.5- to three-day affair, or something more.

The call for this week: This week should tell us if we are in a 17- to 25-session “selling stampede,” or if we are making a sustainable low. I would note that in election years there is a tendency to sink a low in the January/February timeframe leading to a rally into the spring. The set-up in the eighth year of the election cycle also calls for two selling waves. That would be consistent with a 1.5- to three-session throwback rally sometime this week followed by another selling wave into the normal 17- to 25-session duration of a “selling stampede” and today would be day 8. This morning China’s currency has stabilized, but its stock market “melts” again. However at 5:30 a.m. our preopening S&P futures are better by 5 points, so I will leave you with two other quotes from Albert Einstein: “A person who never made a mistake never tried anything new” and “If we knew what it was we were doing, it would not be called research, would it?”

Copyright © Jeffrey Saut, Chief Investment Strategist, Raymond James