The Not So Great White North

by Macro Man

You know that you're in bad shape when your offer to decamp to the spare room is met with a "if you don't, I will" response. Such is the early going in 2016 for Macro Man and Macro Boy the Elder, and if readers are already bored by your author moaning about how bad he feels, please trust him that he's even more bored of providing fodder for the complaints.

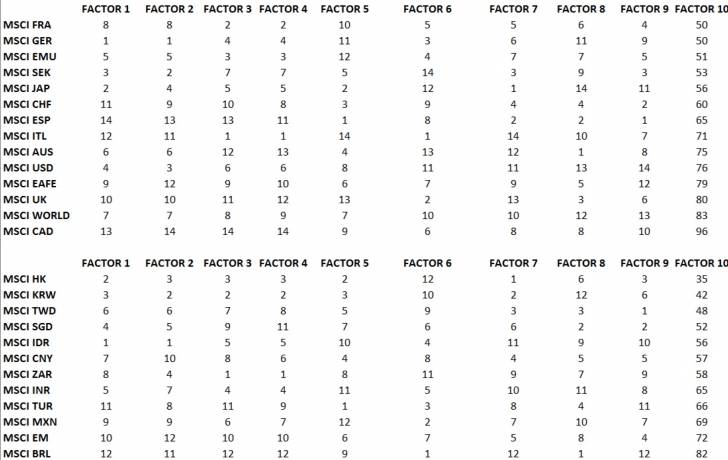

Given that it's a new year, Macro Man thought that he'd re-run his equity screener to see if any fresh developments had emerged. As it turns out, the answer is "not really." It still loves European equities and still hates Brazil. Plus ca change.... Macro Man was intrigued to note, however, that Canadian equities got the lowest rating in the developed market cohort despite the putative comparative advantage offered by the weak Canadian dollar.....

Of course, how weak you think the Canadian dollar might be depends a lot upon your perspective. For a skier choosing between France, Switzerland, Colorado, or the Canadian Rockies, clearly the latter offers a comparative price advantage, rendering the CAD dirt-cheap. For those of us with plenty of gray hair, on the other hand, who can recall the secular dollar bull market of the late 1990's, current CAD valuations are far from outstandingly cheap. After all, USD/CAD spent five and a half years (1998-2003) above current levels. Perhaps coincidentally (or not!) that beginning of that period also coincided with a fierce downdraft in energy prices.

For fun, Macro Man ran a little regression model on USD/CAD using just two independent variables: the oil price, and the spread in 2y2y swap rates between the US and Canada. He used the entire 20 year history as the in-sample period, as he's not trying to build a super-robust trading model here, but rather trying to get a general sense of the level of CAD over/under valuation.

As you'd expect with such a large window and so few variables, there are occasionally periods of large deviations between the model and the spot rate. Overall, however, the model works pretty well, with an r-squared of 0.83 (though admittedly this is regressing levels rather than changes.)

What's particularly interesting to note is that over the last year or so, these two factors (oil and rate differentials):

a) basically explain all of the price action in USD/CAD

b) suggest current CAD valuations are pretty fair.

Obviously, a more robust model would look at something like a dynamically-weighted CAD export price index, which would probably improve the performance over the first 10 years of the study.

So while selling the chalet in Verbier to buy the ski lodge in Whistler may indeed be an excellent trade (though surely one needs to hedonically adjust for travel?), Macro Man is hard pressed to see that USD/CAD is yet a fade as an FX punter. To make that call, you essentially have to believe that oil will sustainably bounce or that the US rate premium over Canada (which already drastically undersells the amount of Fed tightening vis-a-vis the dot plot) has way too much Fed baked into cake.

For now, Macro Man isn't willing to put his name (or his money) behind either one of those propositions.

Copyright © Macro Man