by Don Vialoux, Timingthemarket.ca

StockTwits Released Yesterday @equityclock

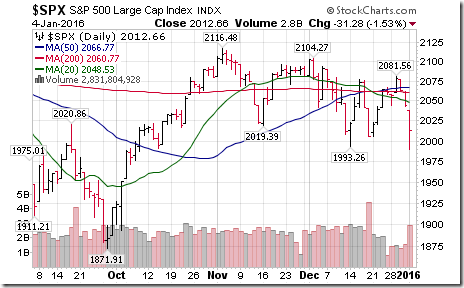

January and February are the weakest two months of the six month positive seasonal trend for stocks. equityclock.com/2016/01/02/… $SPX $SPY

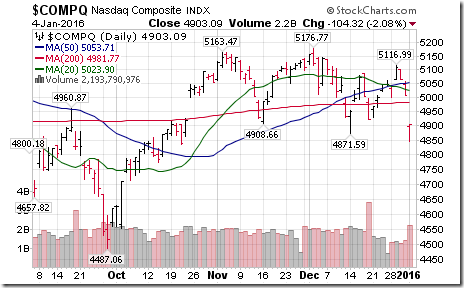

Technical action by S&P 500 stocks to 10:30: Bearish. 47 stocks broke support. Prominent on the list were Financial and Technology stocks.

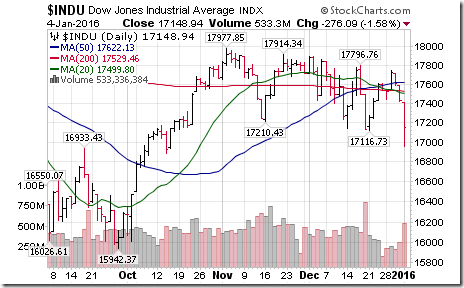

The Dow Jones Industrial Average, NASDAQ Composite Index, Russell 2000 Index and related ETFs broke support this morning. $DIA $QQQ, $IWM

Editor’s Note: The S&P 500 Index also broke support at 1993.26 set three weeks ago before recovering in late trading.

Notable Cdn. stocks below support are banks: $BMO.CA $NA.CA $CM.CA $ZEB.CA

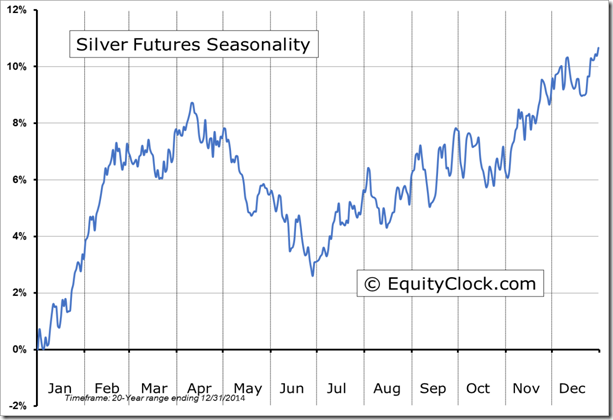

Gold/Silver stocks stronger. Selected stocks breaking to new highs. $SMF.CA $DGC.CA

‘Tis the season for strength in silver and silver stocks!

Trader’s Corner

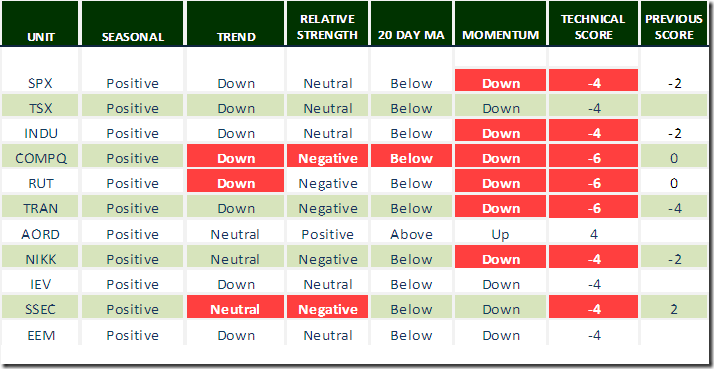

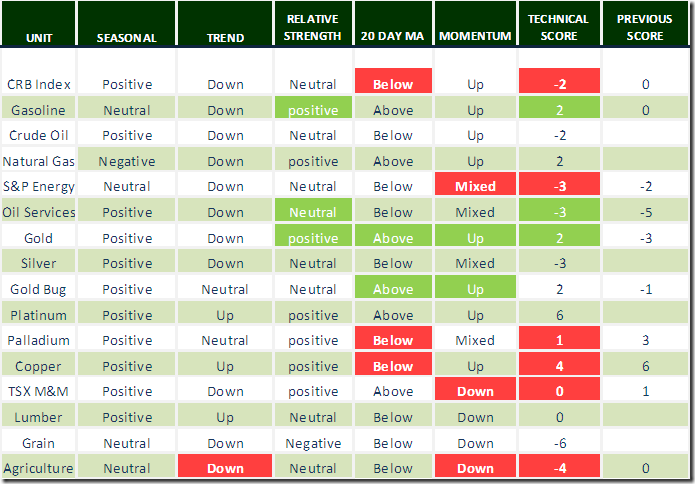

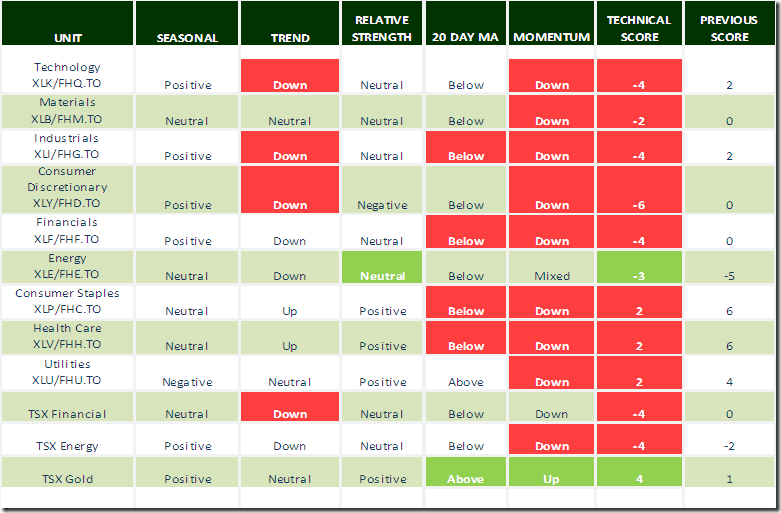

Technical scores dropped significantly yesterday for most equity markets and sectors, but improved nicely for precious metals and precious metal stocks. Drops in momentum scores were most notable.

Daily Seasonal/Technical Equity Trends for January 4th 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Commodities Trends for January 4th 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for January 4th 2016

Green: Increase from previous day

Red: Decrease from previous day

Interesting Charts

Weakness in the Chinese equity market triggered a world-wide selloff in equities. The following chart is representative of the performance of Chinese “A” shares

The VIX Index spiked in response to greater uncertainty.

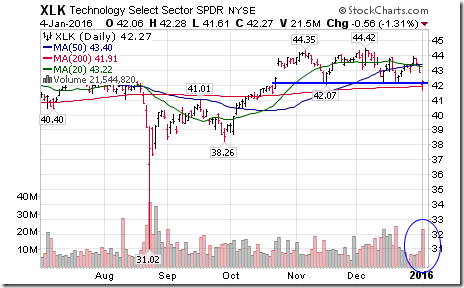

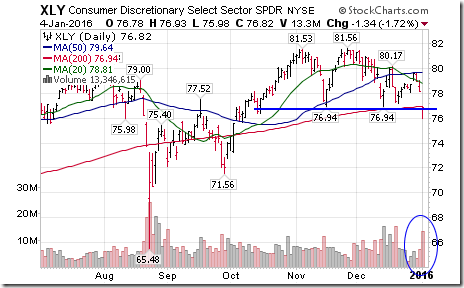

Technology and Consumer Discretionary ETFs completed Head & Shoulders patterns

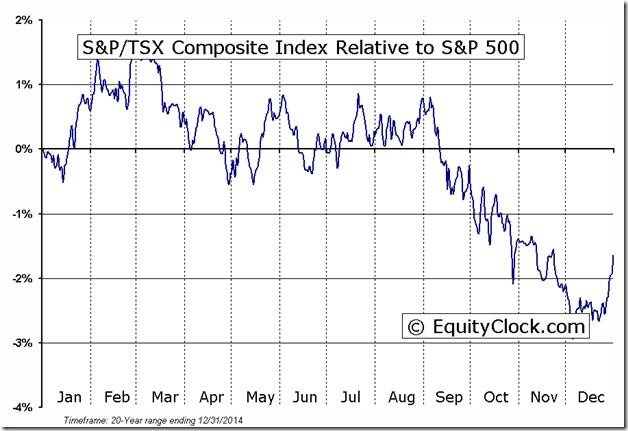

The TSX Composite Index also was hit, but favourable seasonal influences curtailed the loss. The Index continues to outperform the S&P 500 Index

FP Trading Desk Headline

FP Trading Desk headline reads, “How important is January to the stock market”? Following is a link:

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca