Marketing Your Firm's Brand Change

by Commonwealth Financial Network

Whether it’s a small adjustment, a total overhaul, or something in between, there are many reasons you might consider changing your firm’s brand. Of course, you should fully examine the reasons for the change to ensure that it makes good business sense. But once you’ve decided to move in this new direction, the next question to ask is, “What are the most effective ways of marketing your firm's brand change?”

Whether it’s a small adjustment, a total overhaul, or something in between, there are many reasons you might consider changing your firm’s brand. Of course, you should fully examine the reasons for the change to ensure that it makes good business sense. But once you’ve decided to move in this new direction, the next question to ask is, “What are the most effective ways of marketing your firm's brand change?”

To help answer this question, I thought it would be useful to look at some examples of brand change, as well as how to market through a transition and ways to communicate this change to your clients and prospects.

Deciding to focus on a niche isn’t an overnight decision. Rather, it tends to happen organically over time as you find success with a target market and decide to concentrate your marketing efforts in that area. In a sense, it’s not really a change at all but a realization of your focus.

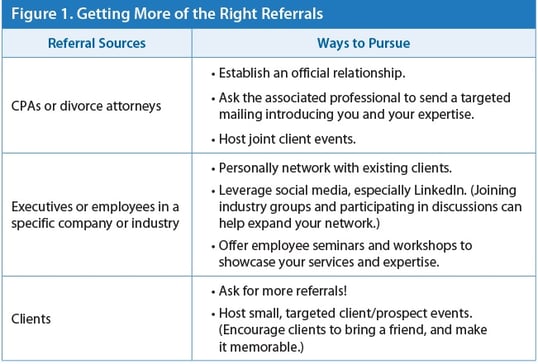

To determine the type of marketing efforts you should pursue, think about the activities and collateral you originally used to attract your existing clients—and then do it again in a more focused way.

- Did a specific prospect mailing or client event resonate with your target niche more than others?

- Did many of those clients come from a specific referral source?

By taking a close look at your book, you will be able to identify your key referral sources and find ways to cultivate them (see Figure 1).

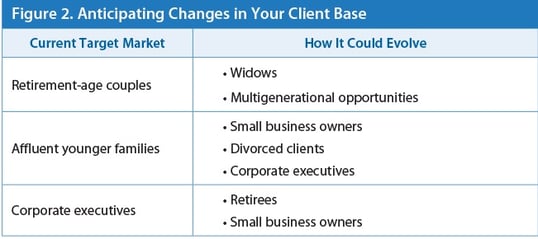

Keep in mind that this is just a starting point. You’ll need to review your results on a regular basis, as your client base will shift over time. As much as you may focus on a specific market, time and any number of changing economic conditions make it imperative to stay flexible and ready to address the evolving needs of your client base (see Figure 2). You may also find that an industry or region you were previously successful in no longer provides the same opportunities it once did (and vice versa).

By adapting your marketing efforts to serve the clients you have and want more of, you’re more likely to keep them as clients through their own changing circumstances.

Whether it’s a retirement, a merger, or an effort to more closely align with your target market, there are many reasons you might want to change your business’s name. When considering a change, first evaluate the brand equity your firm has in its current name and logo and the impact a rebranding could have. Changing from James Smith Financial to Smith & Co. Wealth Management, for instance, would be a much smaller shift than changing from James Smith Financial to Wellness Financial.

Before you proceed with a name change, it’s essential to do your due diligence. Is your new name available? Appropriate? As a starting point, search Google and state and local listings of registered names. Remember, the process for selecting your new name is important, but it’s how you communicate it that really matters.

Existing clients. Your current client base can be a great source of feedback on your decision to adjust or overhaul your name, brand, or services. And as a referral source, you want them to continue to be brand champions. Communicating a change can be an opportunity to further define your ideal clients and the types of referrals you’re hoping to receive.

- Think about how big the change you’re making will appear to your clients.

- Major: Taking on new staff to support clients in a niche that's no longer your focus

- Minor: Changing the firm’s name to reflect a growing advisor group versus a sole proprietor (e.g., James Smith Financial becomes Smith & Co. Wealth Management)

- Clearly explain the reason for the change and any impact to the service that clients are used to receiving.

- Be sure to tailor your communications to the client. A letter might be perfectly acceptable to introduce minor changes to some clients, but others may need a softer touch.

Prospects and the public. How quickly you can turn the ship depends on how well known you are in your niche (go-to advisor for divorced women?) or in your community (a multigenerational family business in a small town?). Presenting the change consistently across all channels can help provide a smooth transition.

For instance, don’t start a mailing campaign to a new audience if your website doesn’t reflect and reinforce the value proposition in your marketing pieces. After all, your site is likely the first place prospective clients will look to learn more about you.

After you update your website, do the same with your social media profiles. Depending on the size of your following, you might need to create new profiles. (Facebook won’t let you change your business name more than once if more than 200 people follow you.)

Here are some additional tips you might want to keep in mind:

- Hire a professional. Whether you’re redesigning a logo, creating a targeted sales kit, or building a new website, enlisting a professional designer and copywriter can be money well spent.

- Assign a priority to pieces. Is your existing inventory still relevant to your target market? Do you have an expensive supply of brochures or stationery? Take stock of the money already spent and the timing of any new materials.

- Be consistent. Resist the urge to use up old branded material if it doesn’t reinforce your new approach.

Changing your firm's brand is an opportunity to talk about your firm in terms of who you work with and why you can help them. If you’re focusing on a specific niche, explain the experience you have in that space and your passion for working with these clients. And always be ready to answer the “So why the change?” question.

Whatever the reason may be for the shift, by following the guidelines above, your marketing messaging will reflect the services you provide and target the ideal clients and prospects whom you are trying to reach.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network