by Don Vialoux, Timingthemarket.ca

Mr. Vialoux on BNN on Thursday, December 31st

Following is a link:

http://www.bnn.ca/Video/player.aspx?vid=779343

Economic News This Week

November Construction Spending to be released at 10:00 AM EST on Monday is expected to increase 0.8% versus a gain of 1.0% in October.

December ISM Index to be released at 10:00 AM EST on Monday is expected to improve to 49.0 from 48.6 in November

December ADP Private Employment to be released at 8:15 AM EST on Wednesday is expected to slip to 190,000 from 217,000 in November

November U.S. Trade Deficit to be released at 8:30 AM EST on Wednesday is expected to increase to $44.7 billion from $43.9 billion in October

November Canadian Trade Deficit to be released at 8:30 AM EST on Wednesday is expected to slip to $2.6 billion from $2.8 billion in October.

November Factory Orders to be released at 10:00 AM EST on Wednesday are expected to slip 0.2% versus a gain of 1.5% in October

December ISM Services to be released at 10:00 AM EST on Wednesday are expected to improve to 56.4 from 55.9 in November.

Weekly Initial Jobless Claims to be released at 8:30 AM EST on Thursday are expected to slip to 275,000 from 287,000 last week.

December Non-farm Payrolls to be released at 8:30 AM EST on Friday are expected to slip to 200,000 from 211,000 in November. December Private Non-farm Payrolls are expected to slip to 194,000 from 197,000 in November. December Unemployment Rate is expected to remain unchanged from November at 5.0%. December Hourly Earnings are expected to increase 0.2% versus a gain of 0.2% in November

December Canadian Employment to be released at 8:30 AM EST is expected to drop 5,000 versus a decline of 35,700 in November. December Canadian Unemployment Rate is expected to remain unchanged from November at 7.1%.

November Wholesale Inventories to be released at 10:00 AM EST on Friday are expected to slip 0.1% versus a decline of 0.1% in October.

Earnings News This Week

Wednesday: Monsanto

Thursday: Bed Bath & Beyond, Constellation Brands, KB Homes, Walgreen Boots

The Bottom Line

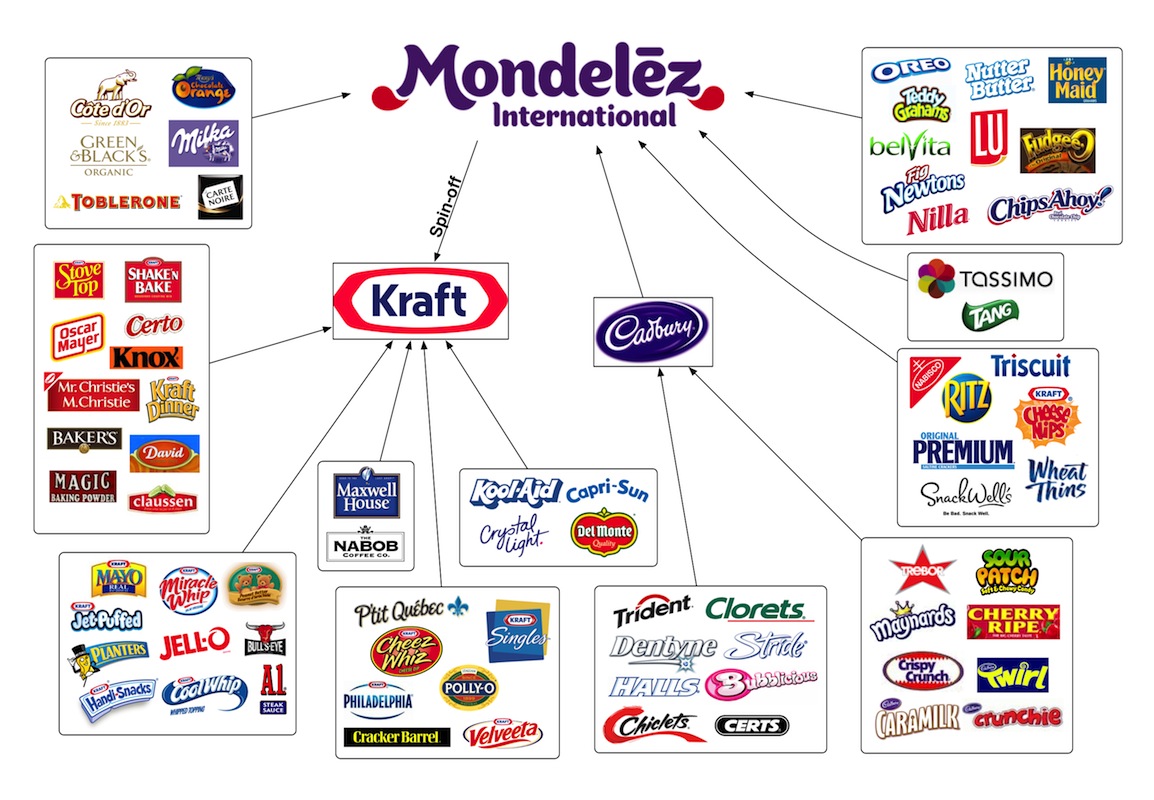

The classic Santa Claus rally from December 15th to January 6th is expected to continue this week. Primary sectors with positive seasonality at this time of year that will most benefit are Materials, Financials, Industrials and Technology. Subsectors with positive seasonality include and improving technical prospects include Biotech, Semiconductors, Medical Devices, Home Builders, Forest Products, Metals & Mining and Aerospace & Defense. Commodities with positive seasonality and improving technical prospects include Silver, Platinum and Palladium. Bonus events that are unique during the current Santa Claus rally period include an intermediate peak in the U.S. Dollar Index, a positive impact on equity markets of an El Nino weather event and anticipation of a return to earnings and revenue growth beyond the release of difficult fourth quarter results. The stage is set for continuation of strength in North American equity markets until at least January 6th and possibly until the end of February.

Equity Indices

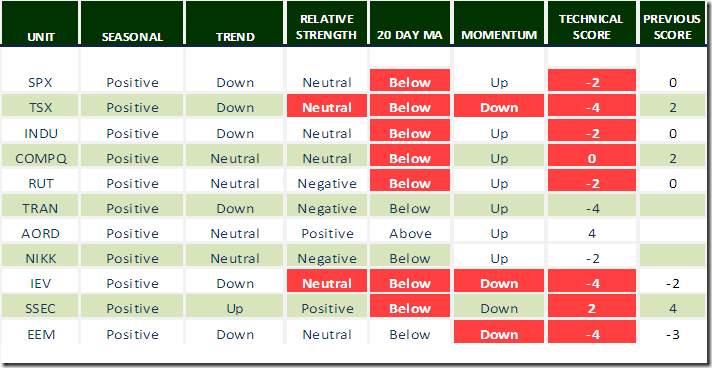

Technical scores dropped significantly on Thursday mainly because units fell below their 20 day moving average.

Daily Seasonal/Technical Equity Trends for December 31st 2015

Green: Increase from previous day

Red: Decrease from previous day

Calculating Technical Scores

Technical scores are calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

Higher highs and higher lows

Intermediate Neutral trend: Score 0

Not up or down

Intermediate Downtrend: Score -2

Lower highs and lower lows

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of 0.0 or higher. Conversely, a short position requires maintaining a technical score of 0.0 or lower.

The S&P 500 Index dropped 17.05 points (0.83%) last week. Intermediate trend remains down. The Index dropped below its 20 day moving average on Thursday. Short term momentum indicators are trending up.

Percent of S&P 500 stocks trading above their 50 day moving average slipped last week to 50.60% from 51.80%.

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 48.80% from 48.00%.

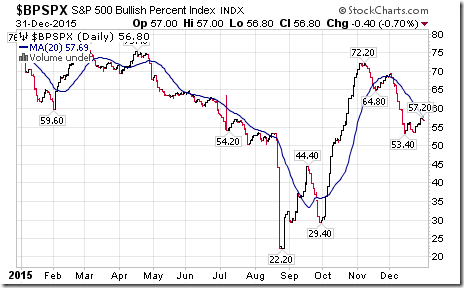

Bullish Percent Index for S&P 500 stocks increased last week to 56.80% from 55.80%, but remained below its 20 day moving average.

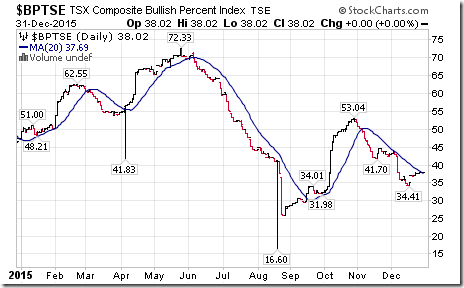

Bullish Percent Index for TSX Composite stocks increased last week to 38.02% from 37.60%, but remained below its 20 day moving average.

The TSX Composite Index added 0.15 (0.00%) last week. Intermediate trend remains down (Score:-2). Strength relative to the S&P 500 Index changed to Neutral from Positive (Score: 0). The Index fell below its 20 day moving average on Thursday (Score: -1). Short term momentum indicators have just rolled over and are trending down (Score: -1). Technical score dropped to -4 from 2.

Percent of TSX stocks trading above their 50 day moving average fell last week to 38.84% from 42.98% last week.

Percent of TSX stocks trading above their 200 day moving average was unchanged last week at 30.17%.

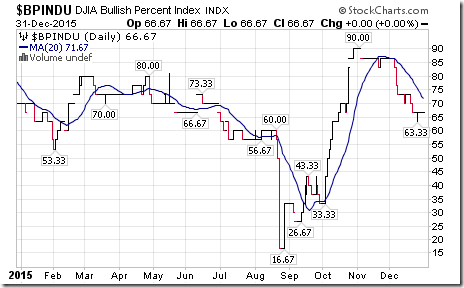

The Dow Jones Industrial Average dropped 127.14 points (0.72%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Neutral. The Average returned to below its 20 day moving average on Thursday. Short term momentum indicators are trending up. Technical score remained at -2 last week.

Bullish Percent Index for Dow Jones Industrial Average remained at 66.67% last week and remained below its 20 day moving average.

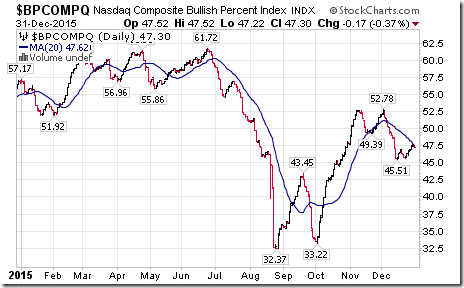

Bullish Percent Index for NASDAQ Composite stocks increased last week 47.30% from 46.63% and remained below its 20 day moving average.

The NASDAQ Composite Index dropped 41.08 points (0.81%) last week. Intermediate trend remains Neutral. The Index dropped below its 20 day moving average on Thursday. Short term momentum indicators are trending up. Technical score dropped last week to 0 from 2.

The Russell 2000 Index dropped 18.87 points (1.63%) last week. Intermediate trend remains Neutral. The Index returned to below its 20 day moving average on Thursday. Short term momentum indicators are trending up. Technical score remained last week at -2.

The Dow Jones Transportation dropped 127.14 points (1.49%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Average remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score remains at -4.

The Australia All Ordinaries Composite Index added 88.50 points (1.68%) last week. Intermediate trend changed to Neutral from Down on a move above 5334.50. Strength relative to the S&P 500 Index remains Positive. The Index remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 4 from 2.

The Nikkei Average added 244.02 points (1.30%) last week. Intermediate trend remains Neutral. Strength relative to the S&P 500 Index remains Negative. The Average remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at -4.

Europe 350 iShares dropped $0.75 (1.84%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed to Neutral from Positive. The Index dropped below its 20 day moving average. Short term momentum indicators are trending down. Technical score fell to -4 from 2.

The Shanghai Composite Index dropped 73.31 points (2.03%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains positive. The Index dropped below its 20 day moving average on Thursday. Short term momentum indicators are trending down. Technical score dropped last week to 2 from 6.

Emerging Markets iShares fell $0.81 (2.45%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Neutral. Units fell below their 20 day moving average. Short term momentum indicators are trending down. Technical score dipped to -4 from -3

Currencies

The U.S. Dollar added 0.73 (0.74%) last week. Intermediate trend remains up. The Index moved back above its 20 day moving average. Short term momentum indicators are trending up.

The Euro dropped 1.06 (0.97%) last week. Intermediate trend remains down. The Euro fell below its 20 day moving average on Thursday. Short term momentum indicators are trending down.

The Canadian Dollar slipped US 0.30 cents (0.42%) last week. Intermediate trend remains down. The Canuck Buck remains below its 20 day moving average. Short term momentum indicators are trending up.

The Japanese Yen slipped 0.01 (0.12%) last week. Intermediate trend remains down. The Yen remains above its 20 day moving average. Short term momentum indicators are trending up.

Commodities

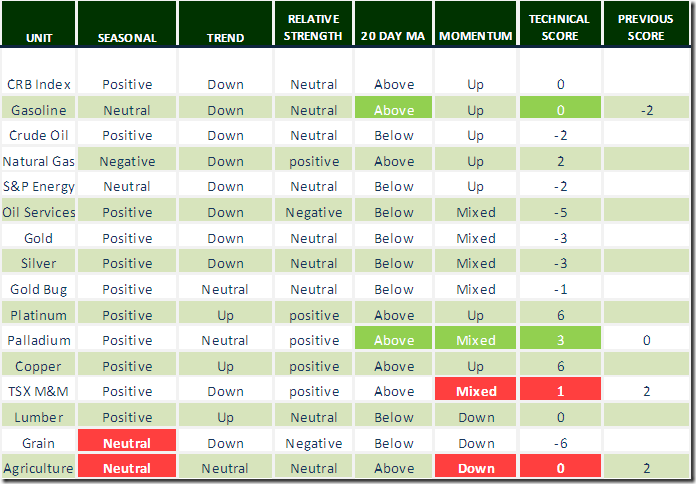

Daily Seasonal/Technical Commodities Trends for December 31st 2015

Green: Increase from previous day

Red: Decrease from previous day

The CRB Index gained 0.18 (1.02%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Neutral. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 0 from -4.

Gasoline slipped $0.01 per gallon (0.78%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Neutral. Gas remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 0 from -2

Crude Oil dropped $1.03 per barrel (2.70%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Neutral. Crude remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score slipped last week to -2 from 0.

Natural Gas jumped $0.27 (12.98%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index improved to Positive from Neutral. “Natty” moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved to 2 from 0.

The S&P Energy Index dropped 10.3 points (2.23%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Neutral. The Index remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score last week remained at -2.

The Philadelphia Oil Services Index dropped 5.43 points (3.33%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Negative. The Index remains below its 20 day moving average. Short term momentum indicators are mixed. Technical score slipped to -5 last week from -4.

Gold dropped $15.40 per ounce (1.43%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed to Neutral from Positive. Gold moved below its 20 day moving average. Short term momentum indicators are Mixed. Technical score dropped last week to -3 from 2.

Silver dropped $0.56 per ounce (3.89%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed to Neutral from Positive. Silver moved below its 20 day moving average. Short term momentum indicators are Mixed. Technical score dropped to -3 from 2. Strength relative to Gold remains Neutral.

The AMEX Gold Bug Index fell 5.56 points (4.76%) last week. Intermediate trend remains Neutral. Strength relative to the S&P 500 Index remains Neutral. The Index moved below its 20 day moving average. Short term momentum indicators are Mixed. Technical score slipped last week to -1 from 2.

Platinum gained $8.70 per ounce (0.98%) last week. Intermediate trend changed to up from down on a move above $888.20. Relative strength: Positive. Trades above its 20 day MA.

Palladium added $2.75 per ounce (0.49%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Positive. PALL remains above its 20 day moving average. Short term momentum indicators are Mixed. Technical score remained last week at 3.

Copper added $0.01 per lb. (0.47%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains Positive. Copper remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score remains at 6.

The S&P Metals & Mining Index dropped 22.17 points (5.95%) last week. Intermediate trend remains Down. Strength relative to the S&P 500 Index remains Positive. The Index remains above its 20 day moving average. Short term momentum indicators are Mixed. Technical score slipped last week to 1 from 2.

Lumber dropped $7.60 (2.86%) last week. Intermediate trend remains up. Strength relative to the S&P 500 changed to Neutral from Positive. Lumber dropped below its 20 day MA.

The Grain ETN dropped $0.38 (1.24%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed to Negative from Neutral. Units remain below their 20 day moving average. Short term momentum indicators are trending down. Technical Score: -6.

The Agriculture ETF dropped $0.81 (1.71%) last week. Intermediate trend remains Neutral. Strength relative to the S&P 500 Index remains Neutral. Units dropped below their 20 day moving average. Short term momentum indicators are trending down. Technical score dropped last week to 0 from 2.

Interest Rates

Yield on 10 year Treasuries added 1.6 basis points (0.71%) last week. Intermediate trend remains up. Yield remained above its 20 day moving average. Short term momentum indicators are mixed.

Conversely, price of the long term Treasury ETF dropped $1.25 (1.03%) last week. Units fell below their 20 day moving average.

Other Issues

The VIX Index gained 2.47 (15.69%) last week. Intermediate trend remains up. The Index moved above its 20 day moving average.

Short term technical indicators are overbought for most equity indices and primary sectors and showed signs of rolling over on Thursday (e.g. breaks below 20 day moving average, short term momentum indicators starting to show signs of peaking)

The Santa Claus rally from December 15th to January 6th remains valid despite weakness in U.S. equity indices on Thursday. The rally is expected to be fueled early this week by January pension money.

Technical action by individual S&P 500 stocks remained bullish last week despite late weakness by U.S. equity indices. Thirty S&P 500 stocks broke intermediate resistance levels and only two broke support. Gains were most notable among Financial Services stocks.

Canadian and U.S. economic news this year is expected to be neutral to mildly bearish

The El Nino effect on equity markets is expected to be positive until at least the end of February.

According to FactSet consensus earnings for S&P 500 companies show a 4.7% decline on a year-over-year basis. 85 companies have issued negative fourth quarter guidance and 26 companies have issued positive fourth quarter guidance. Earnings and revenues turn positive in the first quarter of 2016. Consensus for first quarter earnings on a year-over- year basis is a gain of 0.9% and consensus for first quarter revenues is a gain of 2.6%. Consensus for 2016 is a gain in earnings of 7.5% and an increase in revenues of 4.3%. The implication is that many S&P 500 companies will release lousy fourth quarter results, but with positive guidance.

Earnings reports released this week are relatively quiet. The focus is on Monsanto on Wednesday and Bed, Bath & Beyond on Thursday.

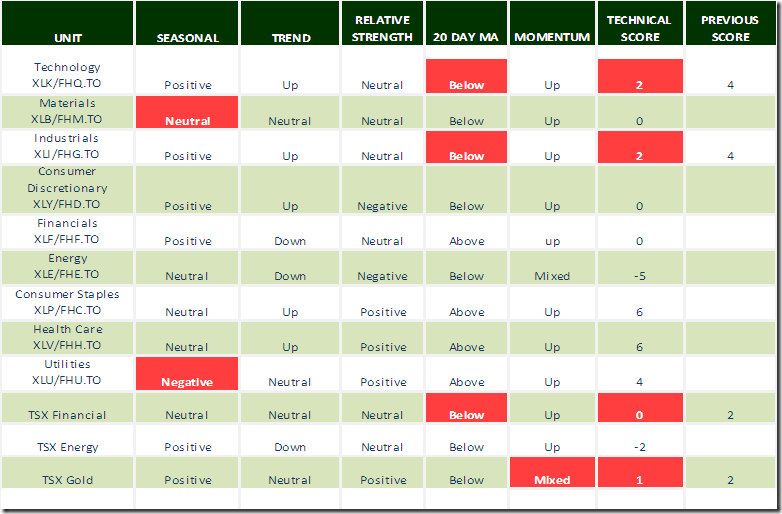

Sectors

Daily Seasonal/Technical Sector Trends for December 31st 2015

Green: Increase from previous day

Red: Decrease from previous day

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca