Where Does the U.S. Dollar Go from Here?

by Brad McMillan Commonwealth Financial Network

As many of you know, one of the most popular trades for investors in 2015 was a hedging of the U.S. dollar for international exposures—the overriding assumption being that the dollar would continue to increase following a hike in interest rates.

The reasoning behind this is that higher interest rates, coupled with an expanding economy, should attract foreign capital to the U.S., resulting in a demand for dollars relative to other currencies. Further, an imbalance of supply and demand should result in an increase in the value of the dollar, which would detract from the returns offered by international investments for a domestic investor. The simple solution, therefore, is to hedge all international exposures in an effort to avoid the translation losses from foreign currencies back to the dollar in an environment where the dollar is appreciating.

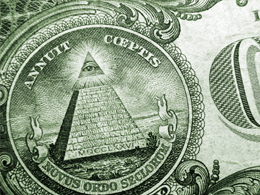

Monthly asset flows into strategy tracking the MSCI EAFE Index

The popularity of this trade is evidenced by flows into strategies tracking the MSCI EAFE hedged index.

As the chart below shows, monthly asset flows into this strategy peaked in April after the very strong appreciation of the dollar in the latter part of 2014 and the first few months of 2015, as investor concern over an appreciating dollar hit multiyear highs. Following this strong influx of assets, however, the dollar index declined and has spent much of the year range-bound at a level lower than that reached in the early part of the year.

Monthly dollar flows into strategy tracking MSCI EAFE hedged index Source: Morningstar® Direct

Source: Morningstar® Direct

Should investors expect an appreciation of the dollar?

For the first time in almost a decade, last week the Federal Reserve (Fed) hiked the interbank lending rate by 25 basis points, as was well documented in previous posts. Following the announcement, the dollar has remained flat. This begs the question: Why aren’t we witnessing an appreciation of the dollar?

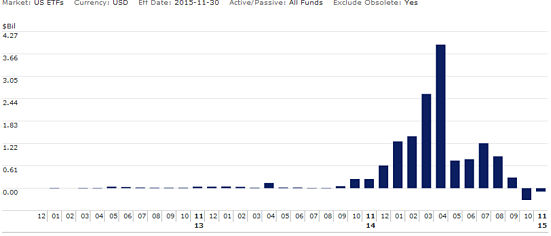

To help answer this, let’s explore the historical relationship between the dollar and interest rate hikes. In looking at the last three Fed tightening cycles, there is no evidence to suggest that the dollar appreciates in the days following the initiation of hikes. As shown in the chart below, in all three cases, the value of the dollar on a trade-weighted basis actually declined in the 12 months after the initiation of a rate hike.

Why does the dollar decline?

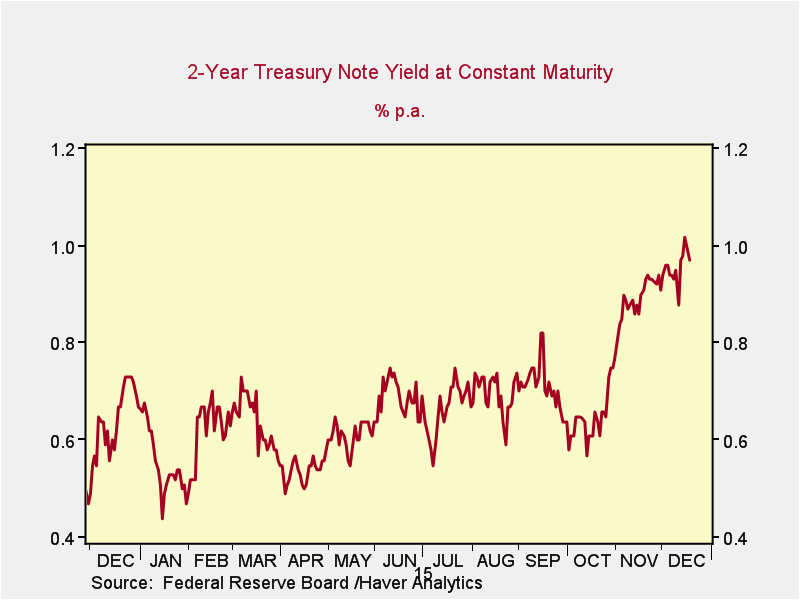

Much like other investable markets, currency exchange markets are forward looking, and the notion of “buy the rumor/sell the news” is very much at play. To illustrate this point, let’s first turn to the fixed income market, specifically the two-year U.S. Treasury yield. Leading up to the Fed hike, the prevailing feeling by many investors regarding fixed income was that any increase in the Fed funds rate would send ripples through the bond markets and result in declines in fixed income.

What many investors failed to realize, however, is that similar to currency exchange markets, fixed income markets are forward looking, so any well-documented move by the Fed would have little to no impact on the markets themselves. As the chart below shows, the two-year Treasury yield experienced a majority of its move this year in October and November—rather than in the days following the actual increase—and currency markets are no different.

Final thoughts

In my view, the appreciation of the dollar has already occurred for this rate cycle, and any further appreciation against a broad-based basket of currencies would be the result of exogenous factors other than those mentioned at the beginning of the post.

If you’d like additional commentary on this subject, feel free to contact me to continue the discussion.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network