Negative Interest Rates for Canada?

by Norman Mogil, via Sober Look

In his December 8th speech, the Governor of the Bank of Canada, Stephen Poloz introduced the possibility of negative interests as a policy tool . He was adamant that the Bank was not embarking upon this policy, rather it was exploring the implications of using such an unconventional policy instrument in times of economic shock or major dislocations. It was his view that " it's prudent to be prepared for every eventuality " (1)

Yet, his discussion went beyond just academic musings and into the practical realm of how would negative interests impact the Canadian financial markets . In 2009, the Bank looked at the application of negative interest rates ,but rejected it as a possible tool. What has changed since that time that caused the Bank to come out in favour of such an unprecedented policy move?

I believe there are two important developments that go a long way towards explain the shift in the Bank's thinking towards the "unthinkable".

First, the Canadian economy has weakened further since mid-2015, raising the spectre of a rate cut to revive growth; negative rates are just another form of rate cutting.

Secondly, the experience with negative rates in the Eurozone and in the EU in general has proven to be more positive ( less to be feared) than many experts thought early on; some half dozen countries now experience negative rates and continue to function without major market disruptions. Before we look at Canada, specifically, it is helpful to explain why some central banks chose to establish negative rates.

Why Go Negative

Negative interest rates are introduced for one of two reason. In the case of Switzerland, it had to manage a very sharp and sudden upward pressure on Swiss Franc ; investors were fleeing the Euro and the sudden capital inflows from the Eurozone drove the value of Franc to dangerously high levels. In the case of Sweden, the country was facing serious deflation and an ensuing recession ; the central bank turned to this unconventional policy to reverse this trend. The Eurozone adoped negative rates to combat both deflation and a weak economy.

Canada's recent economic performance continues to face serious headwinds.

* GDP growth over the past 12 months stands at 1% annualized;

* Unemployment has remained stubbornly high at 7%

* Consumer prices are increasing at no better than 1% yearly, well below the target rate of 2%;

* WTI oil prices have fallen to around $35bbl ( and Canadian oil sells at a further discount to as low as $22 bbl); and,

* Our balance of trade continues to worsen; non-energy exports have not filled the gap created by the loss of oil export revenues.

Although the Bank continues to express optimism about the near term , it fully recognizes that there is a significant output gap ( as high as 1.5%) that will not be closed before 2017, at best. Given the most recent economic data mentioned above, closing this gap remains a very tall order, indeed.

A New View on Negative Rates

In 2009 the Bank believed that it should not drop its policy rate below 0.25%. It maintained that zero or negative rates were be too disruptive to money market funds, resulting in large money outflows and a reduction in liquidity; both would harm the smooth operations of the credit and equity markets. As for the market for long term financial products, there was a real concern that life insurers and pension funds would not be able to match their long term liabilities, if yields on long term bonds fell to below investment requirements.

Recent research by the Bank's staff have turned up evidence to the contrary. In a discussion paper by Bank staff, it is argued that " negative policy interest rates do not appear to have caused significant volatility...the transmission has been swift... through the exchange rate". Also," money markets have continued to function smoothly.....as long as there is a positive spread to encourage borrowing and lending". And, the paper concludes simply by saying that "recent experience indicates that negative interest rates are indeed a viable policy tool."

This research report has given the Governor the confidence to state that " the Canadian financial markets could also function in a negative interest rate environment".

It seems as if there is, almost, a feeling of relief that this unconventional tool has come out of the realm of academia and into the realm of real world policy making.

More significantly, the Governor stated that the " effective lower bound for Canada's policy rate is around minus 0.5%". In other words, there is considerable room for the bank rate to be lowered to stimulate growth without any adverse impact on the functioning of our financial markets.. It seems that the door is now ajar the regarding the introduction of negative rates in Canada.

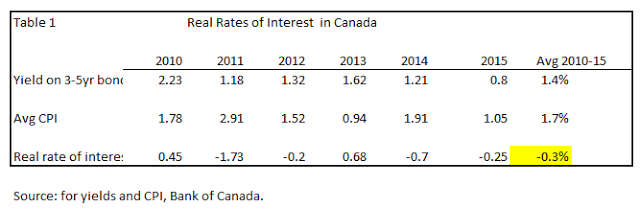

Canada has already experienced negative rates of return, as measured by the real rate of interest. The average yield on Government bonds in the 3-5 year range , when discounted for inflation, reveal an average real rate of minus 0.3% .Granted that real rates over time vary considerably depending on inflationary expectations, the fact that we have been accustomed to zero or below zero real rates since the 2008 crisis, makes any move towards nominal negative rates not as disruptive to the financial markets as once feared. Moreover , the real rate of interest has been well below the average of 1-2% that has prevailed over many years in the industrialized world.

A final word. In a very recent interview, Ben Bernanke suggested that 'negative rates are something the Fed will and probably should consider if the situation arises,” .It seems that there is some meeting of the minds that negative nominal rates are no longer unthinkable.

____________________________________________________

Notes

1) Stephen Poloz, "Prudent Preparation: The Evolution of Unconventional Policies" ,The Empire Club of Canada. Dec 8,2015)

2) Harriet Jackson," The International Experience with Negative Policy Rates" The Bank of Canada. Staff Discussion 2015-13

3) MarketWatch, Dec 15, 2015

Copyright © Sober Look