by Don Vialoux, Timingthemarket.ca

StockTwits Released Yesterday

While rates on high yield bonds surge, a seasonal peak is usually reached by mid-December

Technical action by S&P 500 stocks to 10:30 AM: Quiet. Breakout: $ZTS. Breakdown: $ADI

Editor’s Note: After 10:30 AM, additional breakouts included TripAdvisor (TRIP), Carnival (CCL) and Boston Properties (BXP).

Trader’s Corner

Editor’s Note: Most of the increases in technical score yesterday were triggered by a change in short term momentum from down in deeply oversold levels to mixed or up.

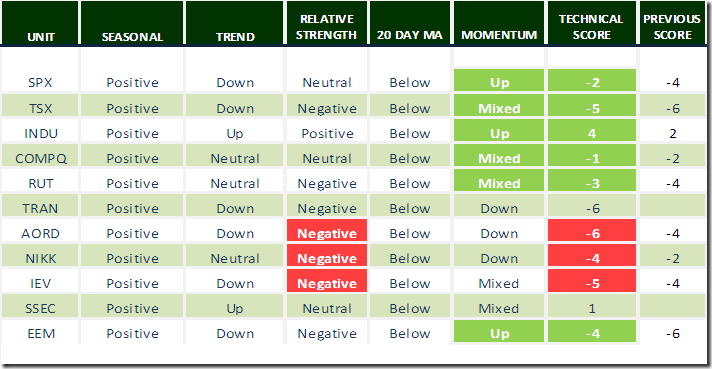

Daily Seasonal/Technical Equity Trends for December 15th 2015

Green: Increase from previous day

Red: Decrease from previous day

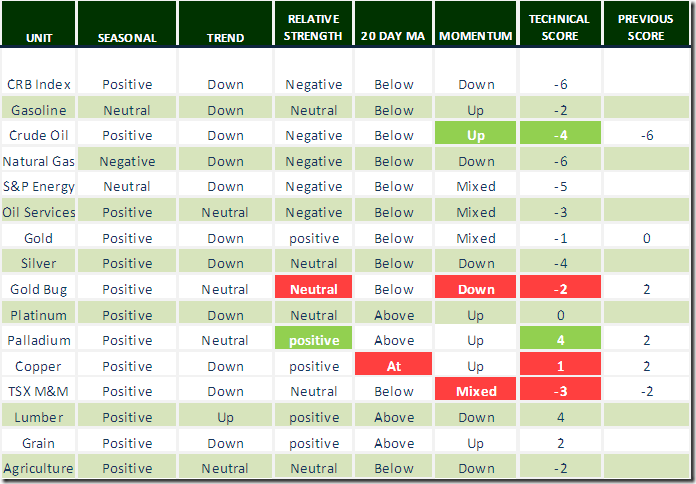

Daily Seasonal/Technical Commodities Trends for December 15th 2015

Green: Increase from previous day

Red: Decrease from previous day

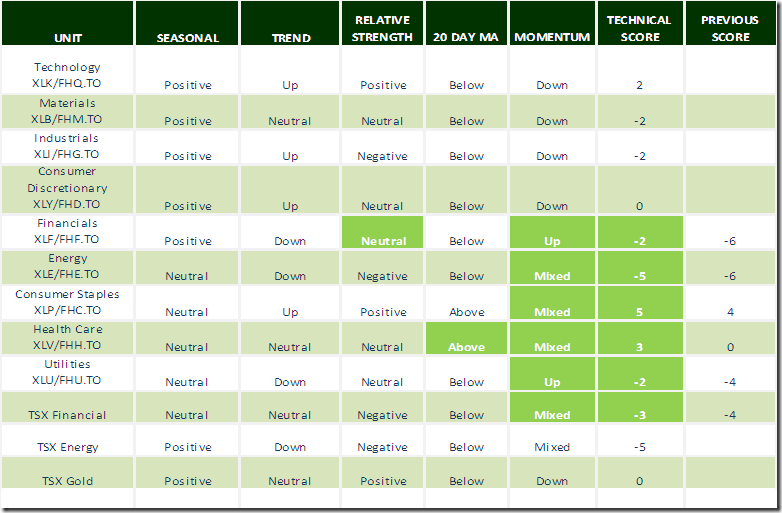

Daily Seasonal/Technical Sector Trends for December 15th 2015

Green: Increase from previous day

Red: Decrease from previous day

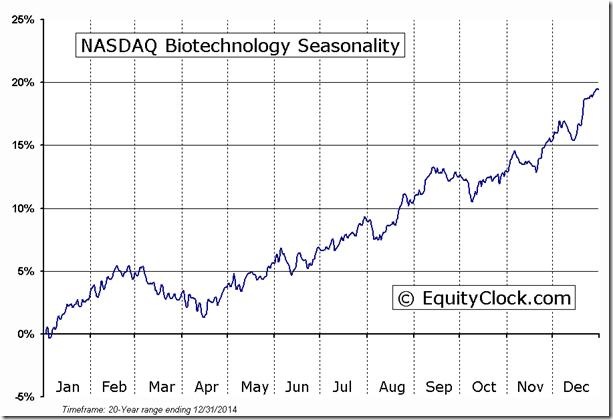

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Editor’s Note: The Biotech Sector and its related ETFs on average enter into a period of seasonal strength today for a seasonal trade lasting until February 18th

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

More Isn’t Always Better For Traders

By Adrienne Toghraie, Trader’s Success Coach

While it is important to have a good education in trading, you must know when to stop and execute what you have learned. Education junkies will not become the best traders unless they have already proven themselves to be successful at being a trader before adding additional information to their memory bank.

Education junkie Ray

Ray is a highly educated man in several professional fields. As a scientist, where he has mainly focused his attention, addictively gathering information has been a good strategy for success in his field.

When Ray was introduced to trading, he decided to read every book that was recommended by professional traders he encountered at trade shows and other events. Four years into his studies he still has not been able to develop a clearly defined strategy. The reasons are:

· He is trying to come up with the perfect system

· The information he has learned very often is in conflict

· If he uses all of the filters that are recommended, he will never find a decent opportunity

· He is afraid of being wrong

· He is afraid of loss

· Loss for him is an indication that he needs more information

· Knowledge itself has become an addiction. When I met Ray at an Expo, I asked him if he wanted to be a trader who earned money, or if he wanted to be a trading academic? He, of course, said that he wanted to be a trader. When I suggested to him that he put down the books and come up with a strategy, he found it impossible. This is when he called me to invest in coaching.

On the first day of our coaching, which was mostly dedicated to gathering information on how he thinks, he said, “What will I do with my evenings if I can’t read my books?” I handed him a short mystery novel. This started a debate and ended with him wanting to prove to me that he was not addicted. Of course, I knew that he would not be able to read the novel. This was another wake up call for Ray.

Ray was also addicted to energy deprivation. He trained his neurology to adapt to living life with a high level of stress and little sleep. In other words, he was borrowing energy from his future, and he was almost bankrupt. His addictive behavior of cluttering his mind with more information added to his stress. When he stopped pushing, all he wanted to do was sleep. He was so sleep deprived it was not easy to keep him awake during our second day session.

Ray had to learn how to simplify, plan, de-stress and be willing to study in an area other than trading.

Other areas of trading where you might be doing too much

If traders can be honest with themselves, they may find out that their over-kill behaviors are the reason that they are not earning profits from trading. Here are some to consider:

· Too many systems or strategies

· Too many indicators

· Too many time frames

· Too many commodities

· Too much time spent on trading in a day/week

· Too much listening to the advice of others

· Too much environmental stress

Conclusion

There are many reasons you might not be making profits in trading. Consider the possibility that perhaps you are doing too much in one or more areas of trading.

Free newsletter on the discipline of trading

More Articles by Adrienne Toghraie, Trader’s Success Coach

Sign Up at – www.TradingOnTarget.com

Here Comes Santa

The Santa Claus rally is off to a great start thanks to strength in North American equity markets yesterday. Below is a repeat of the GlobeInvestor column published last Friday. Following also is a link to the column:

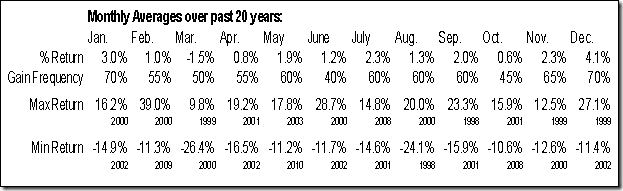

Here comes the Santa Claus rally! Traditionally the Santa Claus rally has occurred between December 15th and January 6th. Since 1950, the S&P 500 Index has gained 2.13 per cent per period and was profitable 80 per cent of the time. The Nasdaq Composite posted a similar frequency of success, gaining an average of 3.17 per cent per period since 1971. The best return came from the small-cap Russell 2000 Index. The small-cap benchmark gained 3.63 per cent per period since 1987 and was profitable 89 per cent of the time. Best returns for the Russell 2000 Index came following years when the benchmark declined by 4.5 per cent or more year-to-date by the time the Santa Claus rally period arrived. Then, the benchmark gained an average of 4.94 per cent thanks partially to a recovery from year-end tax loss selling pressures. As of Friday’s close, the Russell 2000 Index had fallen 6.73 per cent year-to-date.

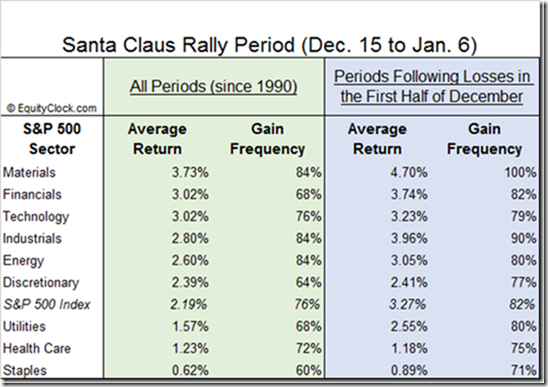

What about performance of primary sectors in the S&P 500 Index? All sectors profited.

The Materials sector recorded the best performance during the past 25 periods with an average gain per period of 3.73 per cent. Other notable returns were record by the Energy, Industrial, and Financial sectors. Weakest sector was Consumer Staples, which averaged a gain of only 0.62 per cent per period.

Sectors, that recorded the largest declines in the first half of December, have a history of subsequently recorded the best gains during the favourable Santa Claus rally period. Best performing sector following declines in the first half of December was the Materials sector with an average gain of 4.70 per cent per period and a frequency of profitability of 100 per cent. As of the close on Friday, only Consumer Staples had recorded a month-to-date gain while Utilities, Energy, Industrials, Materials, Consumer Discretionary and Financials recorded more than a 2 per cent decline.

How has the TSX Composite Index performed during the past 25 periods? Performance was better than the S&P 500 Index. The TSX Composite gained an average of 2.61 per cent per period and was profitable 88 per cent of the time.

Why does the Santa Claus rally work? The event is more than a guy in a red suit coming to town. General influencing factors include upbeat investor sentiment, lighter trading volumes, encouraging economic news, bullish reports by investment dealers highlighting prospects for the following year, expectations for stronger than consensus fourth quarter earnings triggered by news of strong consumer holiday spending, institutional investment of pension contributions in the first week in January and the investment of year-end bonuses. All are expected to help equity market during the current period. In addition, selected equities, which have over-reacted to tax loss selling pressures, frequently rebound from bargain prices.

What about this year? Several unique events have come together that favour a strong Santa Claus rally this year. North American equity markets have been under pressure since last May partially due to concerns that interest rates in the United States will begin to increase for the first time in a decade. Related to anticipation of an increase in interest rates has been strength by the U.S. Dollar Index. The likely increase in the Fed Fund rate on Wednesday is expected to be followed by at least a brief period of interest rate stability in the United States and a related period of stability in the U.S. Dollar Index. Both will relieve investor concerns at least into early 2016. Other unique events this year include benefits from lower gasoline prices and the El Nino effect.

Tax loss selling pressures are another important issue this year, particularly among Canadian commodity sensitive stocks. When tax loss selling pressures are relieved, a strong recovery is possible, particularly among forest product, precious metal and base metal stocks. Last trade date for Canadian investors to liquidate listed Canadian equity positions in 2015 is December 24th. Better not to wait until the last minute if planning to sell equities for tax reasons. Liquidity in equity markets becomes thin before Christmas.

Traders and investors can take advantage by owning a wide variety of U.S. and Canadian equities and broadly based Exchange Traded Funds during the current December 15th to January 6th period. ETF examples include S&P 500 SPDRs (SPY US$201.88) for U.S. funds. Choices for Canadian funds include iShares S&P/TSX 60 units (XIU $19.03), Horizons S&P/TSX 60 units (HXT $24.70), BMO S&P/TSX Capped Composite units (ZCN $17.37) and First Trust AlphaDEX Canadian Dividend Plus ETF (FDY $15.95)

Don and Jon Vialoux are authors of free daily reports on equity markets, sectors,

commodities, and Exchange Traded Funds. Daily reports are available at http://TimingTheMarket.ca/ and http://EquityClock.com. The enclosed report is for information only. It should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca