Tech Talk for December 9th 2015

by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Wednesday December 9th

U.S. equity index futures were mixed this morning. S&P 500 futures were unchanged in pre-opening trade.

Dupont added $6.30 to $72.90 and Dow Chemical gained $5.45 to $56.35 on news that the two companies are discussing a merger.

Agilent (A $41.17) is expected to open higher after RW Baird upgraded the stock to Outperform from Neutral. Target was raised to $48 from $45.

Lululemon dropped $5.96 to $46.20 after lowering its fourth quarter guidance.

Computer Sciences (CSC $30.46) is expected to open higher after Jefferies upgraded the stock to Buy.

Intel improved $0.15 to $34.90 after Nomura upgraded the stock to Buy.

Freeport McMoran (FCX $6.75) is expected to open lower after eliminating its quarterly dividend and after reducing its planned capital spending program.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2015/12/08/stock-market-outlook-for-december-9-2015/

Note seasonality charts on Industrials and Materials.

Market Watch Comment on Gold

Headline reads, “This is what it will take for gold to become a buy”. Following is a link:

StockTwits Released Yesterday @equityclock

Gold and silver trading within a narrow long-term range, setting up for an imminent break.

Technical action by S&P 500 stocks to 10:30: Bearish. 15 stocks broke support (including 6 Industrial stocks). None broke resistance

Editor’s Note: After 10:30, another 8 S&P 500 stocks broke support: BEN, PBCT, UPS, LUV, PBI, APD, LM, KMX

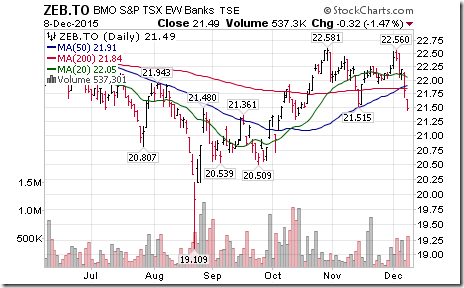

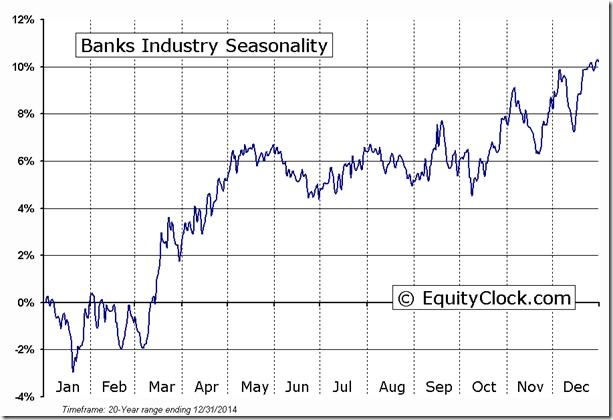

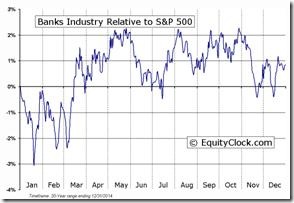

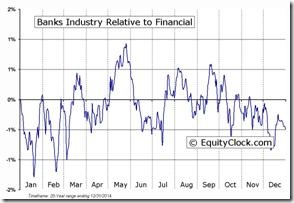

Cdn. bank ETF $ZEB.CA broke support at $21.52 to complete a double top pattern. ‘Tis the season!

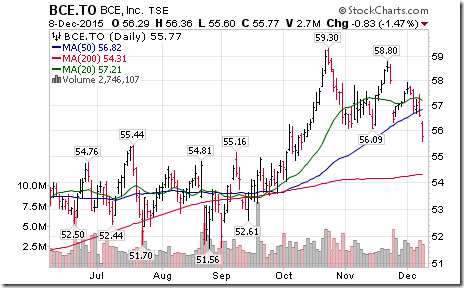

BCE $BCE.CA fell below support at $56.09 to complete a double top pattern.

Investors don’t like the attempt by Canadian Pacific CP.CA to take over $NSC. Support broken at $171.69.

Trader’s Corner

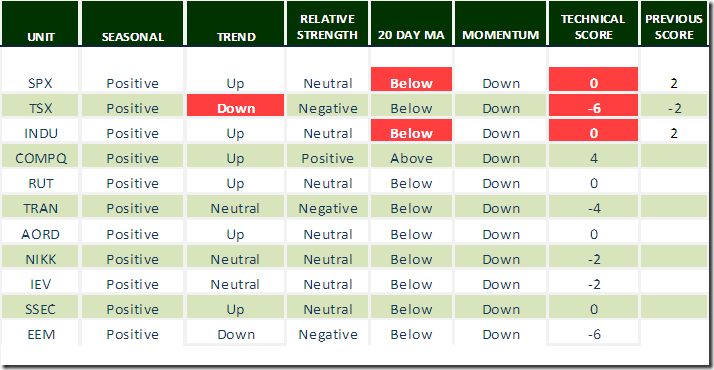

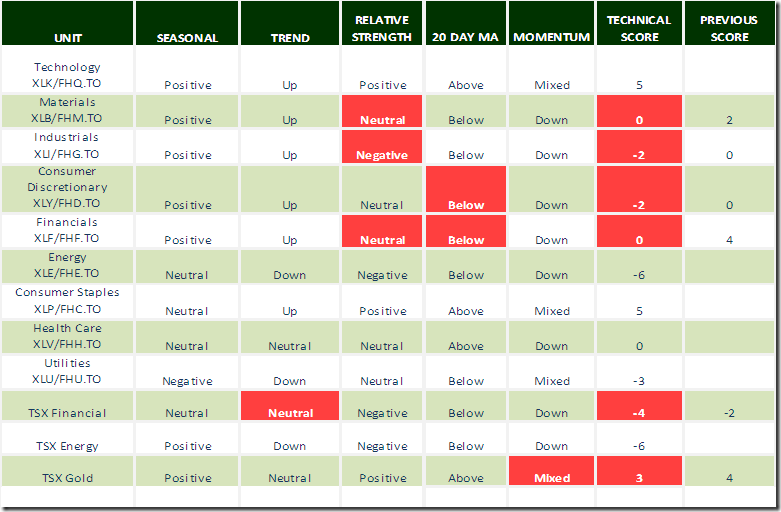

Daily Seasonal/Technical Equity Trends for December 8th 2015

Green: Increase from previous day

Red: Decrease from previous day

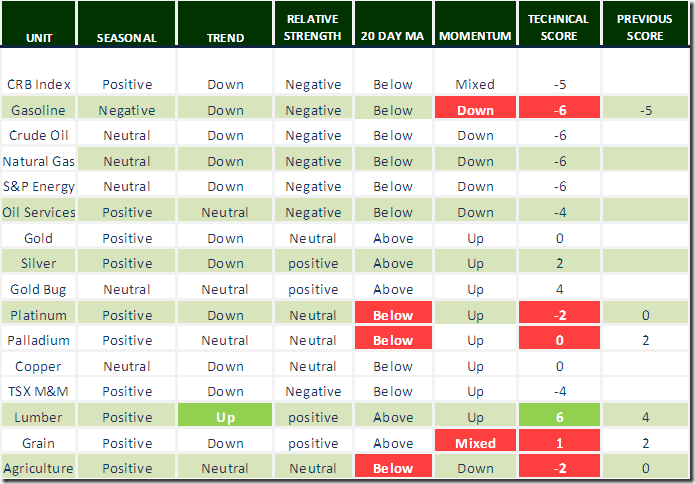

Daily Seasonal/Technical Commodities Trends for December 7th 2015

Green: Increase from previous day

Red: Decrease from previous day

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

FP Trading Desk Headlines

FP Trading Desk headline reads, “What to look for in a U.S. bank stock”. Following is a link:

FP Trading Desk headline reads, “Be ready to buy gold equities: JP Morgan”. Following is a link:

Interesting Charts

The TSX Composite Index broke through support levels at 13,030.46 and 12,964.12. Strength relative to the S&P 500 Index has returned to negative.

Greece equity trends are giving an early warning signal.

Industrial commodity stocks remain under significant downside pressure despite early technical signs despite early technical signs that the U.S. Dollar Index probably reached an intermediate peak last week.

Lumber continues to surprise. Nice breakout above $265!

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca