Tech Talk for Tuesday December 8th 2015

by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Tuesday December 8th

U.S. equity index futures were lower this morning. S&P 500 futures were down 22 points in pre-opening trade.

Amazon slipped $6.04 to $663.79 despite Pacific Crest’s initiated coverage with an Overweight rating. Target price is $800.

Hershey (HSY $87.14) was upgraded by Argus Research to Buy

Kellogg (K $87.14) was upgrade by Morgan Stanley to an Equal Weight rating

Agilent Technologies added $0.25 to $40.95 following an upgrade by Goldman Sachs to a Buy rating

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2015/12/07/stock-market-outlook-for-december-8-2015/

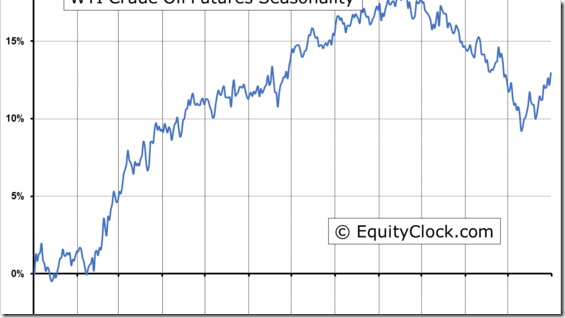

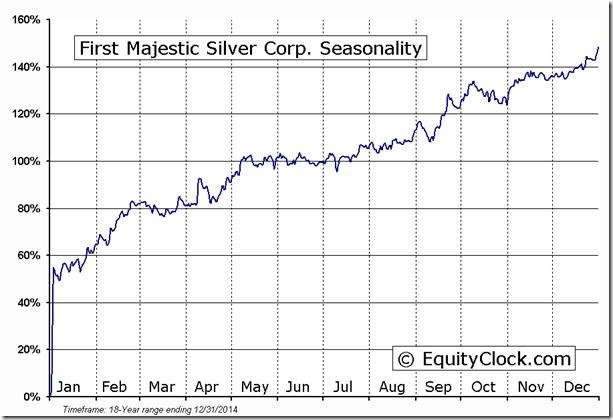

Note seasonality charts on crude oil, gold and silver.

Mr. Vialoux on Berman’s Call Yesterday

Following is a link:

http://www.bnn.ca/Video/player.aspx?vid=760740

StockTwits Released Yesterday @equityclock

Period of seasonal weakness for Oil nearing an end, peaking on December 11, on average. $CL_F $USO #OIL

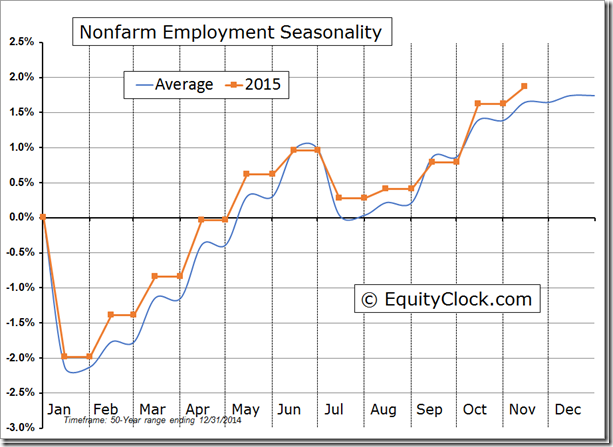

Warmer than average weather appears to have had an influence on November’s payroll report. equityclock.com/2015/12/04/… $STUDY $SPX $SPY

Technical action by S&P 500 stocks to 2:00: Bearish. 19 stocks broke support (including 8 energy stocks and 5 broke resistance.

Canadian energy stocks were notable on the list of Canadian stocks breaking support including 8 TSX Composite stocks

Editor’s Note: They included CNQ, CVE, ECA, IMO, ARX, CPG, PEY

More Canadian bank stocks breaking support: $BNS.CA, $CM.CA

Trader’s Corner

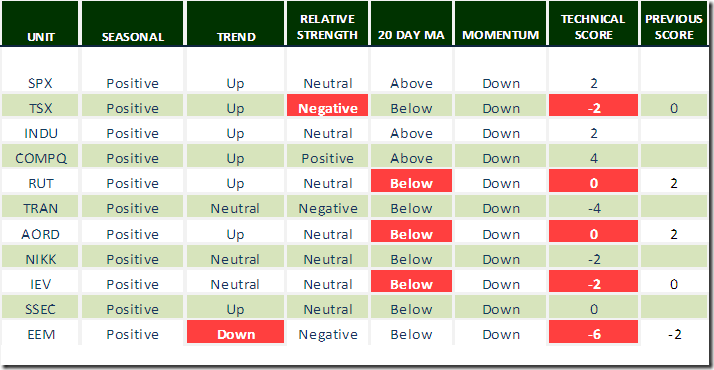

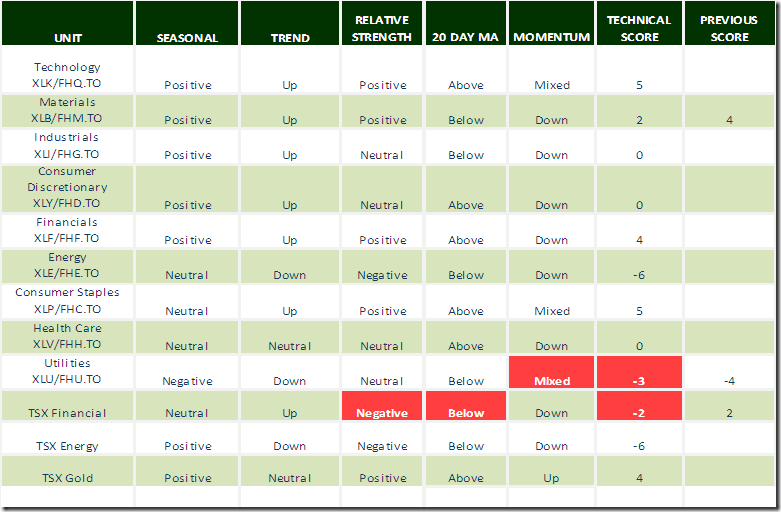

Daily Seasonal/Technical Equity Trends for December 7th 2015

Green: Increase from previous day

Red: Decrease from previous day

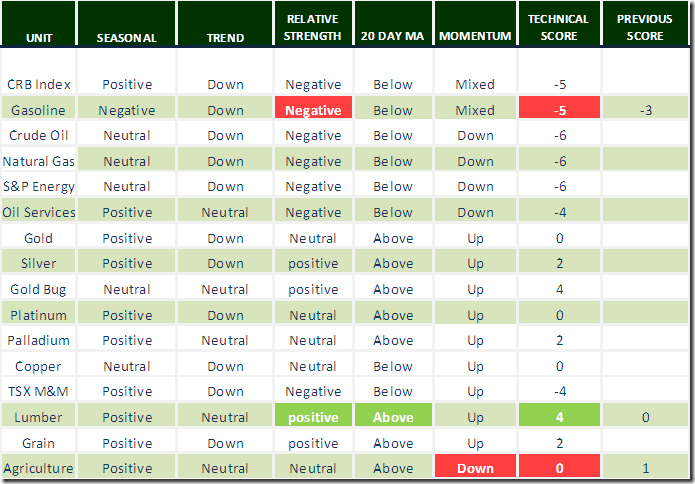

Daily Seasonal/Technical Commodities Trends for December 7th 2015

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for December 7th 2015

Green: Increase from previous day

Red: Decrease from previous day

Interesting Charts

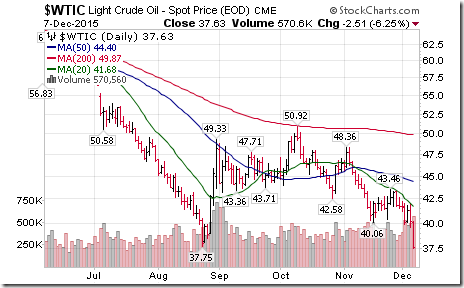

Crude oil prices broke short term support at $40.06 and subsequently broke long term support at $37.75 to reach a six year low.

TSX Energy stocks and related ETFs quickly responded.

Weaker energy stocks flowed directly into the TSX Composite Index.

Falling crude oil prices triggered weakness in the Canadian Dollar. The Canadian Dollar broke short term support near 74.57 and medium term support at 73.31 to reach an 11 year low.

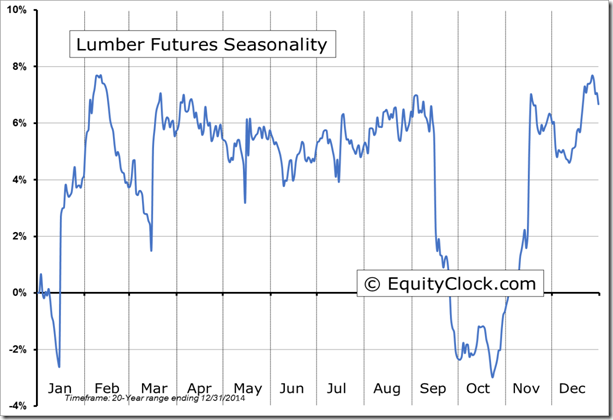

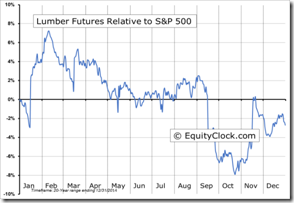

Interesting anomaly! Lumber prices rose strongly.

‘Tis the season for lumber prices to move higher until at least mid-February!

Lumber Futures (LB) Seasonal Chart

|

Lumber stocks will benefit. |

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca