by Don Vialoux, Timingthemarket.ca

Editor’s Note: Don Vialoux appears on BNN’s Berman’s Call today at 11:00 AM EST

Economic News This Week

November Canadian Housing Starts to be released at 8:15AM EST on Tuesday are expected to slip to 197,500 units from 198,061 in October.

October Wholesale Inventories expected to be reported at 10:00 AM EST on Wednesday are expected to increase 0.1% versus a gain of 0.5% in September

Weekly Initial Jobless Claims to be released at 8:30 AM EST on Thursday are expected to remain unchanged from last week at 269,000

November Producer Prices to be released at 8:30 AM EST on Friday are expected to slip 0.1% versus a decline of 0.4% in October. Excluding food and energy, November PPI is expected to increase 0.1% versus a decline of 0.3% in October.

November Retail Sales to be released at 8:30 AM EST on Friday are expected to increase 0.3% versus a gain of 0.1% in October. Excluding auto sales, November Retail Sales are expected to increase 0.3% versus a gain of 0.2% in October.

October Business Inventories to be released at 10:00 AM EST on Friday are expected to increase 0.1% versus a gain of 0.3% in September.

December Michigan Sentiment to be released at 10:00 AM EST on Friday is expected to slip to 91.6 from 93.1

Earnings News This Week

Tuesday: Autozone

Wednesday: Costco, Laurentian Bank

The Bottom Line

Last week was another wild week for North American equity indices. By the end of the week, indices were virtually unchanged, but rotation by sectors within the indices was substantial. Look for higher than average daily volatility in sectors, but limited upside/downside by indices during the next two weeks. Tax loss selling pressures and anticipation of the first increase in the Fed Fund rate will dominate investor interest. Currency fluctuations also are a notable influence. Early technical signs show that the U.S. Dollar Index likely reached an intermediate peak last week. Weakness in the U.S. Dollar Index implies a base building period for commodities and commodity sensitive equities. Preferred strategy is to take advantage of weakness in seasonally favoured equities and ETFs during the first half of December to add to positions prior to a significant yearend rally.

Equities

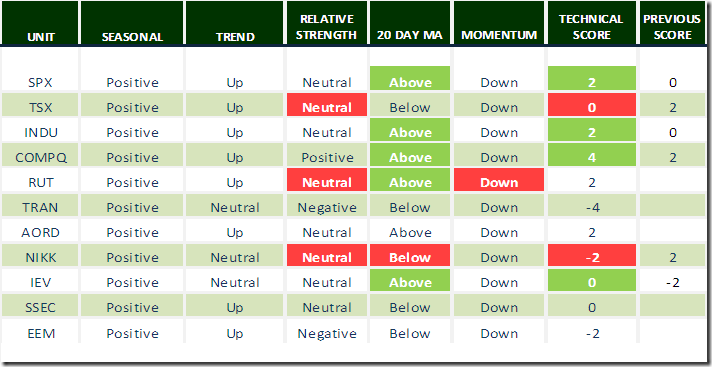

Daily Seasonal/Technical Equity Trends for December 4th 2015

Green: Increase from previous day

Red: Decrease from previous day

Calculating Technical Scores

Technical scores are calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

Higher highs and higher lows

Intermediate Neutral trend: Score 0

Not up or down

Intermediate Downtrend: Score -2

Lower highs and lower lows

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of 0.0 or higher. Conversely, a short position requires maintaining a technical score of 0.0 or lower.

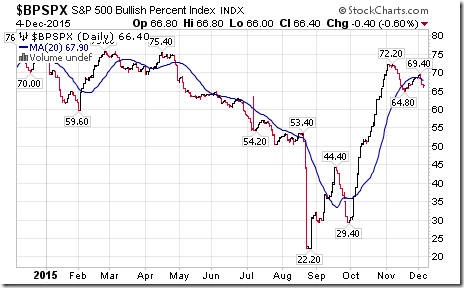

The S&P 500 Index added 1.58 points (0.08%) last week. Intermediate trend remains up. The Index recovered above its 20 day moving average on Friday. Short term momentum indicators are trending down.

Percent of S&P 500 stocks trading above their 50 day moving average dropped to 65.80% from 70.80%. Percent is intermediate overbought and has rolled over.

Percent of stocks trading above their 200 day moving average slipped last week to 52.60% from 53.00%. Percent remains slightly overbought.

Bullish Percent Index for S&P 500 stocks slipped last week to 66.40% from 68.80% and remained below its 20 day moving average. The Index is intermediate overbought and shows signs of rolling over.

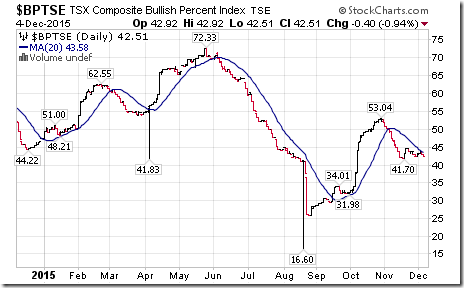

Bullish Percent of TSX stocks was unchanged last week at 42.51% and remained below its 20 day moving average.

The TSX Composite Index slipped 9.47 points (0.07%) last week. Intermediate trend remains up (Score: 2). Strength relative to the S&P 500 Index improved last week to neutral from negative (Score: 0). The Index remains below its 20 day moving average (Score:-1). Short term momentum indicators are trending down (Score: -1). Technical score remained last week at 0.

Percent of TSX stocks trading above their 50 day moving average dropped last week to 37.65% from 40.49%.

Percent of TSX stocks trading above their 200 day moving average increased last week to 30.36% from 27.53%.

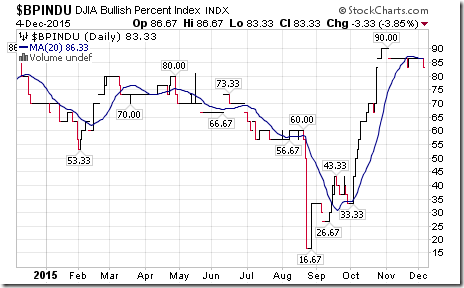

The Dow Jones Industrial Average added 49.14 points (0.28%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index changed to neutral from positive. The Average recovered above its 20 day moving average on Friday. Short term momentum indicators are trending down. Technical score dropped last week to 2 from 6.

Bullish Percent Index for Dow Jones Industrial Average stocks slipped last week to 83.33% from 86.67% and fell below its 20 day moving average. The Index is intermediate overbought and showing signs of rolling over.

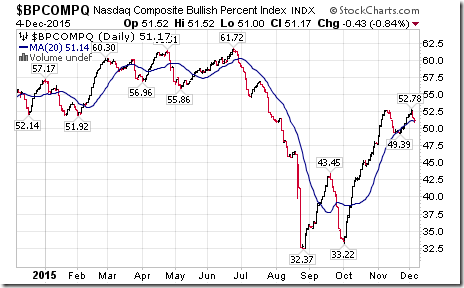

Bullish Percent Index for NASDAQ Composite stocks was unchanged last week and moved below its 20 day moving average. The Index remains slightly overbought and showing early signs of rolling over.

The NASDAQ Composite Index added 14.75 points (0.29%) last week. Intermediate trend remains up. Intermediate trend remains up. Strength relative to the S&P 500 Index remains positive. The Index recovered to above its 20 day moving average on Friday. Short term momentum indicators are trending down. Technical score slipped last week to 4 from 6.

The Russell 2000 Index lost 18.98 points (1.58%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remained neutral after briefly turning positive. The Index moved back above its 20 day moving average on Friday. Short term momentum indicators are trending down. Technical score slipped last week to 2 from 6

The Dow Jones Transportation Average dropped 260.59 points (3.17%) last week. Intermediate trend changed to neutral from up following a drop below 7921.27. Strength relative to the S&P 500 Index changed to negative from neutral. The Average fell below its 20 day moving average. Short term momentum indicators are trending down. Technical score fell last week to -4 from 2.

The Australia All Ordinaries Composite Index dropped 49.90 points (0.95%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains neutral. The Index fell below its 20 day moving average on Friday. Short term momentum indicators are trending down. Technical score slipped last week to 2 from 3.

The Nikkei Average dropped 379.46 points (1.91%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index changed to neutral from positive on Friday. The Average fell below its 20 day moving average on Friday. Short term momentum indicators are trending down. Technical score dropped last week to -2 from 3.

iShares Europe 350 added $0.01 (0.02%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index improved to neutral from negative. Units moved above their 20 day moving average on Friday. Short term momentum indicators are trending down. Technical score remained last week at 0.

The Shanghai Composite Index added 88.69 points (2.58%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains neutral. The Index remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score last week remained at 0.

Emerging Markets iShares slipped $0.06 (0.18%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains negative. Units remain below their 20 day moving average. Short term momentum indicators are trending down. Technical score slipped last week to -2 from -1

Currencies

The U.S. Dollar plunged 1.72 (1.72%) last week despite a strong gain on Friday. Intermediate trend remains up. The Index fell below its 20 day moving average on Thursday. Short term momentum indicators are trending down.

Conversely, the Euro gained 2.79 (2.63%) last week despite a significant drop on Friday. Intermediate trend remains down. The Euro moved above its 20 day moving average on Thursday. Short term momentum indicators are trending up.

The Canadian Dollar slipped 0.04 (0.05%) last week. Intermediate trend remains neutral. The Canuck Buck remains below its 20 day moving average. Short term momentum indicators are mixed.

The Japanese Yen dropped 0.19 (0.23%) last week. Intermediate trend remains down. The Yen remains below its 20 day moving average. Short term momentum indicators are trending up.

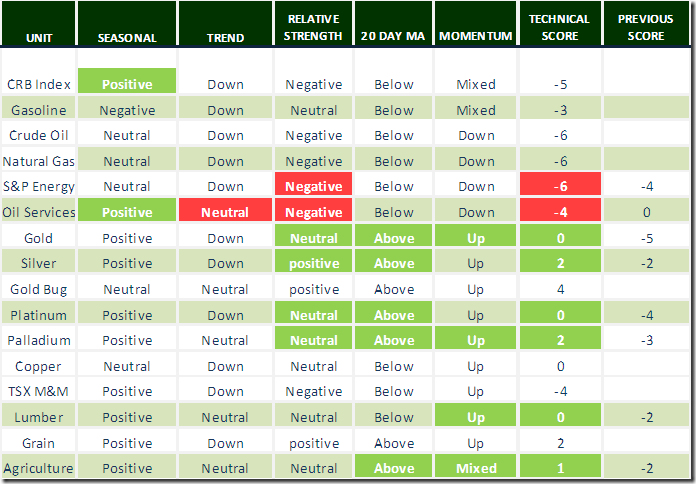

Commodities

Green: Increase from previous day

Red: Decrease from previous day

The CRB Index slipped 0.49 (0.27%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index remains below its 20 day moving average. Short term momentum indicators are mixed. Technical score slipped last week to -5 from -4

Gasoline dropped $0.07 per gallon (5.22%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains neutral. Gas fell below its 20 day moving average. Short term momentum indicators are mixed. Technical score slipped last week to -3 from 0.

Crude Oil dropped $1.74 per barrel (4.17%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. Crude remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped to -6 from -4.

Natural Gas dropped $0.02 per MBtu (0.90%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. “Natty” remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score remained last week at -6

The S&P Energy Index dropped 22.40 points (4.51%) last week. Intermediate trend changed from neutral to down on a move below 478.67. Strength relative to the S&P 500 Index changed to negative from neutral. The Index remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped to -6 from 0.

The Philadelphia Oil Services Index dropped 6.83 points (3.87%) last week. Intermediate trend changed to neutral from up on a move on Friday below 170.61. Strength relative to the S&P 500 Index changed to negative from neutral. The Index remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped last week to -4 from 2.

Gold gained $27.90 per ounce (2.64%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed on Friday to neutral from negative. Gold moved above its 20 day moving average on Friday. Short term momentum indicators started trending up on Friday. Technical score improved last week to 0 from -5.

Silver gained $0.48 per ounce (3.42%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed to positive from negative. Silver moved above its 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 2 from -5. Strength relative to gold has turned positive.

The AMEX Gold Bug Index gained 13.96 points (12.99%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index turned positive. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved to 4 from -2. Strength relative to gold has turned positive

Platinum gained $44.80 per ounce (5.86%) last week. Trend remains down. Strength relative to the S&P 500 Index improved to neutral from negative. PLAT moved above its 20 day MA.

Palladium gained $17.25 per ounce (3.14%) last week. Trend remains neutral. Strength relative to the S&P 500 and gold has improved to neutral from negative. PALL moved above its 20 day moving average on Friday. Short term momentum indicators are trending up.

Copper added $0.02 per lb. (0.97%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index improved to neutral from negative. Copper remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 0 from -6

The TSX Metals & Mining Index added 2.94 points (0.84%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score last week remained at -4.

Lumber added $4.70 (1.8%) last week. Trend remains neutral. Lumber remains above its 20 day MA. Relative strength remains neutral. Momentum indicators are trending up. Score: 0.

The Grain ETN gained $1.06 (3.42%) last week. Trend remains down. Strength relative to the S&P 500 Index turned positive from negative. Units moved above their 20 day moving average. Short term momentum indicators are trending up. Technical score improved to 2 from -4.

The Agricultures ETF slipped $0.03 (0.06%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index remains neutral. Units recovered to above its 20 day moving average on Friday. Short term momentum indicators are mixed.

Interest Rates

Yield on 10 year Treasuries increased 5 basis points (2.25%) last week. Intermediate trend remains up. Units moved above their 20 day moving average. Short term momentum indicators are mixed.

Conversely, price of the long term Treasury ETF fell $0.39 (0.32%) last week. Units remain above their 20 day moving average.

Other Issues

The VIX Index slipped 0.31 (2.05%) last week. The Index remains below its 20, 50 and 200 day moving average.

Technical action by S&P 500 stocks was mixed last week. 44 stocks broke resistance (notably Consumer Staples, Financials and Health Care stocks) and 59 stocks broke support (notably Energy and Utilities).

Earnings news this week is quiet. Focus is on Costco.

Consensus from FactSet shows that fourth quarter earnings per share by S&P 500 companies on a year-over-year basis will fall 4.3%, up from 4.2% last week. Fourth quarter revenues are expected to decline 3.0%. 83 S&P 500 companies have issued negative earnings guidance for the fourth quarter while 26 companies have issued positive guidance. Prospects beyond the fourth quarter turn positive when the negative impact of a strong U.S. Dollar Index will have less influence. Year-over-year earnings per share are expected to increase 2.0% in the first quarter and 8.1% for 2016. Year-over-year revenues are expected to increase 2.9% in the first quarter and 4.4% for 2016. Question: When will investors begin to anticipate gains by earnings and revenues following their current downtrend? Probably when difficult fourth quarter reports are released in late January accompanied by positive guidance! Stay tuned!

Short and intermediate technical indicators began to roll over last week from overbought levels despite gains by equity and sector indices on Friday.

The month of December is the strongest month of the year for North American equity indices. However, strength tends to be concentrated during the last two weeks of the month (i.e. Christmas rally period). Look for history to repeat. Equity markets will be heavily influenced during the next two weeks to the Federal Reserve’s decision on December 16th and tax loss selling pressures (ending December 24th for Canadian investors holding Canadian equities). Prospects for a Santa Claus rally this year following the end of short term downside pressure are above average.

Economic news this week focuses on November Retail Sales.

El Nino type weather through this winter is expected to have a positive impact on Industrial Production and the S&P 500 Index (i.e. an extra 3% gain during El Nino winters).

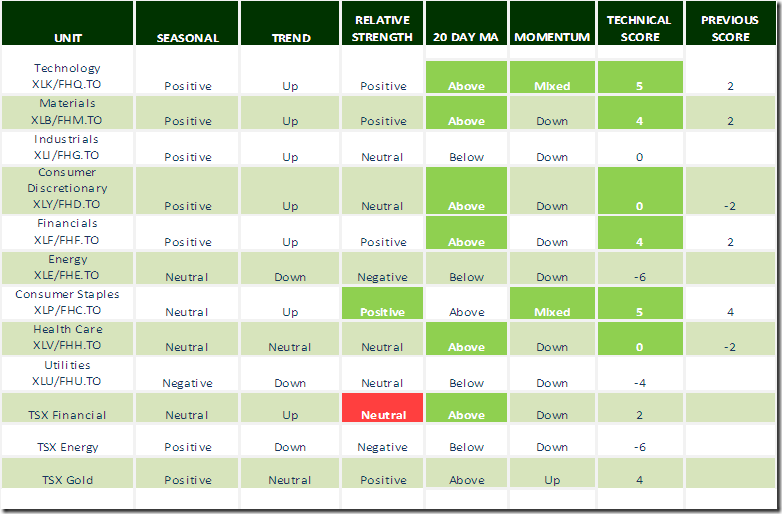

Sectors

Editor’s Note: Most of the gains on Friday came from units moving above their 20 day MA

Green: Increase from previous day

Red: Decrease from previous day

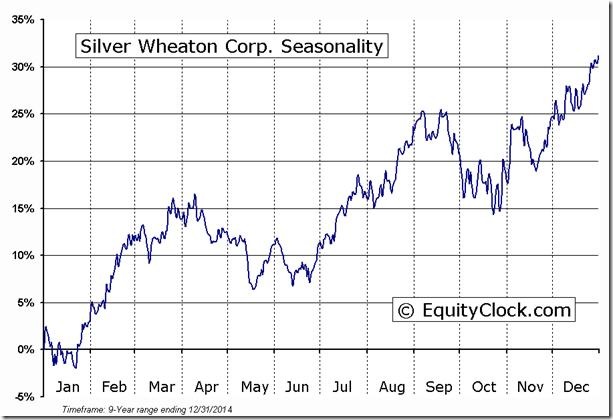

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following are examples:

StockTwits Released on Friday @Equityclock

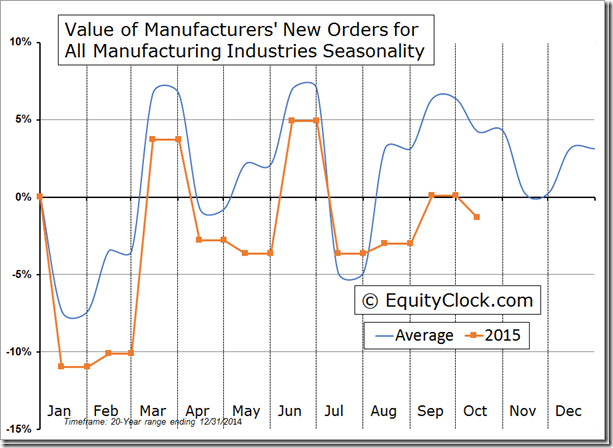

Factory orders on track to realize back to back years of contracting activity, first time since 2000 and 2001.

Technicals for S&P stocks to 10:00: Bearish. 1 stock broke resistance: $AVP. 6 energy stocks broke support: $APC,$COP,$DNR,$DVN, $NE,$XOM.

Editor’s Note: After 10:00 AM EST, equity markets moved strongly higher. Ten S&P 500 stocks broke resistance: MCD, CME, DG, OMC, AON, MMC, BDX, XL, CA, AES

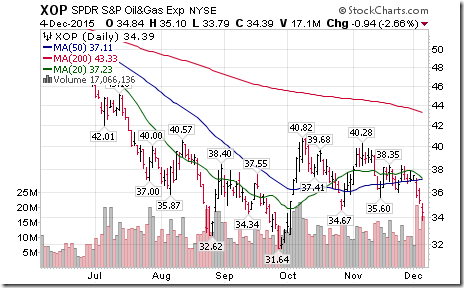

A breakdown of 6 energy stocks this morning triggered a break by $XOP below support at $34.67.

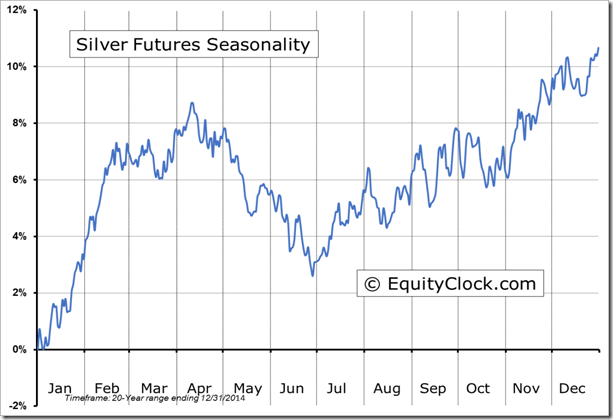

Nice pop by Silver and its ETF $SLV! Short term technicals (Stochastics, RSI, MACD) have turned positive.

Editor’s Note: The silver equity ETF is outperforming the price of silver, a positive technical sign for both.

‘Tis the season for Silver and $SLV to move higher until at least the third week in February!

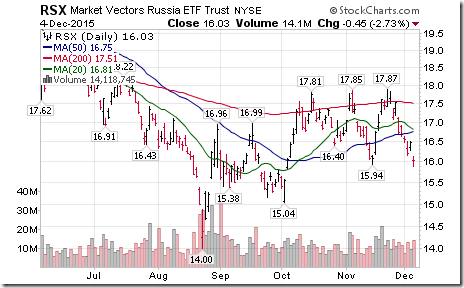

Russian ETF $RSX responding to lower crude oil prices by breaking support at $15.94.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca