by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Thursday December 3rd

U.S. equity index futures were lower this morning. S&P 500 futures were down 4 points in pre-opening trade.

Index futures moved lower following release of the Weekly Jobless Claims report and ECB president Draghi’s comments released at 8:30 AM EST. Consensus for Weekly Jobless Claims was an increase to 267,000 from 260,000 last week. Actual was an increase to 269,000.

European equity prices moved lower, the Euro moved higher and the U.S. Dollar Index moved lower following comments by Draghi that expanded information about ECB’s moves. The moves provided less monetary stimulus than economists predicted. The European Central Bank cut its deposit rate to -0.3% from -0.2%. Its key lending rate was maintained at 0.05%. In addition, the ECB extended its asset purchase program until March 2017.

Medtronic gained $0.89 to $77.00 after releasing stronger than consensus quarterly earnings.

Costco added $3.02 to $164.11 after Deutsche Bank upgraded the stock to buy. Also, Costco announce higher than consensus November sales. Target price is $200.

Travelers dropped $0.71 to $114.00 after Bank of America downgraded the stock to neutral. Target is $120.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2015/12/02/stock-market-outlook-for-december-3-2015/

Note seasonality charts on the U.S. Dollar Index, Transportation, Crude Oil, Crude Oil Supply and Gasoline Days of Supply.

StockTwits Released Yesterday @Equityclock

TSX Composite testing trend line resistance as it nears peak of descending triangle pattern.

Technical action by S&P 500 stocks to 10:15: Mixed. Breakouts: $YUM, $SCHW, $MNK. Breakdowns: $BF.B, $RRC, $CHRW, $CPGX.

Editor’s Note: After 10:15, technical deterioration by S&P 500 stocks appeared and accelerated into the close after news of a massive shooting in California was announced. Another 6 stocks broke resistance and 10 stocks broke support. Notable on the list of stocks breaking support were energy stocks: MUR, NFX, OKE, APA, EOG and MRO.

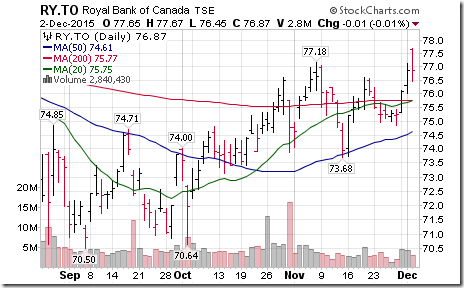

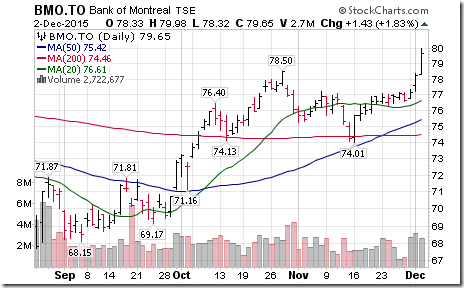

Nice breakout by TSX Financials $XFN.CA to extend an uptrend thanks to breakouts by $RY and $BMO!

Trader’s Corner

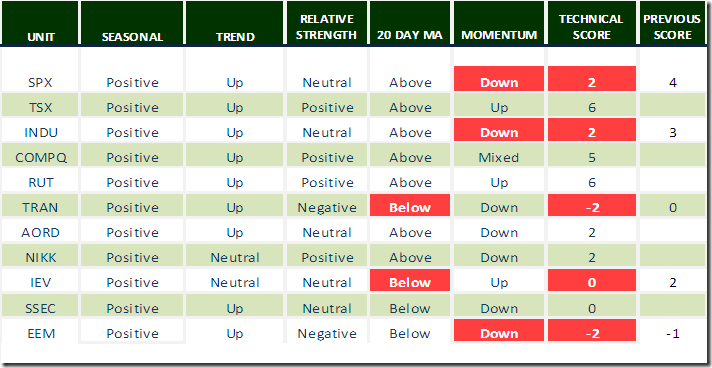

Technical scores dropped significantly yesterday. Some of the declines were triggered by securities moving below their 20 day moving averages thereby cancelling gains recorded on Tuesday when securities moved above their 20 day moving average. Of greater importance, most of the declines were triggered by deterioration of short term momentum indicators following a two week period of positive momentum.

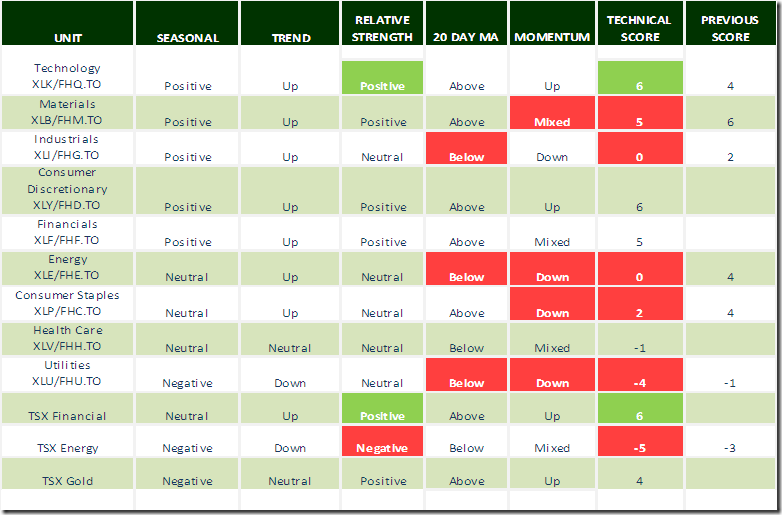

Daily Seasonal/Technical Equity Trends for December 2nd 2015

Green: Increase from previous day

Red: Decrease from previous day

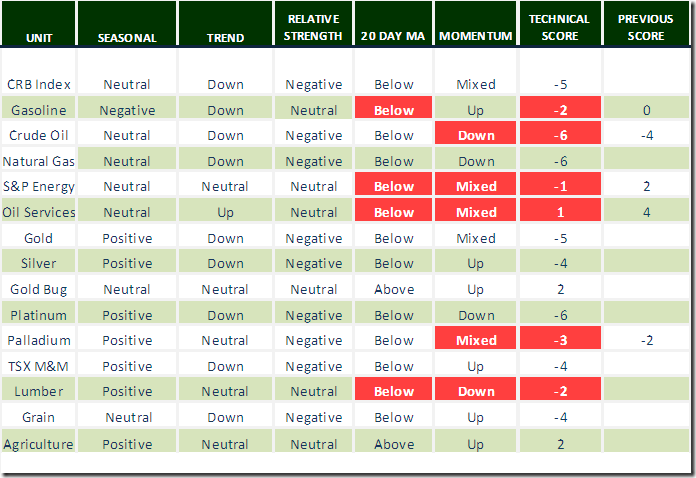

Daily Seasonal/Technical Commodities Trends for December 2nd 2015

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for December 2nd 2015

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

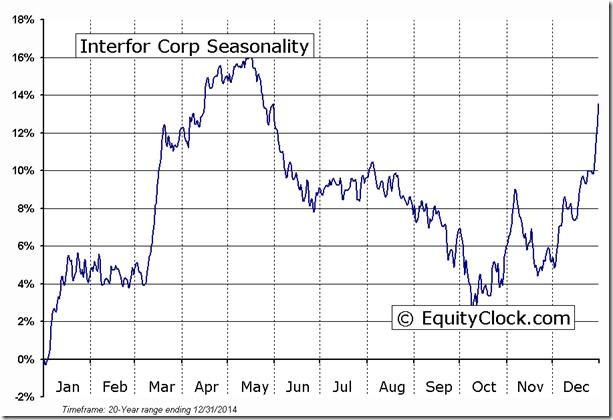

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Interfor Corp (TSE:IFP) Seasonal Chart

FP Trading Desk Headline

FP Trading Desk headline reads,” Are commodities poised for a recovery in 2016”? Following is a link:

http://business.financialpost.com/news/mining/are-commodities-poised-for-a-recovery-in-2016

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca