Bull Market Still Alive ... The Eanings Situation is Not Looking All That Great

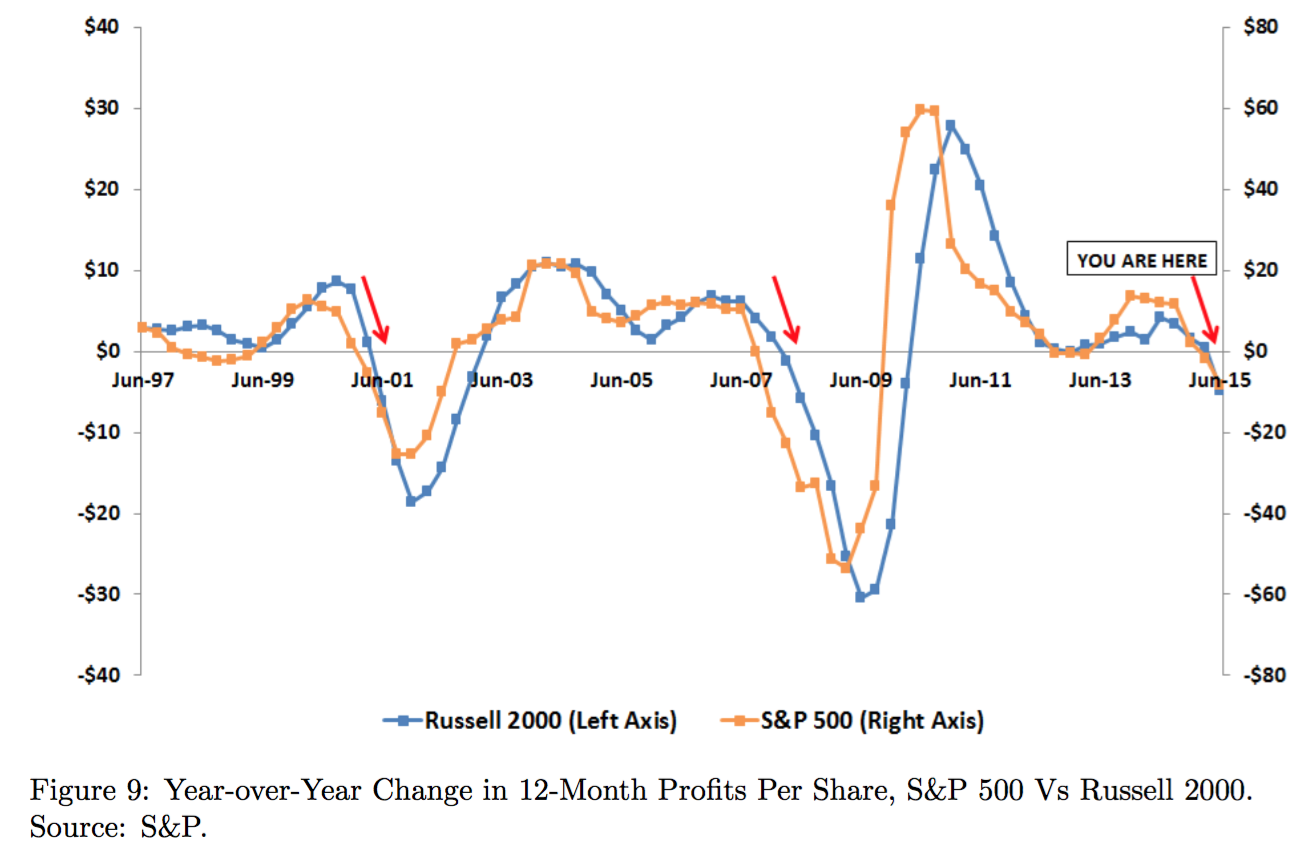

Seems that corporate America is struggling just like in 2001 & 2008

Source: Ellington Management Group

Source: Ellington Management Group

One of the major red flags investors have been paying close attention to is the fall in earnings of corporate America. For only the third time in the last two decades, 12 month change in S&P 500 and Russell 2000 earnings has started to decline. Since the last two events marked major bear markets for the stock market as well as economic recessions, conditions such as these are scaring a lot of people. However, what is very interesting is that the stock market isn’t phased at all right now, unlike in previous two events during 2000 and 2007. Lets have a closer look.

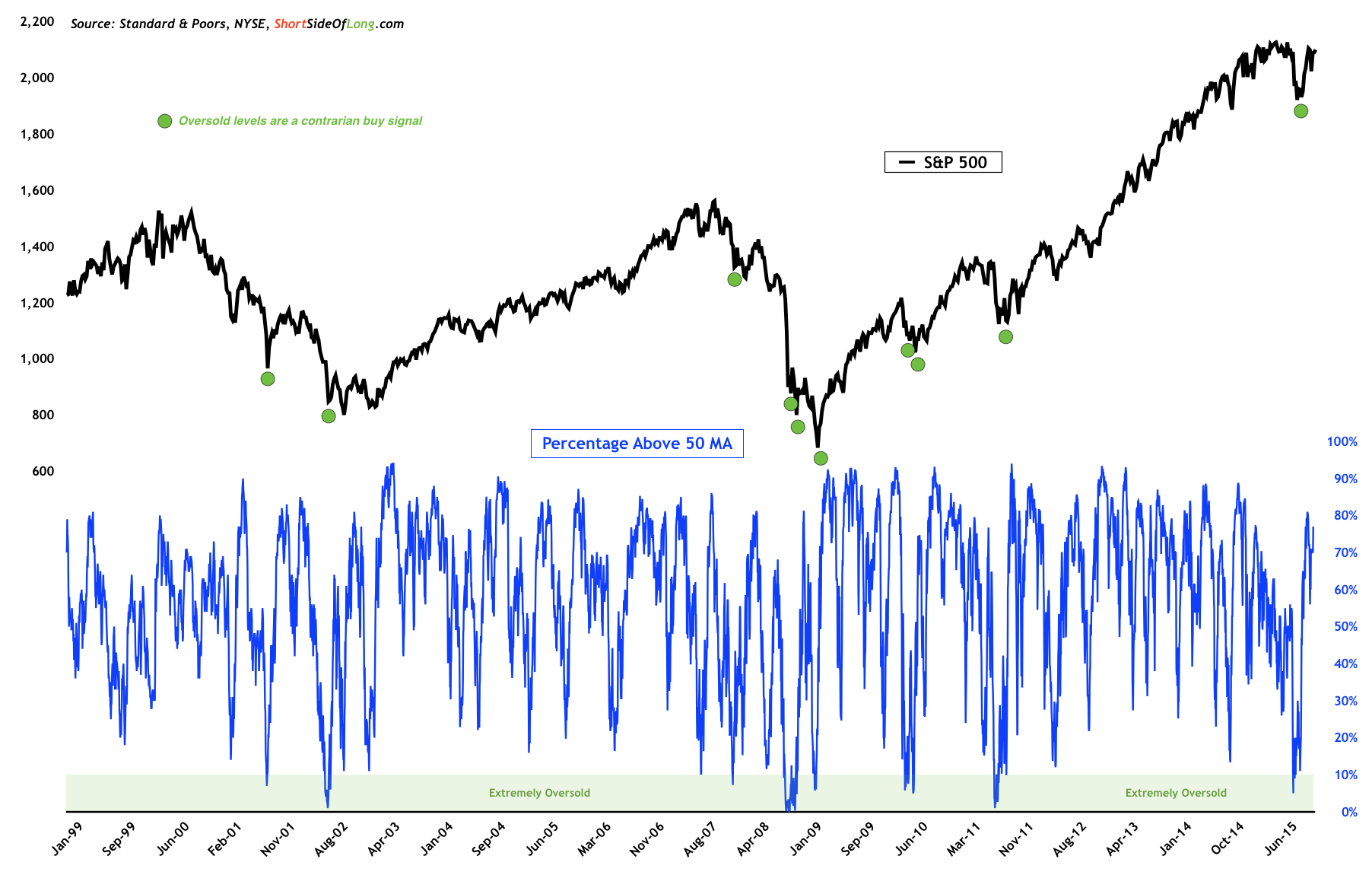

Market price and breadth has recovered since the August panic

The market has rallied all the way back to 2100 points, while the percentage of stocks trading above their respective 50 day moving averages is close to 80% of the S&P index. Breadth isn’t perfect by any means, but short term participants is rather broad, while not overbought and therefore prone to a sell off (usually seen when this indicator goes above 90 or even 95 percent).

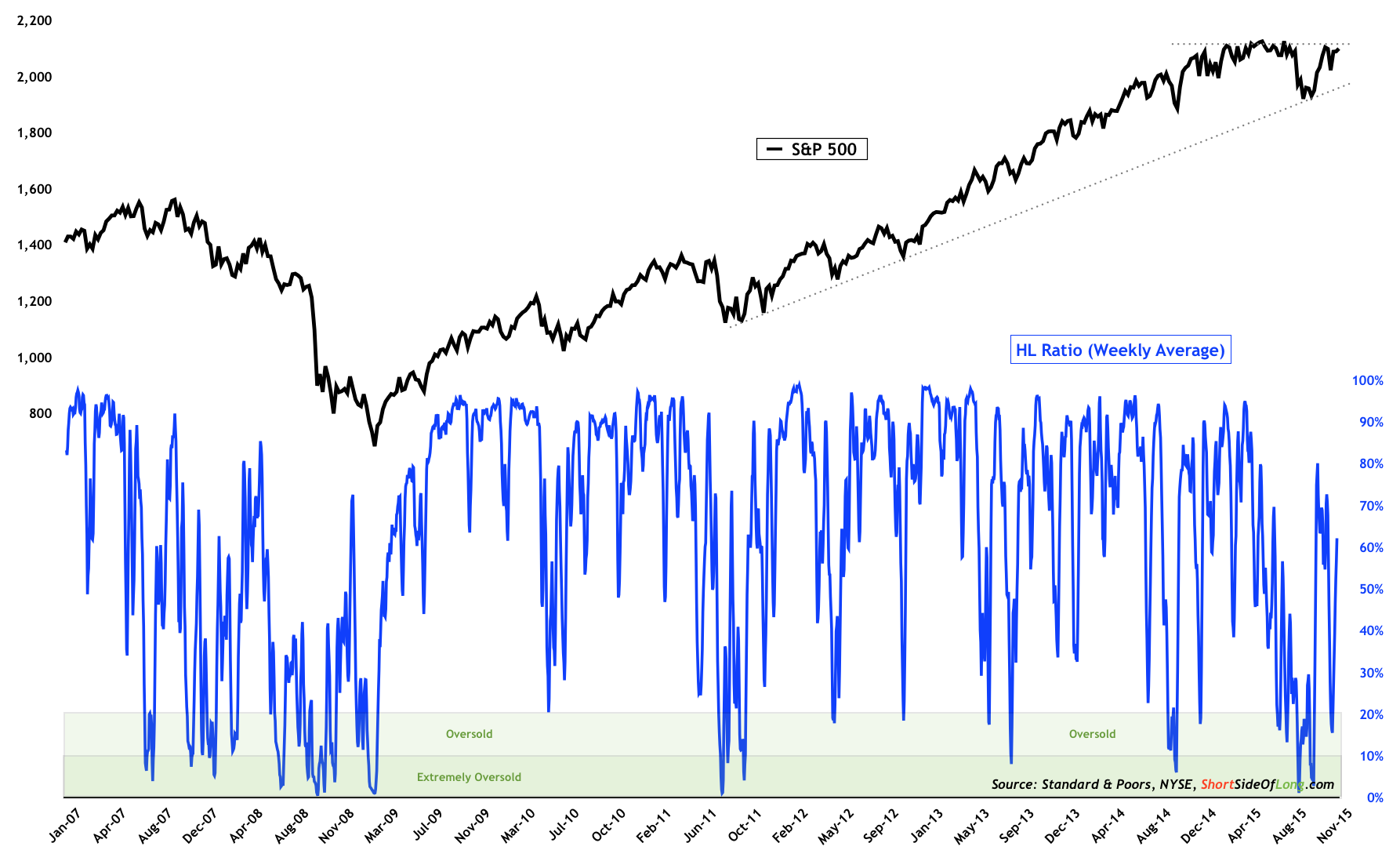

On the other hand, chart below shows that the ratio of 52 week new highs relative to 52 week new lows has been rather weak as of late. This is actually quite normal, as the market has been moving sideways while experiencing a mini-panic during the month of August. Important thing to note here is that the market remains in a primary uptrend, and is behaving very well every time it becomes oversold. With the tap suggesting that a breakout is possible, I am sure that we will see the percentage of 52 week new highs expand.

If the market breaks upward, percentage of new highs could rise again