Calling On Canadian Telecoms

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

• The Canadian telecom sector faced a number of challenges in 2013 and 2014, as earnings slowed and concerns of a new entrant weighed on the sector. However, these headwinds have abated more recently which in part explains the sector’s solid performance year-to-date (YTD).

• Given the improving fundamental and technical backdrop we have had the sector on upgrade watch and today are officially upgrading the sector to overweight.

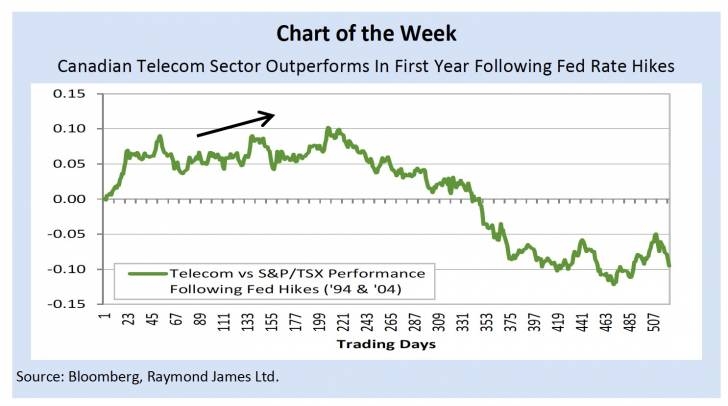

• Our bullish view of the sector is predicated on: 1) improving earnings (sector is forecasted to grow earnings at 6.4% in 2016); 2) solid dividend growth; 3) improving technicals; 4) diminished risk of a new entrant; and 5) historically the sector has outperformed in the first year after the US Federal Reserve (Fed) hike rates (see Chart of the Week).

• Our preferred name in the sector is Telus Corp. (T-T). The shares have recently pulled back to good technical support around the $40 level. We would use this weakness to establish or add to positions given our bullish outlook on the sector and company.

Read/Download the complete report below: