Where Do We See Value?

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

• Since the equity market low in March 2009, global equities (MSCI World Index) and US stocks (S&P 500 Index) are up 138% and 196%, respectively, on a price basis. As a result, equities have become more expensive, making it increasingly difficult to find good value in the equity markets. In this week’s piece we do a deep dive on valuations across the global equity markets, sectors, and asset classes, in effort to help isolate undervalued assets.

• In global equities we see decent value in Europe and Japan, with the European equity markets being our preferred global market.

• Within the Canadian equity market we see good value in the financials and industrial sectors.

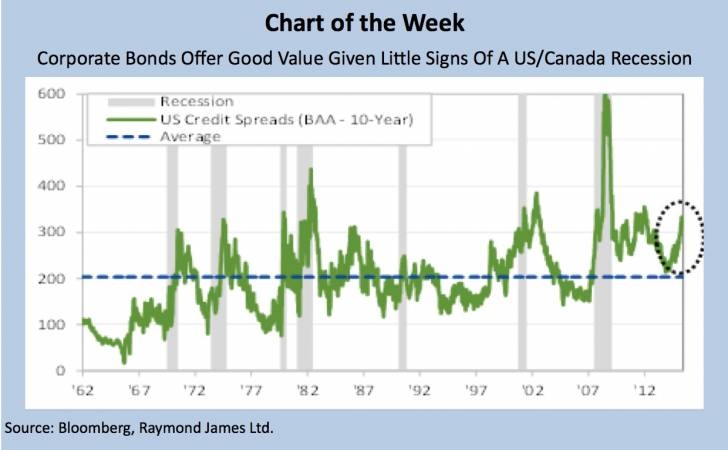

• Within fixed income we continue to have a clear preference for high-quality corporate bonds, which we believe offers good value following the sell-off in H2/15 (see Chart of the Week).

• Lastly, one area where we see really good long-term value is the Canadian preferred share market. Year-to-date (YTD) the iShares S&P/TSX Preferred Share Index ETF (CPD-T), which tracks the S&P/TSX Preferred Share Total Return Index, is down 15.3%. As a result the 12-month trailing dividend yield has increased to 5.5%, which is the highest level since 2009. As the Bank of Canada (BoC) begins to tighten monetary policy over the next few years, we believe the Canadian pref market, particularly fixed resets, will recover and deliver solid total returns for patient investors.