U.S. Equities Still Outperforming

by Tiho Brkan, Short Side of Long

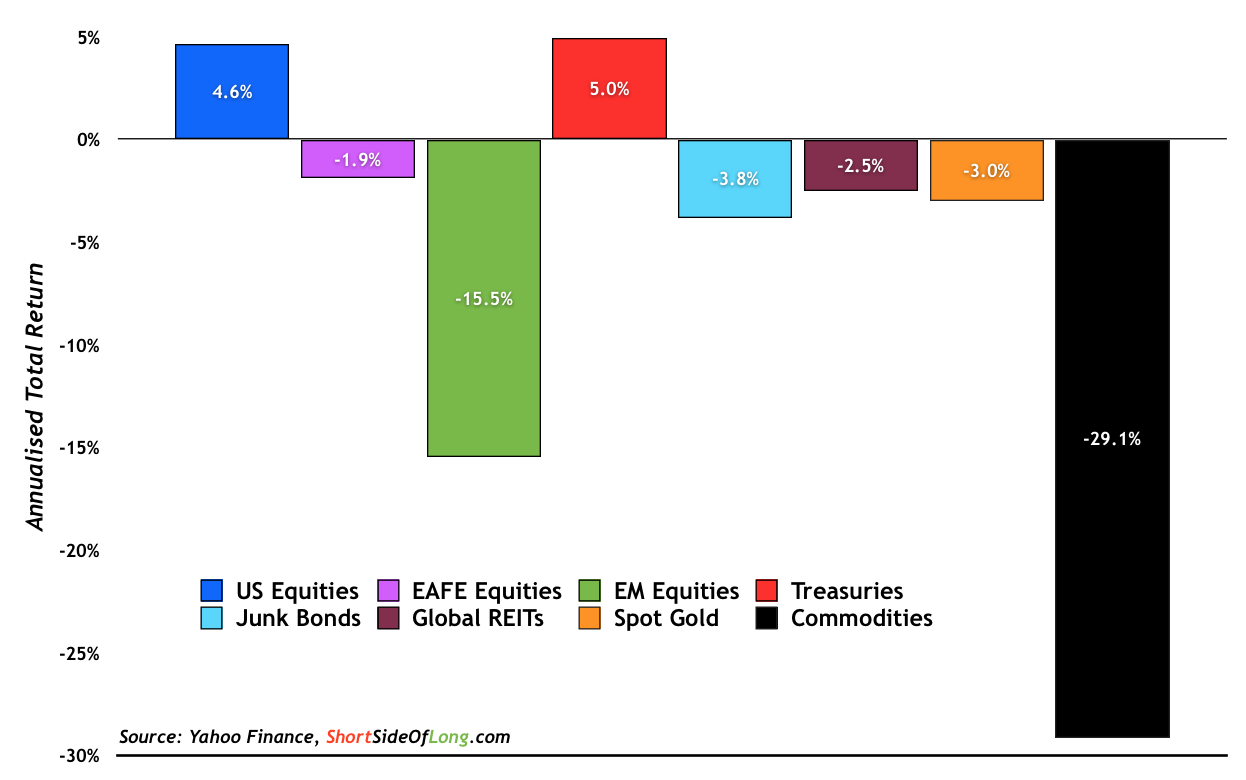

EM equities and commodities have underperformed over the last 52 weeks

If you were to constantly listen to US centric business media, you would eventually be under impression that Google, Amazon and Apple are the most important segments of the world economy. Maybe that is because this segment is the one still delivering strong returns. However, the world is made up of many stock regions, including developed markets excluding US and the currently hated regions of the global emerging markets. Furthermore, investors also have the ability to purchase holdings of bonds as well as commodities, to diversify away from shares.

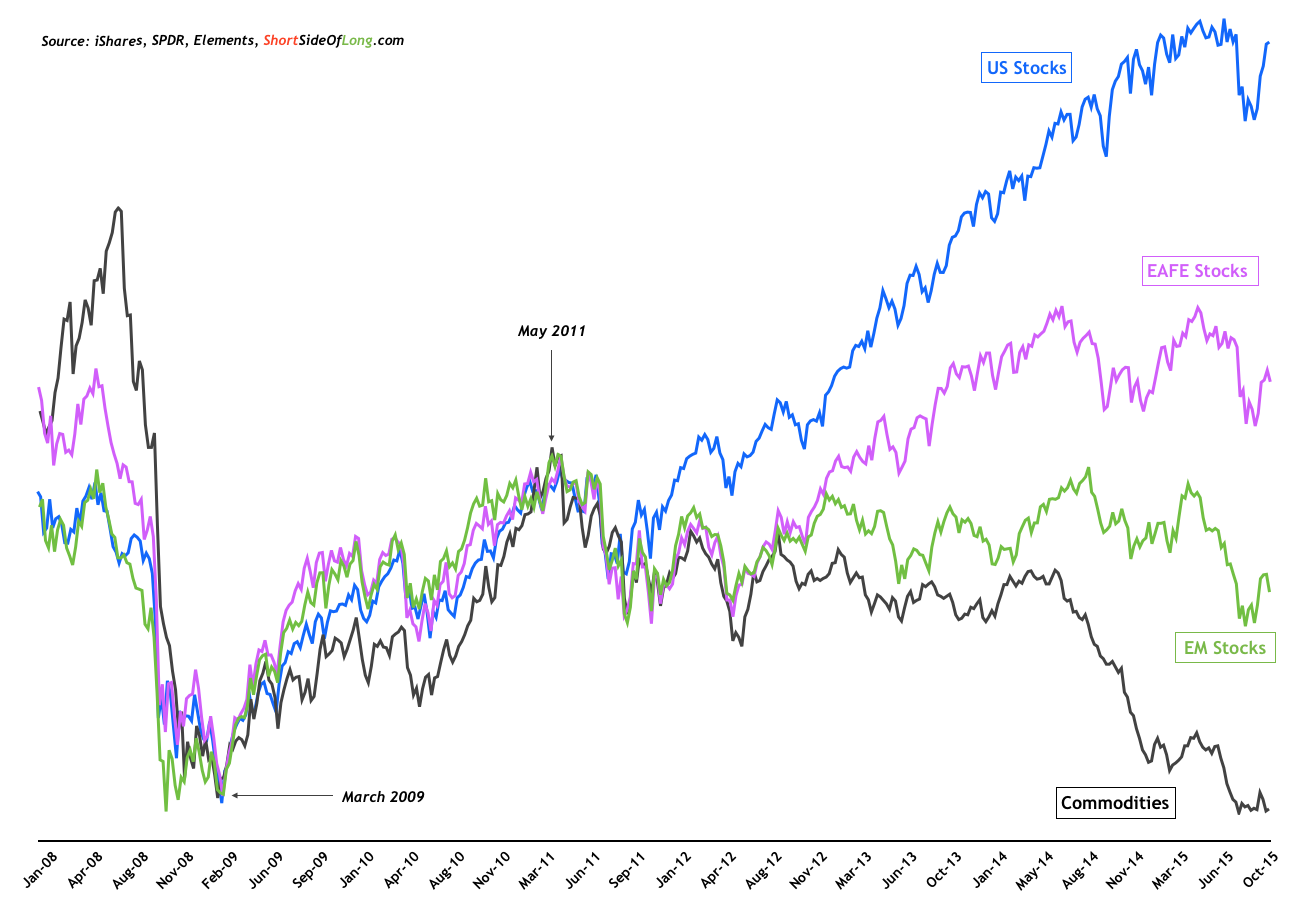

In today’s post we look at the way US shares have outperformed all other equity regions including commodities. As we can clearly see from the chart below, March 2009 was a major infection point at the bottom of the Global Financial Crisis. From here, almost all global assets moved in what was coin-termed “risk on / risk off” correlation. One could argue that this correlation lasted until May 2011, where global stocks and commodities topped out, entering a downtrend. United States as well as other developed markets outside of North American, also known as Europe / Australasia / Far East (EAFE), have managed to recover in better fashion, mainly due to the QE stimulus coming from Federal Reserve, ECB and BoJ.

Since the recent intermediate bottom in late September of this year, US equities continue to outperform once again. They are now approaching their all time high record, while EAFE shares peaked out in June of 2014, lagging behind. Furthermore, in this cycle May 2011 still remains the peaked for both EM equities as well as commodities.

US equities have clearly outperformed, while commodities went through a bust!