The Latest Margin Debt Figures Send An Ominous Signal For Stocks

by Jesse Felder, The Felder Report

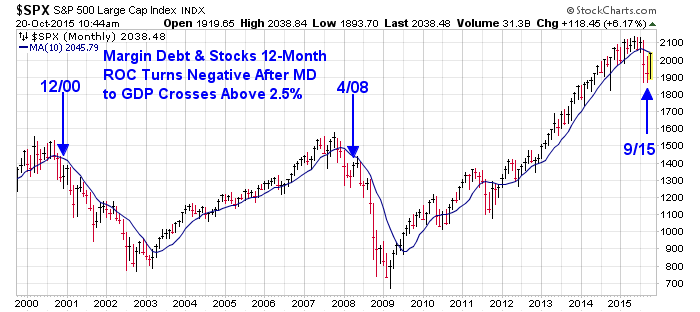

The NYSE margin debt numbers for the month of September were released today revealing a very significant milestone for the stock market. As of the end of September, both stocks and margin debt have seen their 12-month rate of change turn negative after margin debt-to-GDP had risen above 2.5%. The last time this happened was April of 2008, as the stock market crash during the financial crisis was just getting started. The time before that was December, 2000, the very beginning of the dotcom bust.

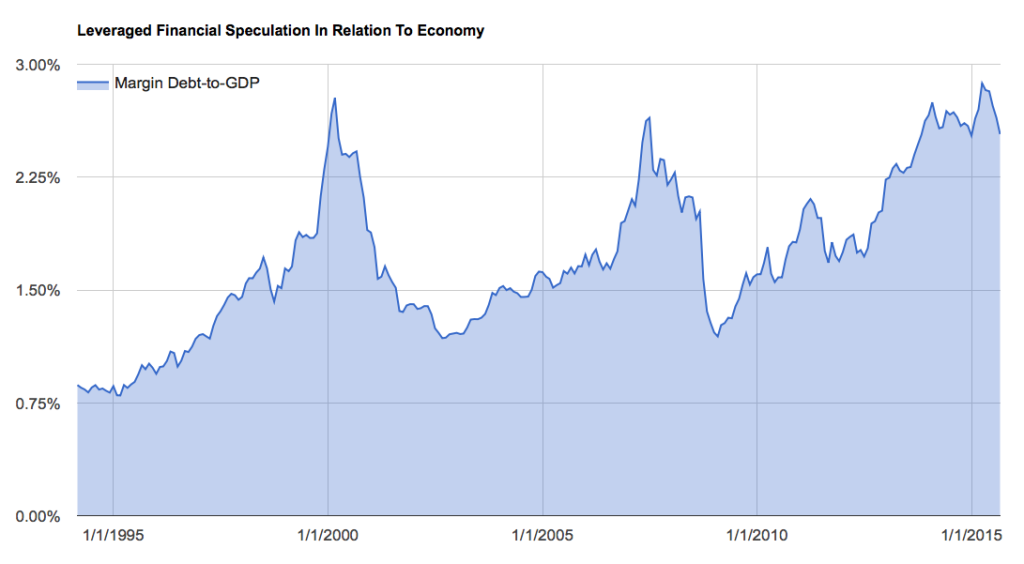

What’s more, the level of margin debt relative to the economy is now contracting from an all-time high. In other words, financial speculation as a percent of overall economic activity looks to have possibly peaked from one of the most extended levels we have ever witnessed.

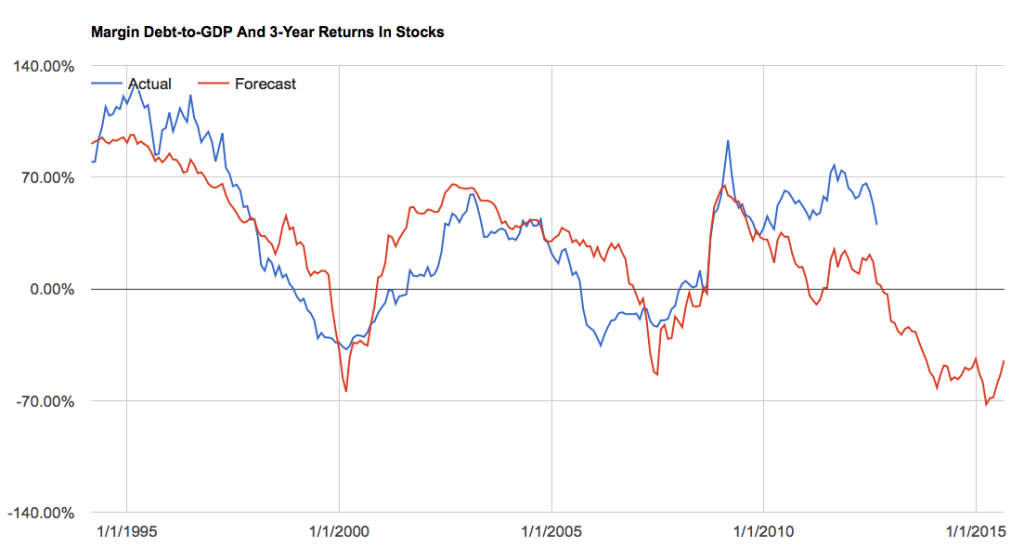

I like to look at this measure because it’s been highly (negatively) correlated with forward 3-year returns in the stock market for at least the past 20 years or so. Right now this measure forecasts a 45% decline over the coming 3 years.

Based solely on these measures, stocks have already likely entered a major bear market that will not end before significant wealth destruction is accomplished. Obviously, this is only one measure, however, so it can’t be relied upon on its own. Still, I believe investors would do well to respect the elevated risk in U.S. stocks right now and position themselves accordingly.

UPDATE: I updated the first chart to include the qualification that margin debt-to-GDP had risen above 2.5%.

Copyright © Jesse Felder, The Felder Report