The rally in consumer stocks rolls on

by James Picerno, The Capital Spectator

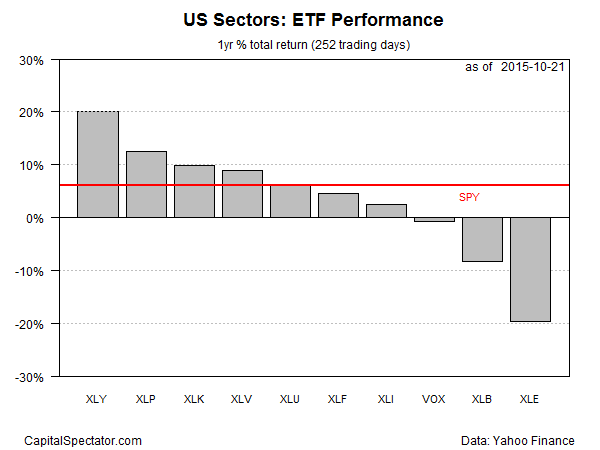

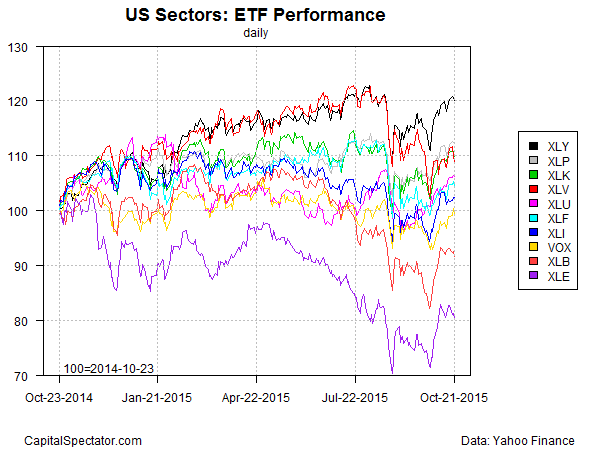

Consumer discretionary stocks have strengthened their lead among the major US equity sectors this month, based on trailing one-year total return data for a set of ETF proxies. After bumping healthcare shares from the top spot recently, the Consumer Discretionary SPDR ETF (XLY) has widened its performance edge over the rest of the field in October.

XLY, which holds consumer-focused stocks such as Amazon and Walt Disney, has posted a 20% total return for the trailing one-year period (252 trading days) through yesterday (Oct. 20). That’s a solid premium over the 12.5% one-year gain for the number-two fund: the Consumer Staples SPDR ETF (XLP), which targets consumer stocks that are considered less cyclically sensitive, such as firms focused on food and household products. For comparison, the US equity market overall is up around 6% for the past year, based on the SPDR S&P 500 ETF (SPY).

With the holiday shopping season approaching, some analysts think that consumer shares generally will continue to lead the pack. “I think the consumer continues to see momentum,” Jeff Kilburg at KKM Financial told CNBC earlier this week.

Meanwhile, the dogs are still the dogs when comparing the sector ETFs. Energy and basic materials continue to wallow at the tail end of the performance horse race for the trailing one-year period. The slide is particularly steep for energy shares: the Energy SPDR ETF (XLE) is still dead last, cut by nearly 20% over the past 12 months.

Some pundits have speculated that the bear market in energy stocks has created deep-value buying opportunities. One factor in this analysis: the relatively high yield for XLE. The fund’s trailing 12-month payout is 3.25%, according to Morningstar.com—a sizable premium over the 2.08% yield for the benchmark 10-year Treasury, as of Oct. 21 via Treasury.gov.

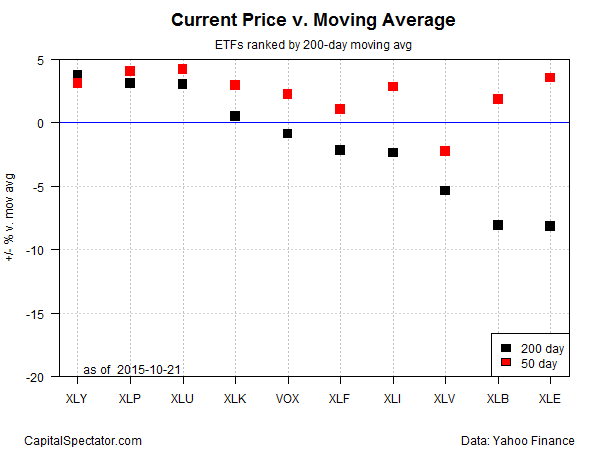

XLE’s momentum, however, still looks weak. Although the fund’s price has been trading moderately above its 50-day moving average in recent weeks for the first time since the spring, the rebound, such as it is, doesn’t yet look convincing. Why? The 50-day average is still below the 100-day average, which is under the 200-day average. In other words, downside momentum still appears to have the upper hand and so the latest rally looks like a dead-cat bounce until or if firmer pricing unfolds in the weeks ahead.

Consumer stocks, by contrast, are enjoying upside momentum these days. That’s no guarantee that higher prices will endure from here on out. The main risk for these shares, and the stock market generally, is macro risk. Heightened uncertainty about the US economy continues to weigh on equities. But if a recession can be avoided, which remains a reasonable forecast at the moment, piling into the relative safety of consumer stocks appears to be a trade with more room to run.

Here’s a list of the sector ETFs cited above, with links to summary pages at Morningstar.com for additional research:

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financial (XLF)

Healthcare (XLV)

Industrial (XLI)

Materials (XLB)

Technology (XLK)

Utilities (XLU)

Telecom (VOX)