Back to the Present

by Andrew Adams, CMT, for Jeffrey Saut, Chief Investment Strategist, Raymond James

On Wednesday of this week (10/21/15), residents of Hill Valley, California are warned to be on the lookout for a flying DeLorean driven by a guy in a white lab coat with crazy hair, and a squeaky-voiced “teen” wearing several layers of out-of-style clothes. If these two are spotted, it is HIGHLY advised that you do not interact with them at all, as doing so could ultimately unravel the very fabric of the space-time continuum. More specifically, whatever you do, please refrain from relinquishing any copy of the Gray’s Sports Almanac (1950-2000 Edition) that you may possess.

I jest, of course, but for the six of you who have not seen the film Back to the Future Part II, Wednesday is the actual day to which the protagonists of the movie, Marty McFly and Doctor Emmett Brown, travel from 1985 in order to prevent Marty’s kids from setting off a chain of events that would have dire consequences for the McFly clan. And as this is one of my all-time favorite movies, I have, unashamedly, been waiting for this day for years now. The version of 2015 that the film presents has always fascinated me, and I truly did believe that by this point we would most certainly be zooming around in flying cars, doing tricks on our hoverboards, and (my personal favorite) “hydrating” pizzas to piping hot perfection in a matter of seconds. Alas, the filmmakers were a tad ambitious with these futuristic technologies, and while they still have a chance to have made possibly the greatest prediction in history – the Cubs winning the 2015 World Series – it is probably a good thing that we do not yet allow ordinary citizens to take to the skies in what would ultimately end up being metallic, flying death traps. Driving is hazardous enough; I don’t think we want road rage to extend above the ground! (Road rage? Where we’re going, we don’t need road rage).

However, technology has still obviously evolved to levels that the people of 1985 could barely fathom, and inventions like the internet, smart phones, GPS, HDTVs, DVRs, streaming music/movies, tablets, and the Chick-Fil-A chicken sandwich have all disrupted our standard way of doing things and improved our lives to a point that we now take for granted. And I continue to be very bullish when it comes to technology and believe its continued evolution, more than anything else, will be what drives our economy over the next couple of decades. I am often asked how I can possibly be optimistic about the stock market given current valuations, the end of the 0% interest rate environment, an aging population, global debt usage, a generation of broke millennials, earnings growth produced by stock buybacks and financial engineering, etc. and perhaps the biggest reason why I am still positive is because of many of the technologies that I know to be on the horizon that have the potential to further change the game completely. We are on the cusp of having things like driverless cars, 3D-printing, virtual reality, human augmentation/biotechnology, robotics, and artificial intelligence further shift our collective paradigm and take us out of the realm of science fiction and into science fact. And this is why I think the next few years have a chance to be very good for stocks and why, if I had to strictly invest in only one sector during my lifetime, it would be technology.

There will, of course, be bumps along the way, and the “technolution” won’t be without its issues, but that has been the case during any previous period of innovation in history. Some jobs will go the way of the leech collector and switchboard operator and disappear, but others will be created as part of the shifting landscape. There has to be someone to fix the robots, after all. So I am still quite bullish on those companies that will create this brave new world, and I will do my best to highlight some of these stocks during the upcoming week.

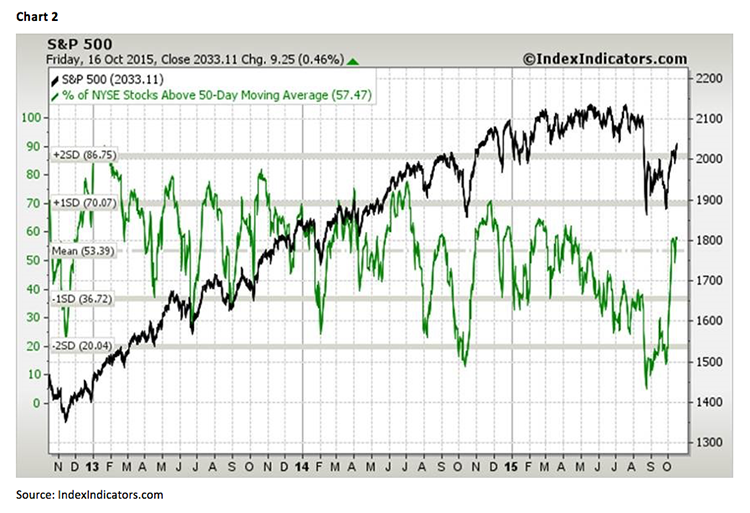

I don’t want to wait too long, however, as this market has recently been racing up at 88 miles per hour and demonstrating that it is a lot stronger than I and most people thought. Generally, it is a clear sign of underlying demand when the major averages can clear obvious technical hurdles while barely pausing to catch its breath, and that is exactly what the S&P 500 did on Thursday and Friday when it closed above the 100- and 200-day exponential moving averages, respectively, in back-to-back sessions. At the same time, breadth measures continue to improve and are now once again nearing historically neutral levels. This means that while we have bounced from the crazy oversold readings we saw over the last two months, we are still nowhere near hitting the upside extremes typically seen near intermediate-term tops. So there is definite room for more upside based on these breadth indicators, though I will throw in the caveat that we are still likely due for a pause or pullback given the unrelenting momentum we have experienced recently. Stocks have been positive 11 out of 14 sessions, and that kind of upside trajectory is probably not sustainable. That leaves us in a tough position, as the market has repaired much of the technical damage done back in August, but still may be a little overheated here. I will therefore reiterate what I said on Friday: aggressive investors and traders can probably start dipping in again here, but realize that if you do this, you risk having to sit through a pullback that is still very possible. I don’t think it’s a bad idea to break up any cash you have and invest it over the next couple of months to try to average out the expected gyrations. After all, there is still quite a bit of concern out there amongst investors, and it may not take much to spook them again.

So why are investors still so nervous? Well, at the end of the day, it comes down to earnings. That is what drives the stock market in the long run and companies are, frankly, struggling to continue growing their profits. During the second quarter of this year, the S&P 500 annualized operating earnings ($108.30) were less than the annualized earnings at the same time last year ($111.83), and while it’s still early into the third quarter reporting season, we are on pace to have yet another period of negative earnings growth (currently trending toward a blended decline of -4.6% with 12% of companies having reported, per FactSet). This broad-market sputtering worries investors because the only other times in the last 25 years that the S&P 500 experienced multi-quarter negative earnings growth were 4Q2007-3Q2009, 1Q2001-2Q2002, and 1Q1990-2Q1992, all of which were accompanied by declines in stocks of at least 20%. And, of course, the early 2000s and 2007-2009 saw more than just the typical bear market, which is why red flags are being sent up all over and why few have been expecting stocks to do much. However, it is often said that bull markets climb a wall of worry and you risk being left behind if you do not admit that the price action trumps your negative outlook. You should know by now that the markets are not rational because at the end of the day it is made up of many irrational individuals, and the primary challenge of investing is trying to figure out how those irrational investors are going to behave. We are not blind to this slip in earnings, but, at this point, it is unclear how much of that was already baked into the ~12.5% fall we saw earlier this year, and how much more adjusting, if any, the market has to do to correct for this slide in profits.

The call for the week: Unfortunately, there are no working DeLorean time machines in existence to help us know what the future will hold (the only functioning model having been destroyed by a train in Back to the Future III). Instead, we are left to utilize all the data and indicators we possess to try to determine how to best position our accounts, and right now they are frustratingly providing mixed signals. The fundamental backdrop is still shaky, at best, but the technical picture has cleared up considerably even if stocks are a tad overbought at the moment. I still believe that for you long-term thinkers out there, we are going to be ok as long as 1867 continues to hold on the S&P 500 and that averaging back into this market with any cash you have left on the sidelines is probably the best course of action heading into year-end. If stocks provide us with more of a “screaming buy point” here shortly, we will obviously let you know, but right now the short-term risk level is still elevated and I don’t believe it prudent to go “all-in.” The former lows from March and July of this year around 2040-2050 are likely to be tested this week, while 1990 should now provide a support floor on the downside. Breakouts above or below these points will provide further signals for near-term direction; however, with as tough as 2015 has been for investments across the board, I think the best opportunity would be if we “could go back to the beginning of the season and put some money on the Cubbies!”

Copyright © Raymond James