Still stuck in slow-growth mode

by Scott Grannis, Calafia Beach Pundit

Not much to cheer about these days. The economy is still underperforming, with a lot of unused (human) capacity. But at least it is still growing—and simply avoiding a recession is a great thing, since it means that risky investments with attractive yields are likely to beat cash.

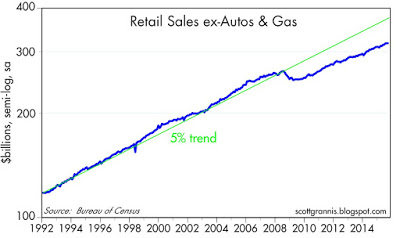

September retail sales were disappointing, but mainly because of falling energy prices. Strip out autos and gas stations and you find that sales rose 3.75% in the past year, exactly the same as their annualized growth over the past four years. The chart above shows that, as well as the potential magnitude of the general shortfall in growth (arguably as much as 15%) in the current business cycle expansion. We could be doing a lot better, to be sure, but continued growth is much better than another recession.

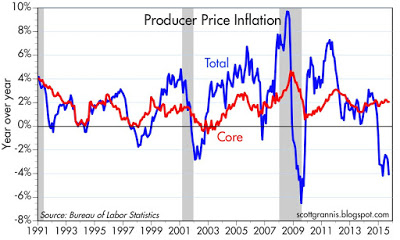

The August Producer Price Index suffered from the same energy-related impact. The overall index is down 4.1% in the past year, but after stripping out food and energy prices, we find that inflation at the wholesale level is running about 2%, very much in line with what we've seen for the past several years.

We're still living in a slow-growth, 2% inflation world.

That's actually remarkable, because sluggish growth and plenty of excess capacity should have resulted in years of very low or negative inflation, according to the popular but flawed Phillips Curve theory of inflation. Contrary to what many have feared, years of slow growth have not led to even slower growth or deflation. The analogy that says the economy is like an airplane approaching stall speed is not apt; neither is it instructive to worry that the U.S. may be following in the footsteps of the notoriously slow-growing Japanese economy. It takes a lot of effort (e.g., very tight monetary policy, as evidenced by high real interest rates, a flat or inverted yield curve, and soaring credit spreads, particularly swap spreads) to generate a recession in the dynamic U.S. economy.

Rather than worry that the economy is at risk of "slipping into recession and/or deflation," we should instead be talking about what needs to be done to allow the economy to grow faster. As I and most other supply-siders see it, the government basically needs to get out of the way and let the private sector do its customary magic. That boils down to cutting marginal tax rates (especially corporate tax rates!), simplifying the tax code, reducing regulatory burdens, and eliminating crony capitalism (e.g., the ex-im bank), among others. In essence, we need a Washington culture that trusts the market to fix things, instead of bureaucrats and agencies.

Copyright © Calafia Beach Pundit