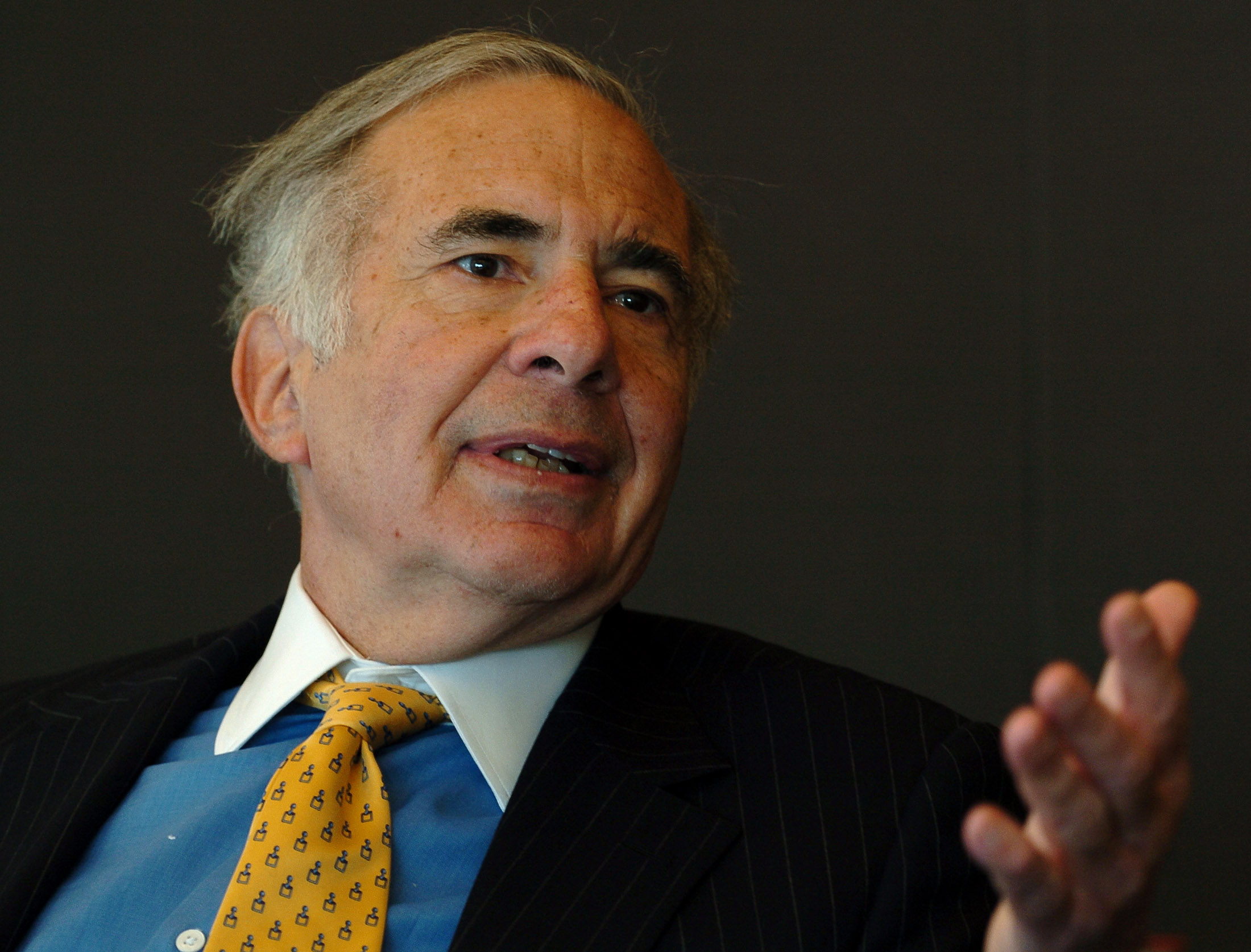

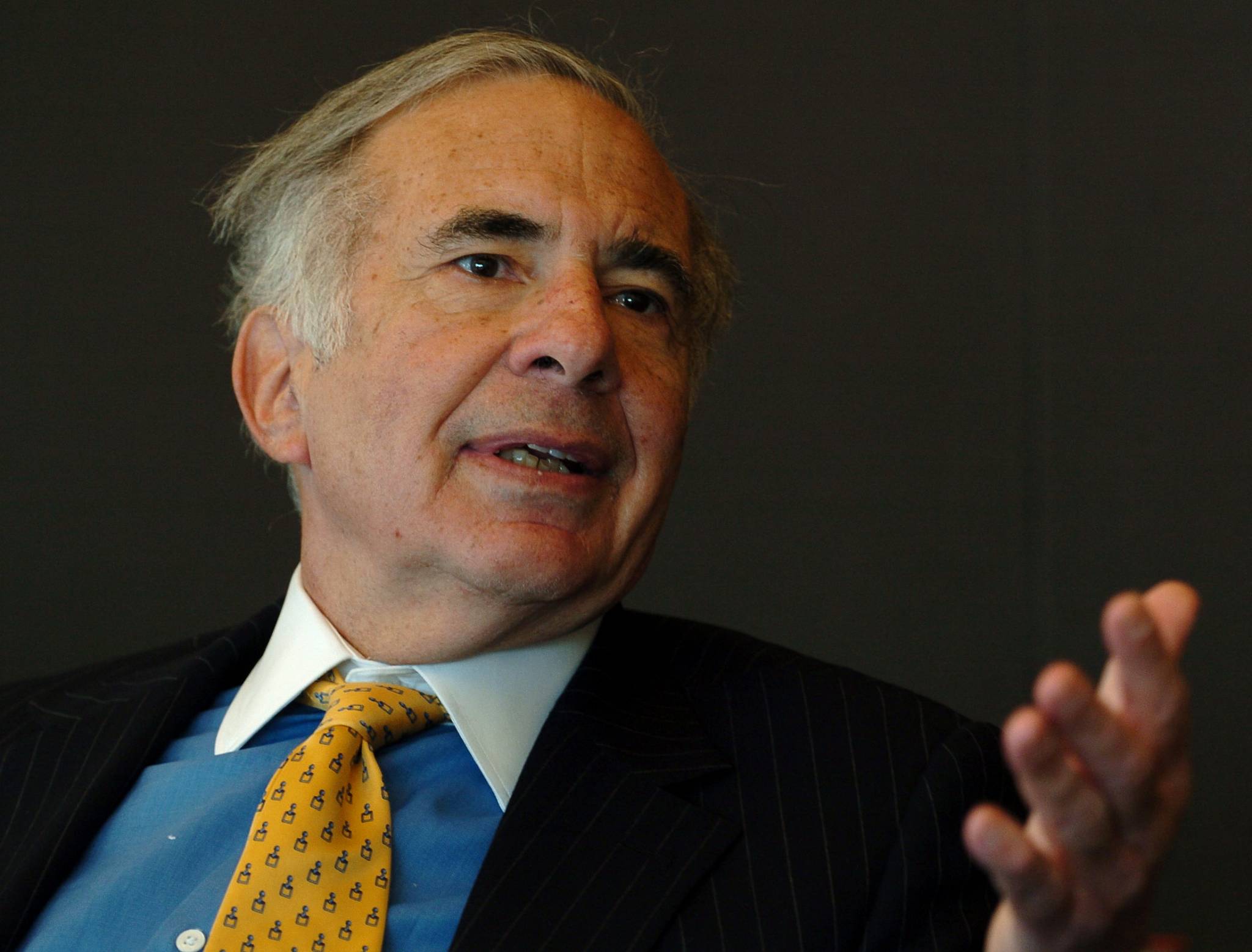

Seven Reasons To Listen To Carl Icahn's Danger Ahead

By Worth W. Wray, Chief Economist, Evergreen GaveKal - EVA on Carl Icahn EVA Summary: This week’s Guest EVA features a video from the legendary activist investor, Carl Icahn, who is starting to make a lot of noise about frothy valuations, fuzzy accounting, and the corrosive consequences of zero interest rate policy. In the video, the…

to his discipline during the financial crisis and then capitalizing on the recovery in asset prices.

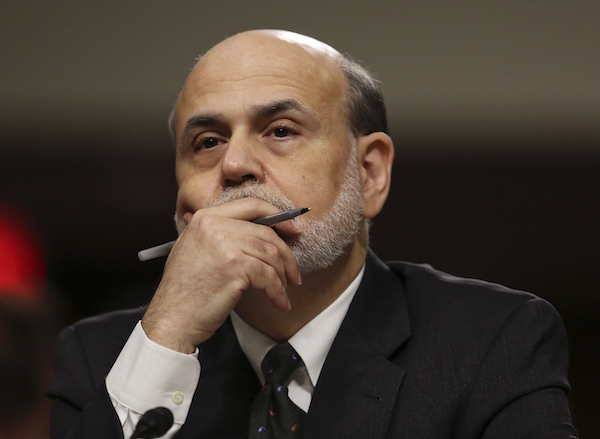

Mr. Icahn didn’t become the greatest turnaround investor of all time without being both and optimist AND a realist. And yet, he is starting to make a lot of noise about frothy valuations, fuzzy accounting, and the corrosive consequences of zero interest rates… which long-time EVA readers will certainly recognize from the extensive writings of our very own Chief Investment Officer, David Hay.

While Icahn isn’t saying anything radically new, the fact that he shares our concerns on so many levels should make your ears perk up. It prompts an important question. What does it mean when a legendary investor – whose personal fortune is so levered

to positive economic growth and rising stock prices – starts to worry publicly that financial markets look like “2007 all over again?”

Perhaps it signals danger ahead as the ongoing correction in commodity, credit, and equity markets threatens to give way to a sharper panic.

If his warnings prove accurate, the investment implications are clear. Investors who can weather the next downturn will find themselves well-positioned to lock-in more attractive yields (in assets like MLPs, Canadian REITs, and corporate bonds) and capitalize on historic long-term opportunities in everything from energy and emerging markets to European banks. It won’t be easy to part with cash in that kind of environment, but try to channel your inner-Carl-Icahn.