If you don't understand duration, you don't understand bonds

by Ben Carlson, A Wealth of Common Sense

One of the most important things you can do as an investors is focus on what you control. This is true when building a portfolio or investment plan, but it also concerns how you think about what’s going to happen in the future. Setting realistic expectations is one of the more under-appreciated aspects of surviving in the financial markets.

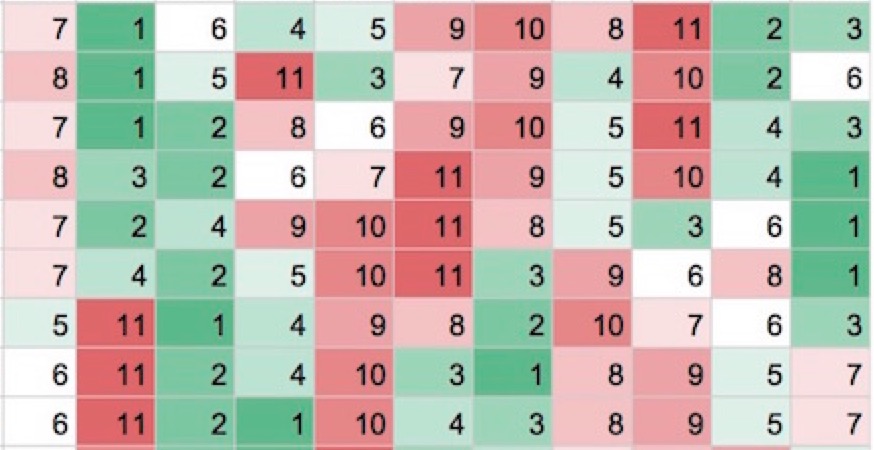

Emotions swing from fear to greed in a much wider arch in stocks, but I think investors need a reality check on bonds these days too. It’s not just that future returns will be lower from current interest rate levels than they’ve been in the past; it’s that volatility in bonds will be much higher from these interest rate levels. Bonds are not going to provide the exact same volatility profile going forward. Investors have to learn to deal with this.

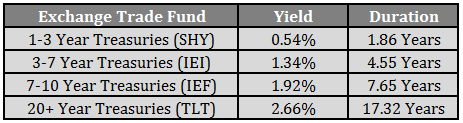

But not all is lost for investors. As always, it comes down to balancing your need for return with your ability to accept volatility. These number show how this works in practice:

Duration is a measure of bond price sensitivity to interest rate movements. While not a perfect relationship in practice, a good rule of thumb is that a 1% move in yields leads to a gain or loss equal to the amount of duration on a bond or bond fund. And since bond rates and prices are inversely related, that means that a rise in rates of 1% would lead to a loss of somewhere near 1.9%, 4.6%, 7.7% and 17.3%, respectively for the ETFs listed here (these numbers aren’t exact because bonds exhibit convexity, meaning the magnitude of the rise or fall can be affected by the duration, but this is close enough to give you a broad sense of how things work).

Bond terminology and math aside, it’s pretty simple really — lower bond yields mean that there’s a smaller cushion from the income payments to soften the blow from rising interest rates. And the longer a bond’s maturity, the more time there is for interest rates to fluctuate.

It’s also intuitive when you think about the magnitude of an interest rate move – in either direction — on bond volatility. A 25 basis point move in yields in either direction would account for 12.5% of the interest rate on a 2% bond yield. If rates were at 5%, a 25 basis point move would make up just over 5% of the interest rate. So the same move in rates will have a much bigger impact at relatively lower yields (assuming the same duration). This is an obvious, yet often over-looked part of the equation for bond investors right now.

It’s very important for investors to define what it is they expect to receive from the bond portion of their portfolio. Are you looking for a higher yield with the expected higher volatility in prices? Or are you looking for relative stability, but with the expected lower returns?

I only used treasury bonds in my duration example. There are far more bond products and structures available to investors, but this gives you a sense of the trade-offs you’re forced to deal with as an investor in fixed income in today’s interest rate environment. Some people are under the impression that bonds aren’t worth the interest rate risk right now. I still think it makes sense for investors to invest in bonds at these interest rates, but there are a few main points to consider:

- You absolutely have to set the right expectations about what bonds can and cannot do for your portfolio.

- Expect more volatility in bonds than we’ve seen over the past few decades, in both directions.

- Risk and return are joined at the hip. There’s no perfect balance between the two, but you have to understand this relationship.

- Bonds were something of a one-decision investment over the past three-plus decades. Diversification within the bond asset class will be more important going forward from here.

Further Reading:

Expectations Management

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

My new book, A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan, is out now.