Solid Bank Profits Despite “Recession”

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

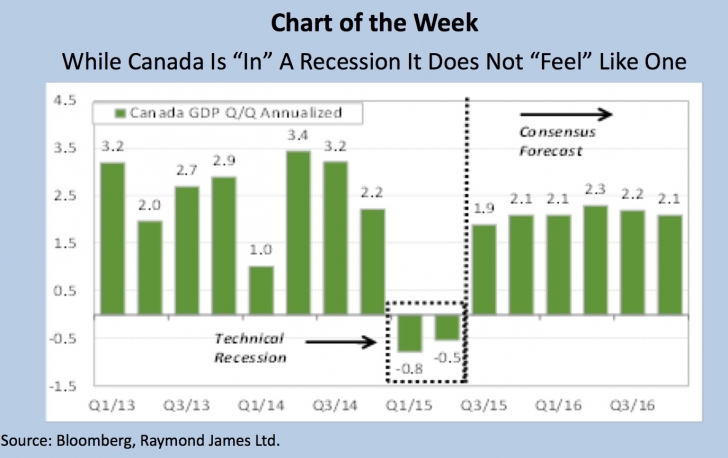

• So it’s official. The Canadian economy is in recession, as defined as two consecutive quarters of negative growth. The Canadian economy shrank in the second quarter with GDP growth of -0.5% annualized, following the 0.8% decline in the first quarter. While technically in recession, it does not “feel” like one, as the weakness is concentrated in a few areas and we are not seeing the typical, widespread conditions normally present during a recession.

• We believe the worst is behind the Canadian economy and see a stronger H2/15. Key supports for this include: 1) monthly GDP data showed the Canadian economy grew at 0.5% M/M in June, which was the first positive monthly print in six months; 2) the US economy appears to be turning the corner which given the high correlation with our economy should be supportive; 3) we expect consumer spending to remain healthy; 4) exports should strengthen in H2/15; and 5) we believe the negative hit from low oil prices will begin to diminish.

• Despite a challenging macro backdrop Canadian banks held their ground in Q3/15. The Big Six delivered an average 5% Y/Y EPS growth with Canadian Imperial Bank of Commerce (CM) and Bank of Montreal (BMO) posting the highest EPS growth of 9.9% and 7.5%, respectively.

• Bank of Nova Scotia (BNS) and Royal Bank (RY) raised their quarterly dividend as expected. However, CM surprised the markets by raising its dividend for the fourth consecutive quarter. The rest left their dividends unchanged.

• Overall, Canadian banks delivered decent results despite a weak macro environment which reinforces our positive long-term view on the industry.

Read/Download the complete report below:

Weekly Trends September 4, 2015

Copyright © Raymond James