The Case for a Bottom in Emerging Markets

by Tiho Brkan, The Short Side of Long

“Black Monday” panic and the spike in VIX most likely signals the low

The panic we saw on Monday, as Volatility Index spiked above 50, was less to do with the S&P 500 (which remains overvalued) and more to do with EM economies. In the chart above, we’ve circled the previous spikes in VIX above 35 together with the developing nations equity index. Each instance, apart from 1997 Asian Financial Crisis, was either close to or at a major low. In 1998, the MSCI Index totally collapsed as Russia defaulted and the Rubble devalued by 70%.

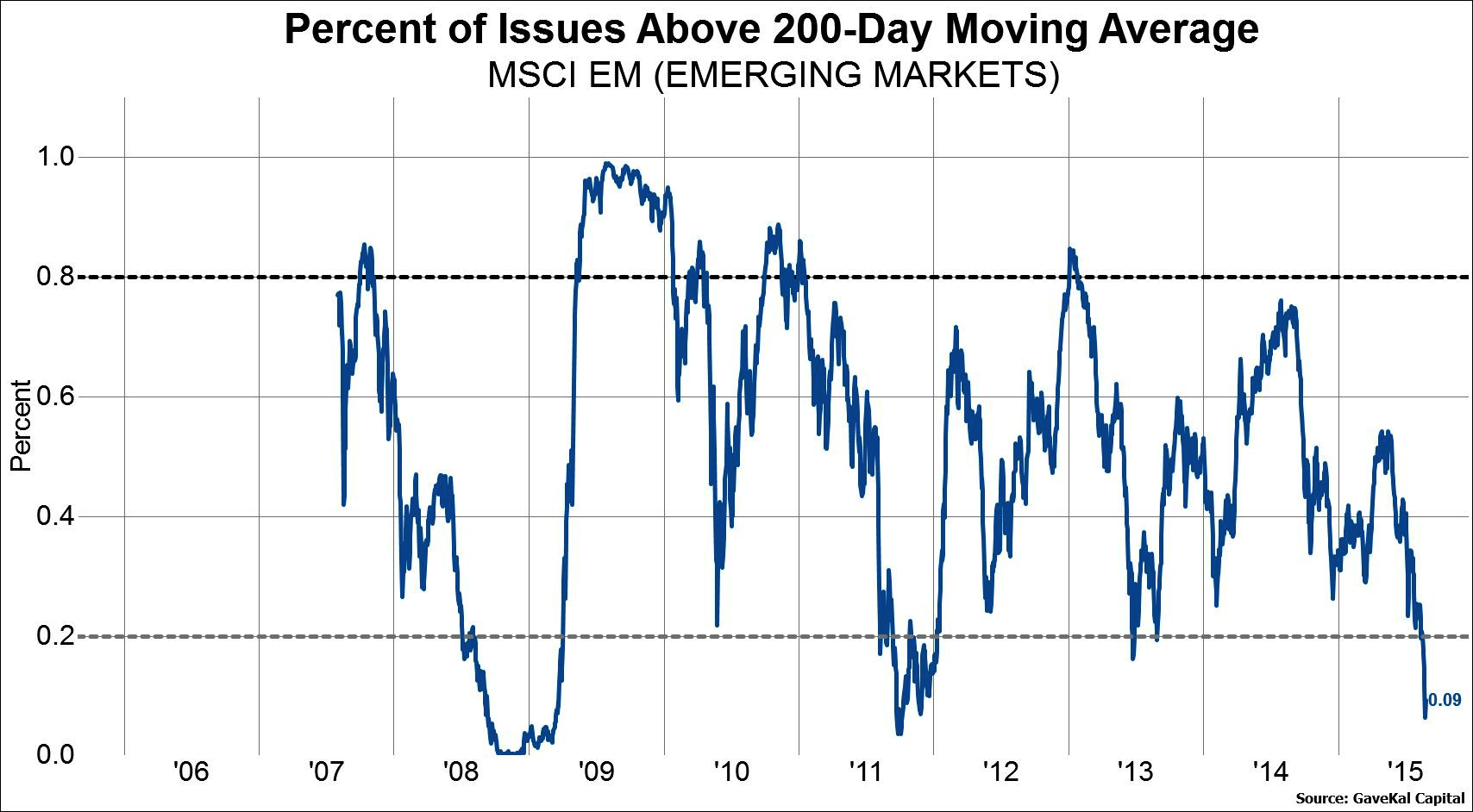

Emerging Markets Index breadth went through a major washout like in ’08 & ’11

MSCI EM breadth readings, tracked by the percentage of stocks trading above the 200 day moving average, collapsed into single digits this week. Whether we look at the breadth history of MSCI DM or MSCI EM, these type of oversold conditions tend to be a signal of a proper wash out or selling climax. During the Global Financial Crisis of 2008, breadth readings got as low as 0%, while Eurozone Recession in 2011 saw a capitulation occur at 4%. As of Monday this week, percentage of stocks above 200 MA was 6%, an extremely oversold level.

Furthermore, yesterdays blog post showed how NYSE 52 week new lows spiked to above 1300 issues or 40% of the exchange. MSCI EM Index went through a more serious sell off, where the number of issues that made 12 month new lows jumped to 60%. How does this reading compare to previous panics of 2008 and 2011? The former saw a spike towards 77% while the latter 51%. The important point here is that it takes a large amount of selling pressure and panic to accomplish these kind of breadth readings.

A large number of EM economies are either in a recession or a slowdown

Unless you’ve been living in a cave, you probably understand that the Chinese stock market is going through a serious crash. After the index rose vertically into summer months of this year and was goosed up by retail investor excessive speculation behaviour, the reality is finally setting in. This event is damping consumer confidence (stock markets always do that), which was already fragile. In turn, worries about the global economy slowing even further is real.

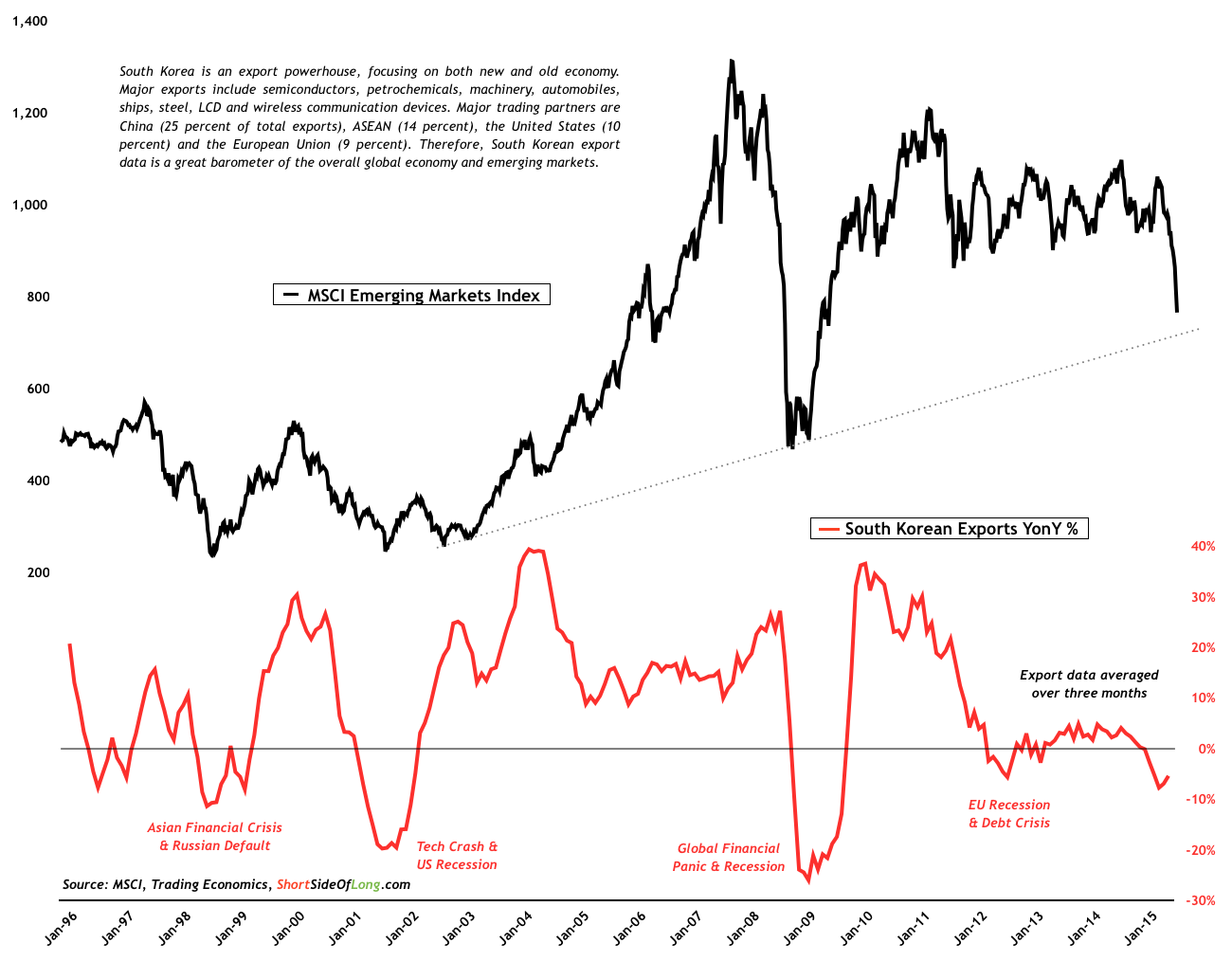

Chinese economic activity and trade figures in general should not be trusted (which government figures can?), so I prefer to look at neighbouring countries such as Taiwan, Japan, Thailand, Hong Kong, Singapore and in particular highly cyclical export powerhouse of South Korea.

Constant negative earnings reversions shows how pessimistic analysts are

I am a huge believer that the current contraction in South Korean annualised exports is a strong signal that a decent chuck of the world’s growth is currently contracting. This was the case during Asian Financial Crisis in 1997/98, Technology Crash 2001/02, Global Financial Crisis in 2008/09 and the Eurozone Debt Crisis in 2011/12. As exports collapse so do earnings, so it is no wonder analysts net earnings reversions have been so negative for so long (currently 1 standard deviation below a two decade mean). However, readers should remember that as contrarians, we are meant to buy recessions and panics.

Valuation wise, developing nations index became almost as cheap as it was during March 2009 (MSCI EM Index went as low as 762 points). Since 1996 the average Price to Book ratio for MSCI Emerging Markets Index has been 1.8 times. Stocks are considered expensive when the ratio is above 2.2 times (1SD+), with subsequent annual returns very volatile. On the other hand, stocks are considered cheap when the ratio is below 1.4 times (1SD-), with subsequent average annual performance of almost 50%. However, it is important to note here that valuations are NOT dirt cheap as they were during the 1997/98 crisis, when EM stocks traded below book.

Policy makers have learned from ’97 AFC by borrowing more in local currencies

Is it possible that EM stocks are still not at secular cycle lows?

Yes, it is. We believe that valuations will once again trade below book, most likely during the next major crisis. However, EM economies and Asia in particular, are not as vulnerable as they were during the late 1990s. Firstly, majority of the EM currencies are now free floating and discount fundamentals ahead of time. Secondly, it seems that policy makers have learned from their mistakes by borrowing more in local currencies.

In summary Short Side of Long is calling a major bottom in the MSCI Emerging Markets Index. It is important to note that we shorted MSCI EM Index (NYSE: EEM) as of $40 per share, catching the technical break of multi year support level. We are now preparing to close these shorts and initiate long positions. We want to make it perfectly clear that we do not believe in V-trough bottoms and we expect the recent lows to be tested during substandard seasonal months of September and/or October.