by Mawer Investment Management, via The Art of Boring Blog

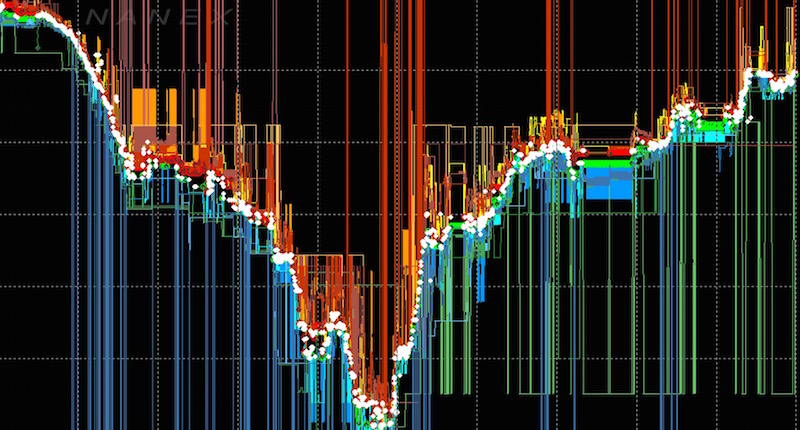

A wave of investor concern moved through global asset markets this week. Stock indices around the world retreated anywhere from 1 to 6% on Monday, while so-called “safe haven” assets rallied. The VIX—a gauge of volatility in markets—shot up to above 35, a level that is consistent with elevated amounts of volatility and greater investor unease.

The cause for concern appears to be China and emerging markets. Two weeks ago, China shocked world markets when it devalued its currency by roughly 4%. While the move itself was small, it signaled Chinese growth could be weaker than anticipated and a currency war could be brewing. Meanwhile, emerging markets continue to experience significant capital outflows. The Financial Times estimates that nearly $1 Trillion in capital has flowed out of emerging market assets in the last 13 months. This trend has intensified in recent weeks. A combination of slower economic growth, the prospect of a Fed rate hike, weak global commodity prices (many of these economies depend on commodities) and the Chinese devaluation seems to be to blame.

These recent events appear to have shaken investors out of a summer haze, but the events themselves were not unexpected per se. For months, we have been warning that the probability of a systemic shock has risen and created a more unstable investment landscape. While we could not know how or when the proverbial shoe would drop, and we fully appreciated that stocks may continue to climb due very accommodative monetary policies, we observed many growing risks. For example, China kept us up at night as did valuations for global equities which seemed priced for perfection. Subsequently, our team made adjustments within individual asset classes and at the asset allocation level.

At the asset allocation level, we made the following moves to build greater resilience:

- We have been reducing our exposure to equities and increasing our allocation to cash and cash equivalents since 2014. Equities now sit at a neutral weight in our balanced mandates.

- We have been reducing our exposure to small cap stocks. These companies tend to exhibit lower liquidity levels and correct deeper in sharp market downturns. We have simply not seen enough of a return benefit in small cap stocks compared to large cap stocks to justify a higher relative weight in our balanced mandates.

- We launched the Global Bond Fund, which aims to add stability by holding assets that should benefit in periods of negative investor sentiment.

When markets get uneasy, investors tend to want to do something – they want to fix things in order to keep their capital safe. This is understandable but usually imprudent; the middle of a hurricane is not the time to fix your ship. Rather, the best time to fortify your ship is long before you let it sail from harbour.

Our team at Mawer has been continually strengthening our ship. Moreover, our investment philosophy of investing in wealth creating businesses, with excellent management teams, at a discount to their intrinsic value, puts the odds of investment success in our clients’ favour from the start. This is why we talk so often about “boring” companies…by investing in businesses with endurance, the ship is fortified long before it sets sail.

While the weather may continue to get worse in the months ahead, we believe we are positioned to endure the storm.

This post was originally published at Mawer Investment Management