What the ETF Just Happened?

by Corey Hoffstein, Newfound Research

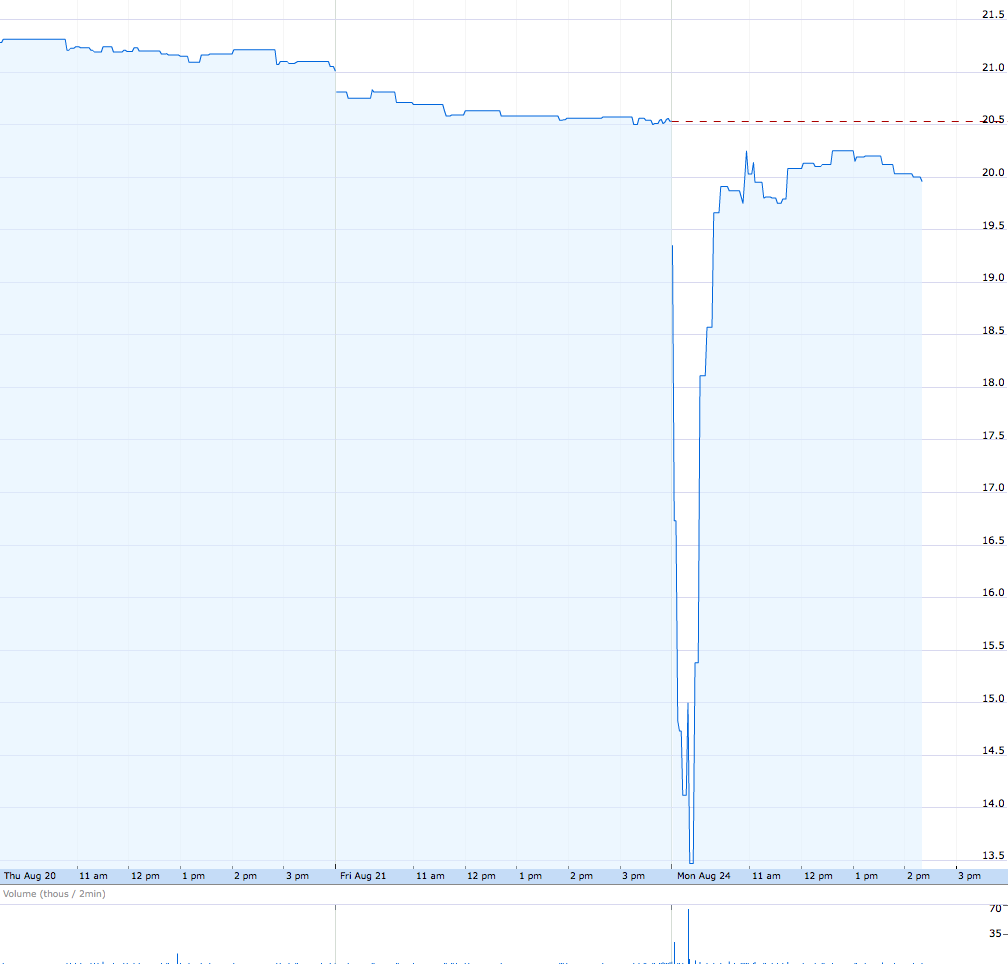

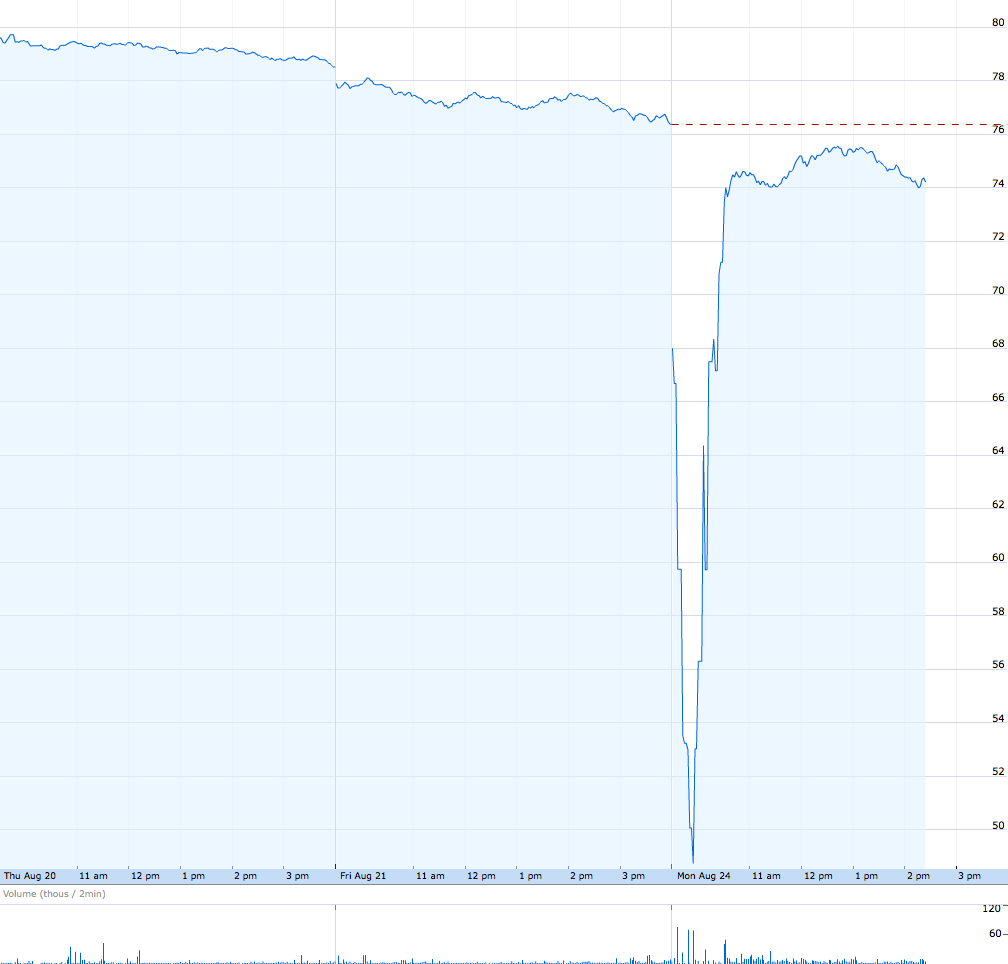

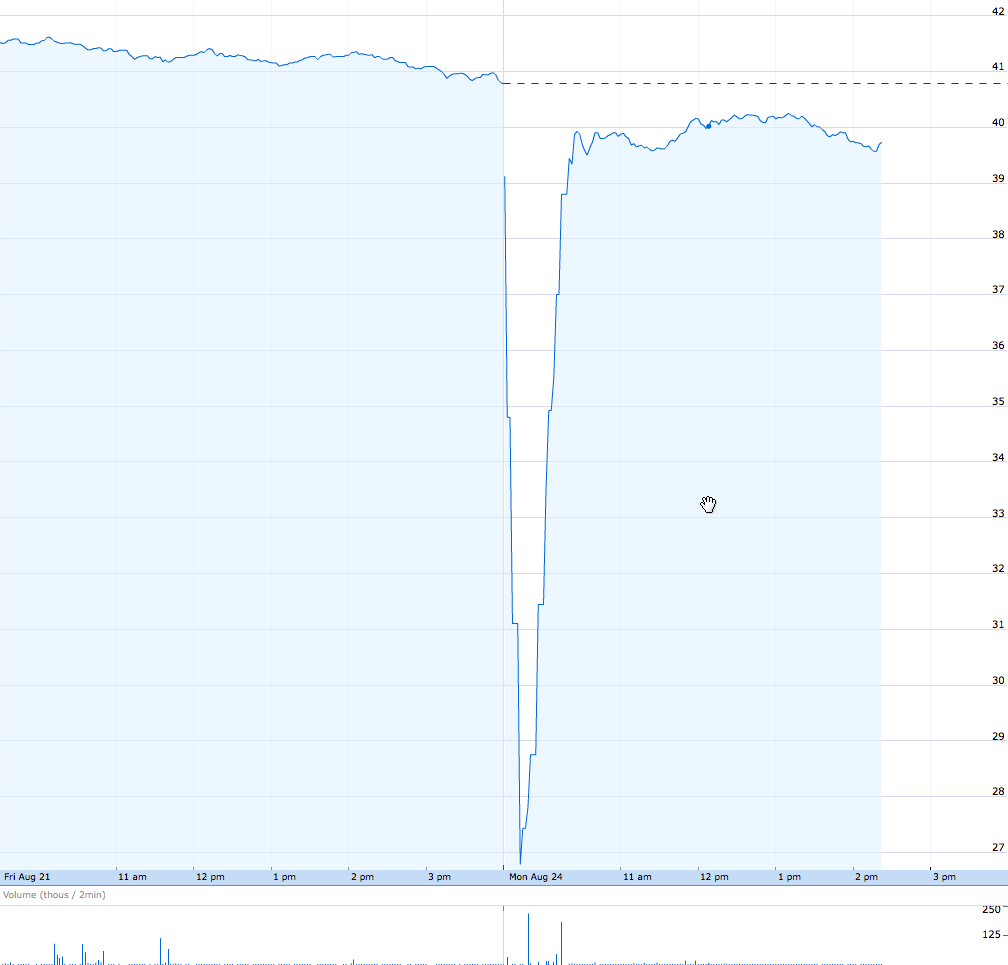

Yesterday morning's trade prints weren't pretty in ETF land. Here's a few select favorites:

PowerShares S&P 500 BuyWrite Portfolio (PBP) – Halted at 9:30:46, 9:36:16, 9:42:16, 9:49:29, 9:55:16, and 10:03:35

iShares US Preferred Stock (PFF) – Halted at 9:30:45

Guggenheim S&P 500 Equal Weight (RSP) – Halted at 9:30:25, 9:36:15, 9:42:15, 9:48:15, 9:54:34, 10:00:15, 10:06:15, 10:12:15, 10:18:16, and 10:24:15

iShares MSCI USA Minimum Volatility ETF (USMV) – Halted at 9:30:56, 9:36:15, 9:42:15, 9:49:08, 9:56:08, 10:02:50, 10:08:55, and 10:14:39

Just to be clear here ... some of these ETFs were halted within a minute of the market open.

What happened? A mixture between people loading up with market orders at the open and a bunch of halts.

These halts are generally at the discretion of the exchange – not the ETF provider – and are called "volatility trading pauses." The idea is to give market participants some time to digest what is going on, reflect, and ask the man in the mirror: "do I really want to hit that sell button?"

This wasn't limited to any one ETF sponsor – but occurred across a whole bunch of them.

My takeaways?

Market Orders + Open = Disaster

Market orders at the open is a recipe for disaster. Please don't ever, ever, ever do it. You don't want to be the person who got that -25% print because liquidity was so thin.

With ETFs, check iNAV

Your brokerage account won't always reflect reality. When you log in and see your account down 15% because a bunch of ETFs you own have horrendous prints, you have to take a deep breath and look at iNAV.

iNAV – or intraday net asset value – tells you what the underlying basket the ETF holds is worth.

You can get it by going to Yahoo! Finance and adding "^" in front of the ticker and "-IV". For example, to get the iNAV of PFF, we'd enter "^PFF-IV". Once we see that price has totally dislocated from iNAV, we need to ask ourselves: are the underlying liquid or illiquid?

With the Greece situation – with markets closed – the GREK ETF provided price discovery. This morning, however, stocks were trading just fine – it was the ETF that was broken.

Markets are Totally Irrational

If market participants were rational, we wouldn't need halts. Let me re-phrase that: if market participants were rational, halts wouldn't be effective. The fact that halts exist and work should tell us all we need to know.

Humans will be human...