Did We Just Witness the Best Risk-Adjusted Returns Ever?

by Ben Carlson, A Wealth of Common Sense

Risk-adjusted return measures have been around for some time now, but following the financial crisis professional money managers and asset allocators zeroed in on these formulaic performance metrics like never before. One of the most well-known risk-adjusted return formulas, the Sharpe Ratio, is simple a measure of return per unit of risk. It takes the annual returns on an investment, subtracts the risk free rate of return (in most cases that’s cash or t-bills) and divides that by the investment’s standard deviation or volatility. So, have we just witnessed the best risk-adjusted returns ever?

Far too many investors confuse risk measurement with risk management so I’ve never been completely sold on volatility as a measure of risk, but plenty of people have become enamored with it because it provides something tangible they can define. My problem is that volatility can’t measure consequences, only the variation in returns. It says nothing of the other risks you took to get that variation. Volatility only matters when it causes investors to make unforced errors, so in that sense it can be a type of risk, both in terms of investor behavior and career risk for portfolio managers.

So I’m not saying you can’t look at volatility as a way to understand the markets. You just never make it your sole determination for making a decision one way or another. Assuming you do subscribe to volatility as a measure of risk, the current market environment ranks as one of the lowest risk periods of the past forty years and could end up being the lowest volatility-adjusted cycle ever.

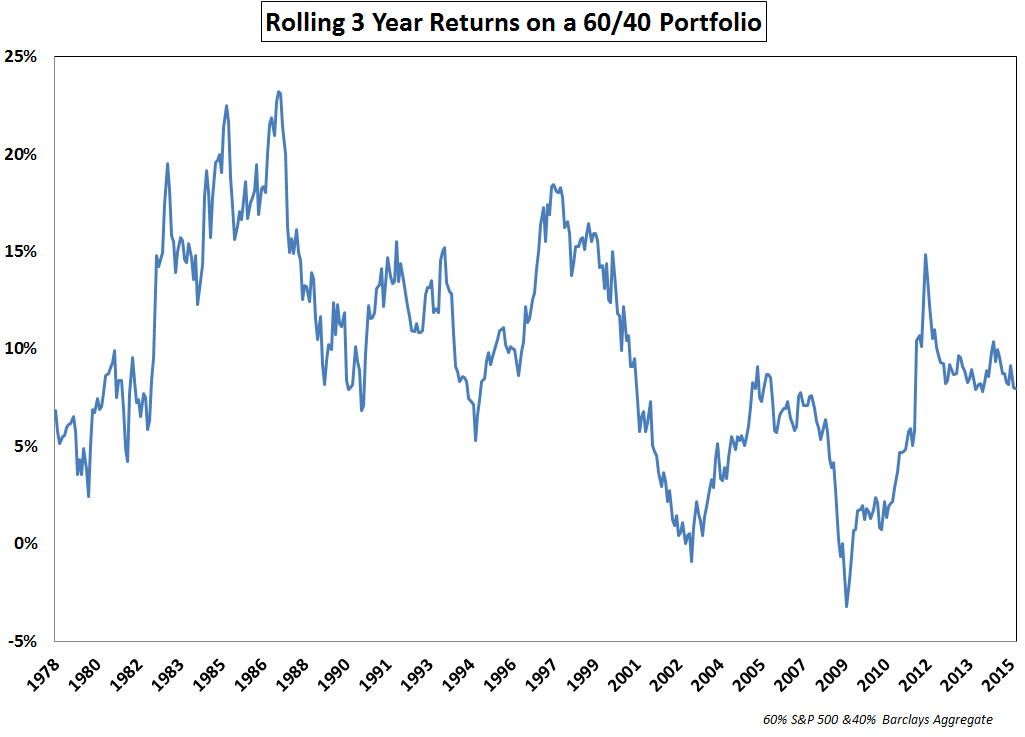

These are the rolling three year annualized returns on a 60/40 stock/bond portfolio comprised of the S&P 500 and the BC Aggregate Bond Index:

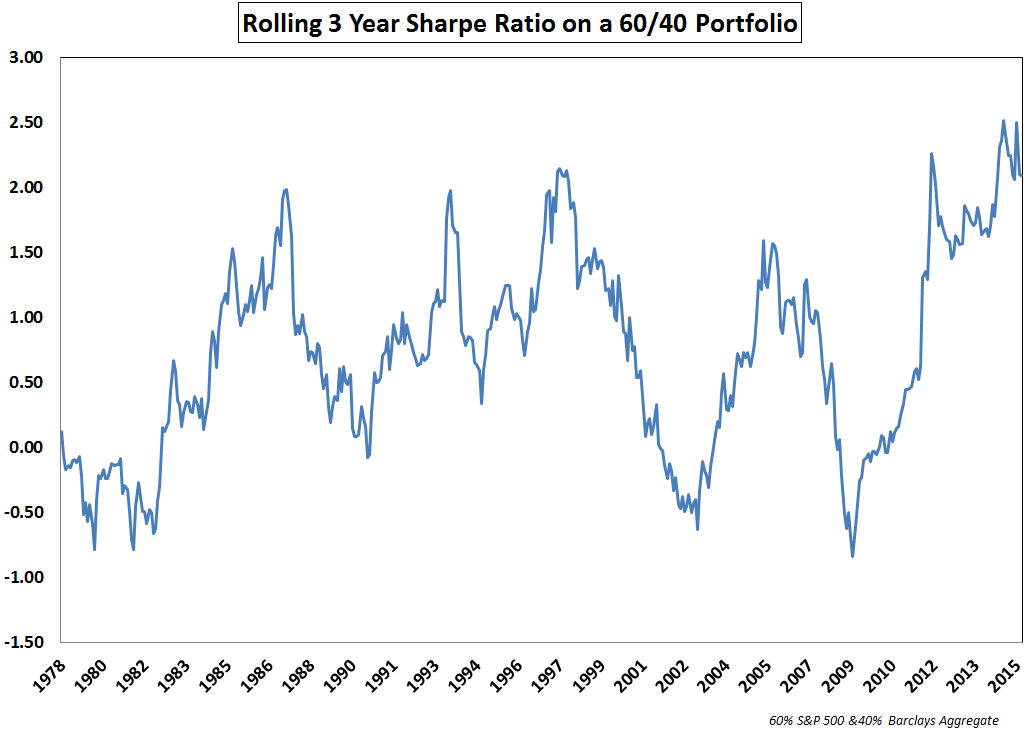

Returns on this simple portfolio have actually been fairly average over the past few years, with higher than average stock gains, but lower than average bond performance. But take a look at the risk adjusted returns using the same time frame:

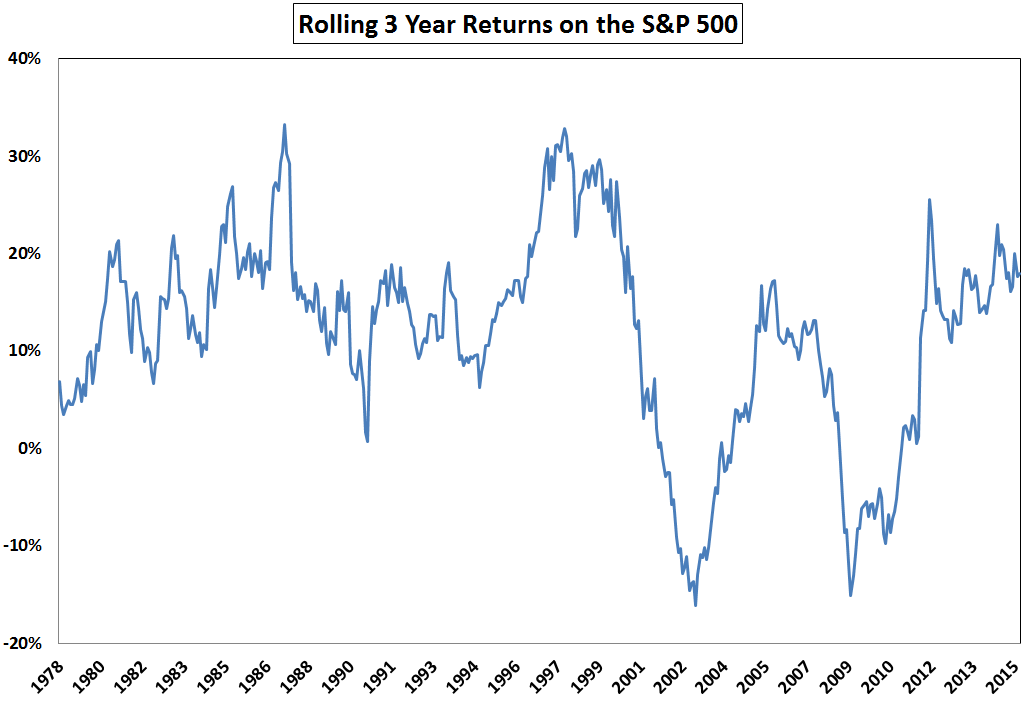

We’ve witnessed the highest Sharpe Ratios on record going back to the mid-1970s. Of course, any time volatility is used as a measure of risk, stocks are going to completely dominate that equation. Here are the three year returns for the S&P 500:

And the rolling three year Sharpe Ratio on stocks:

Stocks are also right around their peak Sharpe Ratio in this window of time. This makes sense in theory — we’ve had high returns, low volatility and extremely low or non-existent risk free returns. Add all of those up and you have the perfect recipe for high absolute and risk-adjusted returns.

This is actually one of the reasons I’m so skeptical of utilizing these types of risk measures. Investors could claim that is was their superior risk management abilities or investment expertise that led to such amazing risk-adjusted returns, when in fact it was all of product of the market environment. I’m not saying you should ignore volatility-based measures of performance, but they always need to be put into context. Nothing is ever as easy as it appears in a ratio.

There’s a running joke in the investment industry that everyone spends all their time researching, benchmarking to and talking about the 60/40 stock/bond mix but no one actually invests in that portfolio. There may be some truth to that statement if you consider cash, real estate and other diversified investment options. If nothing else, 60/40 provides something of a default balanced portfolio option for comparison purposes. It’s also been pretty tough to beat these past few years.

I hate the phrase “the easy money has been made,” because investing is never easy. Just go back and look at some of the headlines and fear-mongering that’s been going on during this recovery. It was never easy no matter what the data says. But if you have a U.S.-centric portfolio that’s heavily allocated to stocks and bonds it’s likely you just lived through one of the lowest risk periods ever to invest in — from a textbook perspective.

Further Reading:

Do Risk-Adjusted Returns Matter?

Two Finance Phrases I Could Do Without

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

My new book, A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan, is out now.