by Tiho Brkan, The Short Side of Long

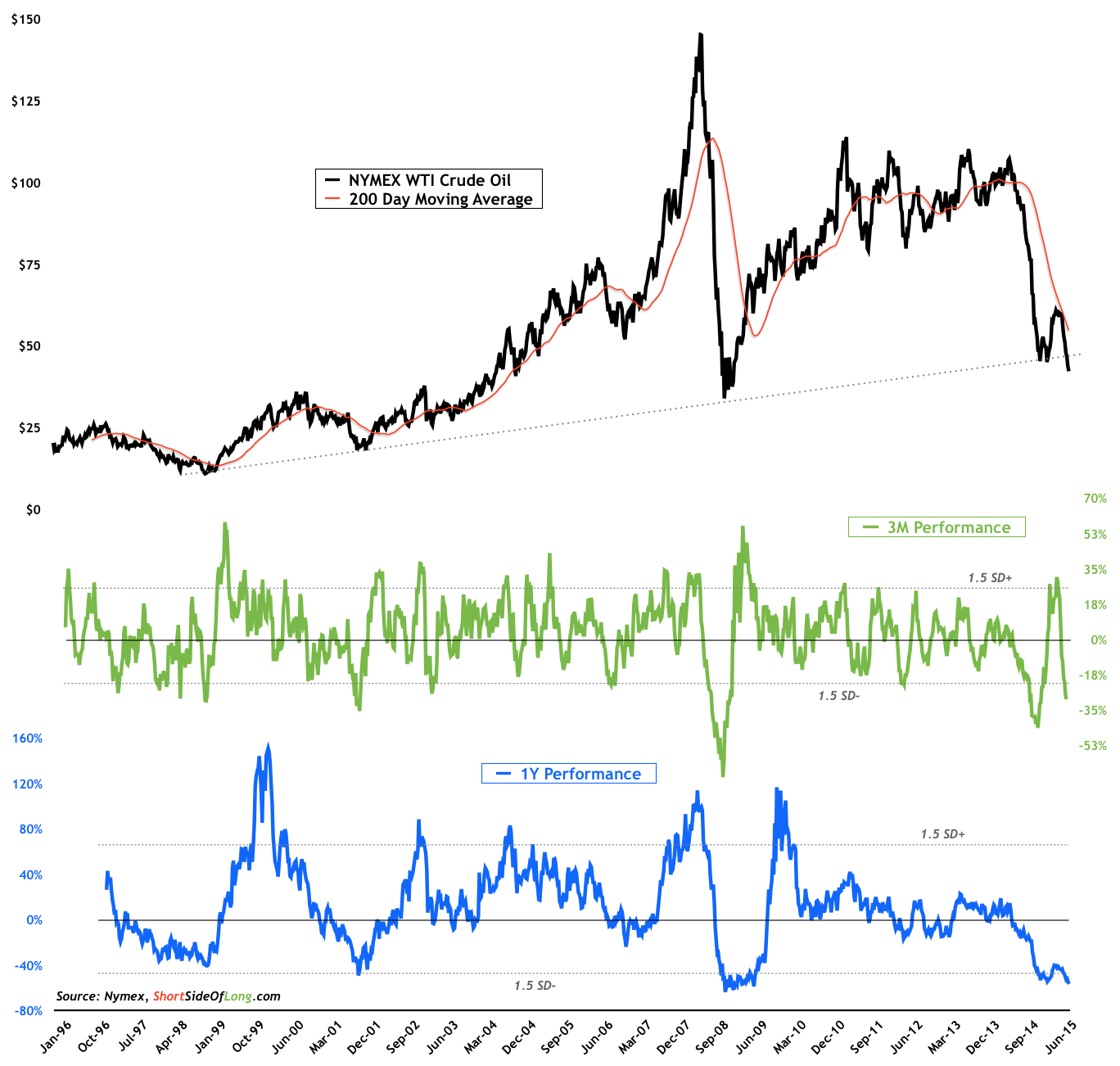

Crude Oil is extremely oversold from short and long term perspective

Crude Oil is once again making headlines, as the selling pressure continues. Basically, the rebound which started from $48 per barrel in middle of March 2015, came to an exhaustion point by early May at around $65 per barrel. Super bears and perma-deflationists believe that Crude Oil is most likely entering another 20 year secular decline (similar to 1980s and 1990s). I do not hold this view myself.

I believe Crude is now in the process of forming a major bottom. In recent times I have recognised that energy stocks have started to recover despite Oils sell off. Very high corporate insider buying activity in the sector is a major buy signal, especially while sentiment survey readings have hit rock bottom levels. In particular, CEOs of energy companies have dramatically reduced the count of US oil rigs, which almost guarantees a noteworthy fall in future supply.

Finally, from the technical perspective, Crude is once more oversold from short and long term perspective. We are looking at at least 1.5 standard deviations below the mean right now. Keep a close eye on this one as the reversal could be in any day now…

Copyright © The Short Side of Long