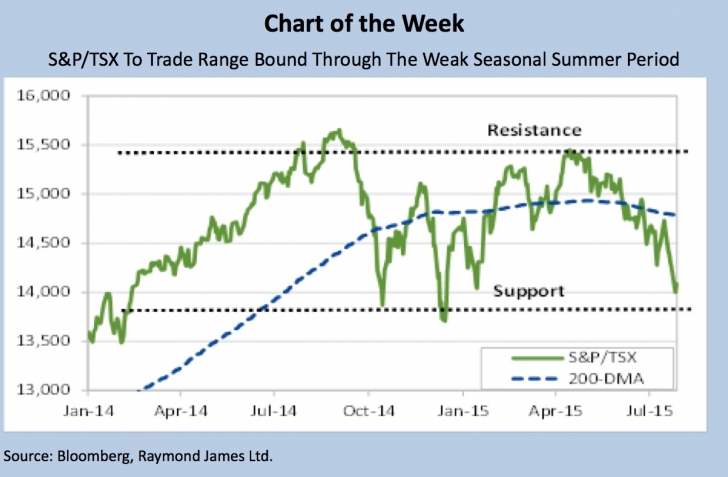

The Summer Doldrums

• It’s that time of year again, the summer doldrums, when we log in to our investment accounts, hopefully from a beautiful cottage overlooking one of Canada’s many amazing vistas, and experience the typical disappointment in seeing our investment portfolios down in the summer months. Since the S&P/TSX Composite Index (S&P/TSX) peaked at 15,552.75 on April 24, the index has declined roughly 1,000 points or 6%.

• The weakness seen in the S&P/TSX can be attributed to the sell-off in commodities, disappointing corporate profits and weak seasonality.

• Given the weak earnings results in H1/15 and our continued cautious outlook for commodities, we are lowering our S&P/TSX 2015 full-year EPS estimate from $900/share to $750/share. While this is a material decrease to our earnings forecast, we are maintaining our S&P/TSX year-end price target of 15,300. The reason for this is that we believe investors will look past the disappointing 2015 earnings results, seeing the weakness as transitory, and instead will focus on the improving US and Canadian economic momentum.

• On that front we believe that the US and Canadian economy are on firmer footing than the headline GDP data suggests and we see little evidence of a US recession over the next 12 to 18 months. Key data points supporting this include: 1) a strengthening US labour market; 2) a healthy US manufacturing sector; 3) the upward slowing US yield curve; and 4) rising consumer confidence.

• As the US economy improves in H2/15, this should provide a boost to share prices, resulting in a year-end rally. We maintain our 15,300 price target on the S&P/TSX which if realized would equate to a mid-single digit price gain.

Read/Download the complete report below: