by James Paulsen, Wells Capital Management (Wells Fargo Asset Management)

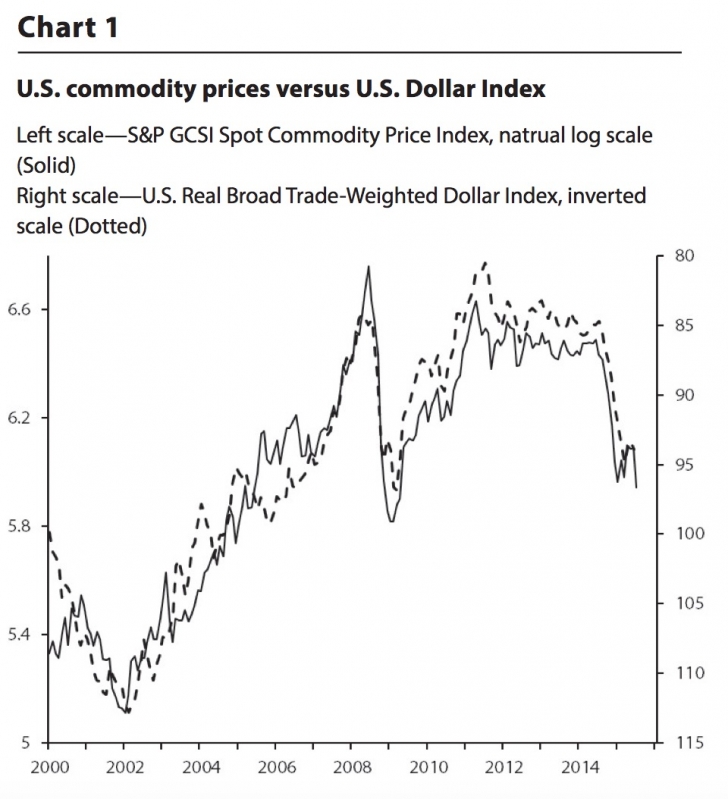

Recently, a sharp selloff in the Shanghai stock market followed by renewed weakness in commodity prices has intensified concerns that the Chinese economy is weakening significantly and has heightened anxieties surrounding the risk of a global deflationary spiral. However, as Chart 1 illustrates, the recent collapse in U.S. commodity prices is probably due more to a strong U.S. dollar than a collapsing Chinese economy. Commodity prices in the U.S. seem to be joined at the hip with movements in the real U.S. dollar. Based on monthly data, their correlation since 1990 is a very strong inverse relationship of -0.96.

We believe recent volatility in the U.S. commodity markets probably represents a normal (and highly emotional) bottoming process after a severe decline last year rather than increasing evidence of a global slowdown. Likewise, we think the U.S. dollar is probably in a peaking process. The S&P GSCI Commodity Price Index is currently very close to its bottom first reached in late January and the U.S. real dollar peaked in March. Most believe commodity prices will fall still further and expect the U.S. dollar to climb even higher. Perhaps this will prove to be correct. However, if the strong dollar, weak commodity price trend is in the process of changing, as we expect, it could result in significant financial market turbulence since many portfolios will need to be adjusted.

We believe recent volatility in the U.S. commodity markets probably represents a normal (and highly emotional) bottoming process after a severe decline last year rather than increasing evidence of a global slowdown. Likewise, we think the U.S. dollar is probably in a peaking process. The S&P GSCI Commodity Price Index is currently very close to its bottom first reached in late January and the U.S. real dollar peaked in March. Most believe commodity prices will fall still further and expect the U.S. dollar to climb even higher. Perhaps this will prove to be correct. However, if the strong dollar, weak commodity price trend is in the process of changing, as we expect, it could result in significant financial market turbulence since many portfolios will need to be adjusted.

Moreover, if the U.S. dollar does surprisingly peak and commodity prices bottom, the calculus surrounding any Fed exit strategy would also likely be abruptly altered. Particularly, if dollar weakness–commodity price strength occurred as wages showed signs of acceleration.

Our best guess is the markets are currently in the late stages of a selling climax in commodities and commodity-related securities. We recommend investors begin to take advantage of the recent carnage and look to increase exposure on weakness to commodities (perhaps directly via exchange traded notes), to commodity stock market sectors (materials, energy, or industrials), or to commodity-biased stock markets (e.g., Canada and Australia). We also think emerging markets will likely do well again once the U.S. dollar peaks renewing some strength in commodity prices.

In any event, as the chart suggests, the U.S. dollar and commodity prices are a singular event. When the time does eventually come, the financial markets will have to deal “simultaneously” with two major trend changes—a peaking U.S. dollar and a bottoming in commodity prices.

Read/Download the complete report below: