For many investment professionals, the seemingly inexorable rise of robo-advisers constitutes an existential threat. The fear is simple and justified: Services now exist that provide investors with a portfolio that fits their expressed risk tolerance and reward inclinations for 0.25% of the assets invested in that portfolio.

That’s comparably a great deal and thus financial advisers offering a similar service are in a tough place.

If we use the example of a financial adviser currently making $75,000 a year, one who splits their fee down the middle with their firm, we can see this pretty clearly. At a 1% fee, this adviser can make a comfortable middle-class income if they spend 60 hours a week talking to 100 or so happy clients with a grand total of $15 million invested with the firm.

If their fee were lowered to 0.25% of assets, the adviser would need to either take on more clients (and provide less service to existing ones) or seek wealthier clients. Either way, their firm would need $60 million in assets instead of $15 million to make the same amount of money. Like, duh, right?

If losing that much in fees worries you, a widely shared blog post should terrify you. Blake Ross, who co-founded Firefox before spending six years at Facebook as director of product, maintains that those already-reduced fees are astronomically high and should be closer to zero. He even accuses Wealthfront, one of the larger robo-advisers, of embodying the same “Wall Street” mentality that many find reprehensible.

So while investment professionals are staring at robo-advisers and wondering how they’ll ever compete on cost, technology folks are looking at robo-advisers and wondering if they can be undercut further. I’ve been saying this for a long time at this point, but free investing is the new free checking. The cost of these services is going to approach and eventually reach zero.

So What Should You Do?

Enterprising Investor is written for professional investors, so it’s tempting to interpret the question above from a business perspective. What should you do if you want to stay competitive?

The thing is that good business comes from good outcomes, so let’s ask the question from a different vantage point. What should you do if you want to give your clients a good outcome?

Blake’s argument is really simple to encapsulate. Many robo-advisers compare their fees to the typical investment adviser’s 1% and argue that they are fantastic. But that’s not necessarily the right benchmark to use. All fees reduce investment return, so what would happen if you didn’t pay any of them?

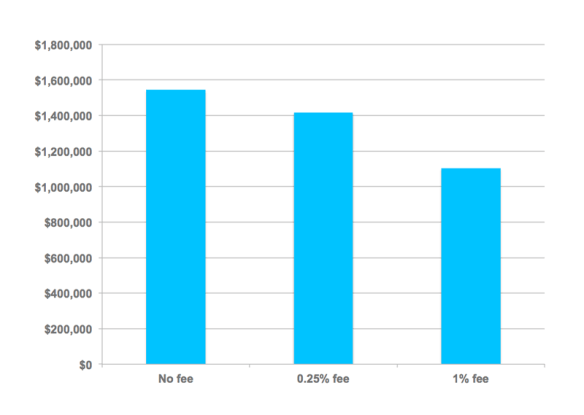

Well, if you’re able to save $5,000 a year for 50 years and invest it at a constant 6%, you’d be richer.

The more than $300,000 gap between a 1% annual fee and a .25% annual fee is striking, but so is the $125,000 gap between paying a seemingly nominal .25% and nothing. If you paid 1% a year in fees, you’d have an account that is smaller by 28.5%, whereas if you paid just .25%, you’d be behind by just over 8%.

Value after 50 Years of Saving $5,000 Annually

And remember, that’s for an account that receives regular contributions over time. For a lump sum investment, the gap is even larger.

So like, why would you pay fees? The answer you have to give is because the fees are for services that add value, right? So the only question that matters is simple . . .

Value Compared to What?

Blake’s post makes the point that many of the services that Wealthfront and other similar robo-advisers provide are of uncertain or questionable value, and he may well be right. It’s awfully difficult to beat a Vanguard target date retirement fund on cost.

But what is value here? What’s the point of saving money? Managing someone’s money well should be about maximizing their quality of life. It seems quite reductive to distill that down to the size of their bank account in retirement. Everybody wants more money, but it’s not the point of existence. It’s just a means to buy the stuff you need or want.

A mean-variance optimized portfolio, however it’s delivered, is simply not the same as insight into what you will need and might want. It is also not as valuable. If you approach a client with a perfectly customized portfolio but fail to explain the role it will play in their life, they won’t care very much. They might well become a client, but they will miss the point of the exercise and you will have failed both them and yourself.

So don’t neglect the conversations that are really important when you sit down with your clients. Don’t forget to ask them about what they’re doing to live a good life. You should be able to have discussions about the trade-off between spending money now to be happier and saving it for later in a context that is broader than an ending account balance.

If you’re willing and able to have those sorts of conversations with clients, then it’ll be worth paying top dollar for your services. But that assertion only confirms that the product you provide — advice — is worth something. It doesn’t tackle the question of how to charge for it.

That’s somewhat intentional. How do you think we should be charging? Let me know in the comments below.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©iStockphoto.com/retrorocket

Copyright © CFA Institute