TV personality, author and commentator William D. Cohan is grumpy about a lot of things.

There’s the Duke lacrosse scandal, for one, about which he’s just publish a “shocking, thought-provoking new book”—according to the description on his own web page.

And for another there’s Wall Street, from whence he came, and about which he’s written plenty of grumpy, conspiracy-minded books.

Hence it’s no surprise to find Cohan invited to speak at the Sun Valley Writer’s Conference, whose attendees tend to be wealthy, Wall Street-leery arts supporters from L.A.

It’s even less surprising that one of the talks he gave to those same attendees was entitled “Who Has the Real Power Now on Wall Street?”—actually, less of a talk and more of a very grumpy, very conspiratorial dish about what he perceives to be the current state of Wall Street—and that the audience was with him from the get-go.

Kicking off with the quite legitimate observation that the Dodd-Frank law was not understood by either man whose name is on it, Cohan explained that Dodd-Frank did nothing but give more power to the six major banks at the heart of the 2008-9 financial crisis (now five, since Bank of America rescued Merrill Lynch), although he failed to explain why (it’s the fact that big banks can spend the big regulatory bucks while smaller banks have a harder time doing so: hence, regulation favors the large and hurts the small, yielding consolidation).

No matter the reason Dodd-Frank failed its mission, the crowd nodded approval at Cohan’s dark conclusion and murmured its disapproval of the Big Bad Banks.

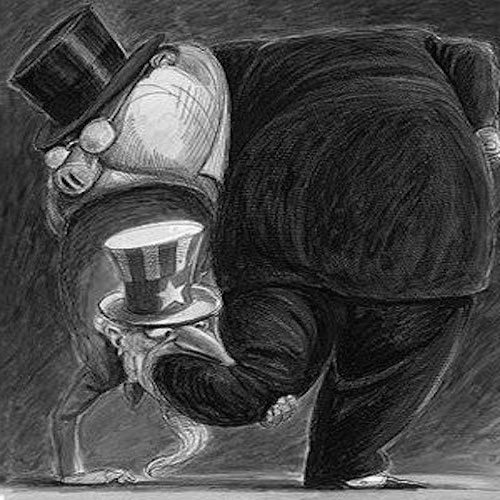

Bolstered by this friendly reception, Cohan then proclaimed that government regulators don’t help address the weaknesses in the Dodd-Frank regulations because “the SEC is a tool of Wall Street.” After all, he pointed out, U.S. Presidents appoint Wall Street people to the job of overseeing Wall Street. Since they will eventually go back to Wall Street, they aren’t going to do anything to kill the golden goose.

Thus, he noted, Mary Shapiro left FINRA to run the SEC with a $9 million bonus from her work at FINRA, at which the crowd gasped and murmured its disapproval of money-grubbing Mary Shapiro.

At this point, Cohan could have said anything he wanted—he could have said Paul McCartney really was dead; John Lennon really had mumbled “I buried Paul” at the end of Strawberry Fields Forever; and the Abbey Road cover photograph was, in fact, an allegory of a burial ceremony because Paul was barefoot—and the crowd would have gasped and nodded and murmured their approval.

Instead what he said was something far sillier than “Paul is Dead.” He said that thanks to their status as bank holding companies regulated by the Federal Reserve, “the investment banks are now a cartel.”

In fact he said they are even more of a cartel than OPEC, because they split up turf, noting darkly that “Goldman Sachs and Morgan Stanley don’t compete all that much,” which might be news to some of the traders and bankers we know at those firms. No matter, the Bank Cartel is alive and well, according to Cohan, because he’s “been assured by bankers on Wall Street” that they are going to “raise prices on their clients.”

The crowd tisked and shook their heads and nodded knowingly: I knew it!

Now, Mr. Cohan is not just a TV Personality. He is an author, and he has written books about Wall Street, where he did, after all, once work.

And being an author, it apparently occurred to him that he ought to offer some proof for his “cartel” theory besides unsubstantiated hearsay.

So he did: “Wall Street is booming in every way,” he said, declaring, as if stating an indisputable fact, “Profits have never been higher. ”

Quote, as they say, unquote.

Now, having just listened to supposed-cartel-co-conspirator BankAmerica CEO Brian Moynihan point out that his company has just completed its 15th consecutive quarter of reducing employment by 3,000 human beings or more, the phrase “booming in every way” wouldn’t necessarily spring to the mind of anyone remotely paying attention to the current environment on Wall Street.

However it’s the “profits have never been higher” that seemed flat-out wrong. Since this was a speech, and there were no fact-checkers around as would be the case if this had been a manuscript for publication, we here at NotMakingThisUp decided to check the facts ourselves to see if Mr. Cohan was, in fact, not Making That Up.

The results, from our trusty Bloomberg, are in the table below, which shows the most recent earnings data from the five money-centers that remain intact from the crisis days compared to their peak quarterly numbers, almost entirely from the 2006-2007 fat years (Wells Fargo is not included because it is a substantially different entity thanks to the Wachovia acquisition):

If that is a cartel, it is not doing a very good job of jacking up prices for its clients.

Return on equity for the “booming-in-every-way” cartel is down 50% from peak levels; return on assets is down 40% from peak, and earnings (in billions of net after-tax dollars, adjusted for non-recurring items), are nearly 30% below peak.

Not even close to “Never been higher.”

And while we are at it, we should probably also point out that John Lennon actually said “cranberry sauce,” not “I buried Paul,” at the end of “Strawberry Fields Forever;” that Paul went barefoot during the Abbey Road cover shoot because it was a warm day outside the EMI studio at St. John’s Wood, not because the cover photograph was an allegory of a burial ceremony; and that Paul is actually still alive and well, and recently turned 73.

Just in case Mr. Cohan tells you otherwise.

Jeff Matthews

Author “Secrets in Plain Sight: Business and Investing Secrets of Warren Buffett”

(eBooks on Investing, 2015) Available now at Amazon.com