by James Picerno, The Capital Spectator

In theory, small-cap and value stocks offer solid premiums over their large-cap and growth counterparts. In the short term, however, turning theory into real-world profits can get messy.

As an example, let’s review how the small-cap and value premia stack up at the moment via representative ETFs for the relevant slices of the US stock market. As we’ll see, there’s an encouraging if not exactly stellar small-cap premium bubbling. The value premium, by contrast, remains on an extended holiday of late.

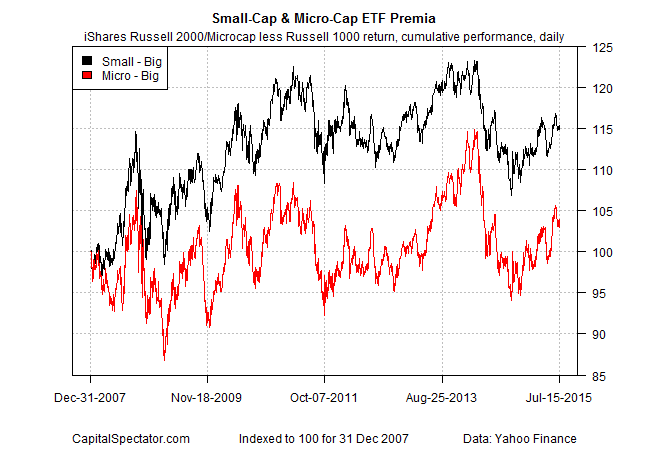

Let’s start with small caps. The definition of premium here is calculated as the daily cumulative return difference for the iShares Russell 2000 (IWM) less iShares Russell 1000 (IWB) through yesterday (July 15). The spread is transformed into an index, with a starting value of 100 for Dec. 31, 2007. This is the performance record for a strategy of going long the small-cap ETF and subtracting the return for the large-cap ETF. I also review how the premium compares when applying this strategy via a micro-cap proxy: the iShares Micro-Cap (IWC) less the large-cap Russell 1000 (IWB).

As you can see in the chart below, the small-cap Russell 2000 ETF has delivered a decent edge over its large cap cousin. The representative spread index is up roughly 15% (cumulative) since the end of 2007, although for the past year (252 trading days) the gain is a thin 2.1% through July 15. By contrast, trying to capture the small-cap premium by using the micro-cap ETF has delivered substantially lesser results in recent years: the associated spread index is ahead by less than 5% since 2007’s close. For the trailing year, however, the micro-cap spread is in the black by roughly 3.7%.

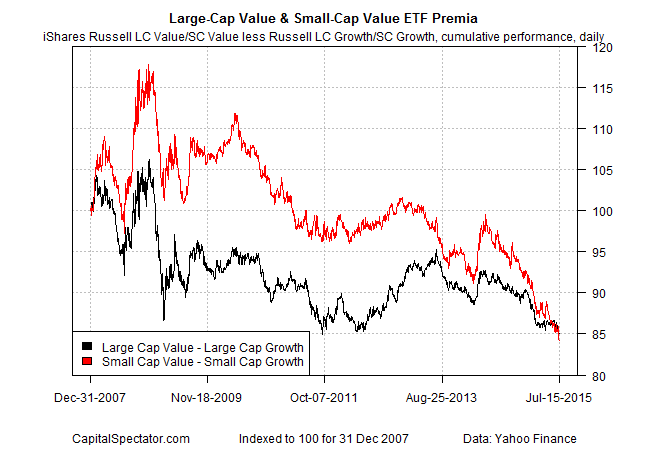

As for the value premium, there’s no sign of it these days by way of two pairings of ETF proxies. Whether searching for the value premium in large caps or small caps, we’re coming up empty handed, as the next chart shows.

For the large-cap value premium, I used the daily return spread for iShares Russell 1000 Value (IWD) less the iShares Russell 1000 Growth (IWF). For the small-cap value premium, the performance difference is based on iShares Russell 2000 Value (IWN) less iShares Russell 2000 Growth (IWO). In both cases, the spread indexes are in the red by around 15% since the end of 2007 through July 15, 2015. For the past year, the large-cap value spread has tumbled more than 7% and the small-cap value spread is lower by a hefty 13.2%.

Does this mean that the value premium is dead? Not necessarily. Over very long periods—decades—there’s a sizable edge in stocks trading at relatively low valuations, but during shorter periods there’s plenty of to and fro. Keep in mind too that how you define value and the period of time you study will yield different and perhaps conflicting results.

So it goes with risk-premium factors, which can be slippery concepts at times in terms of real-world results. Yes, history suggests that you’ll earn a premium over the broad stock market return through time, but there’s no guarantee. In other words, there’s a reason why they call it a risk premium.

Copyright © The Capital Spectator