by Don Vialoux, EquityClock.com

Pre-opening Comments for Wednesday July 15th

U.S. equity index futures were higher this morning. S&P 500 futures added 2 points in pre-opening trade.

Index futures were virtually unchanged following release of economic news at 8:30 AM EDT. Consensus for the July Empire State Manufacturing Index was a recovery to 3.5 from a decline of 1.0% in June. Actual was 3.9. Consensus for June Producer Prices was an increase of 0.3% versus a gain of 0.5% in May. Actual was an increase of 0.4%. Excluding food and energy, consensus for June Producer Prices was an increase of 0.1% versus a gain of 1.0% in May. Actual was an increase of 0.3%.

Second quarter reports continue to pour in. Companies that reported since yesterday’s close included Bank of America, Blackrock, CSX, Delta Air, PNC and Yum Brands.

CSX added $1.03 to $33.10 after RBC Capital upgraded the stock to Outperform

Eli Lilly dropped $0.76 to $88.00 after Morgan Stanley downgraded the stock to Equal Weight.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2015/07/14/stock-market-outlook-for-july-15-2015/

Note seasonality charts on U.S. Retail Trade and S&P/TSX Real Estate

Interesting Charts

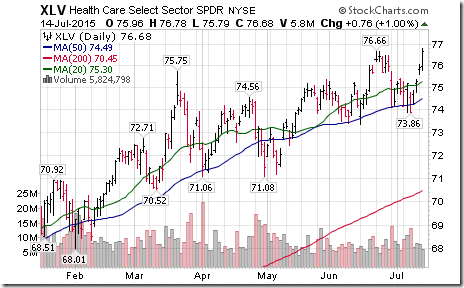

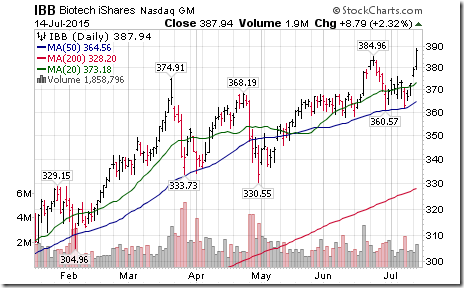

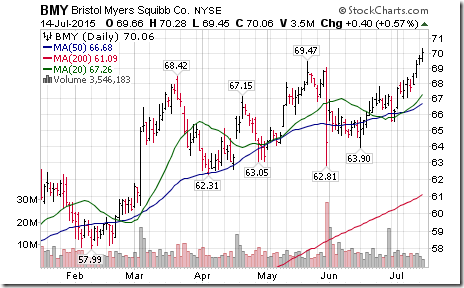

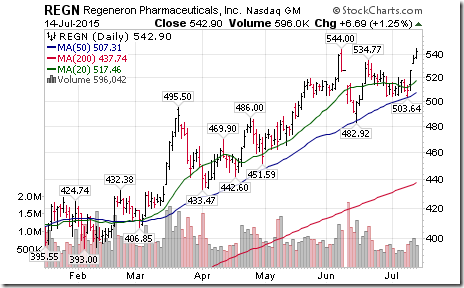

Strength in the biotech subsector was the main reason why the S&P Healthcare Index and its related ETF reaching an all-time high.

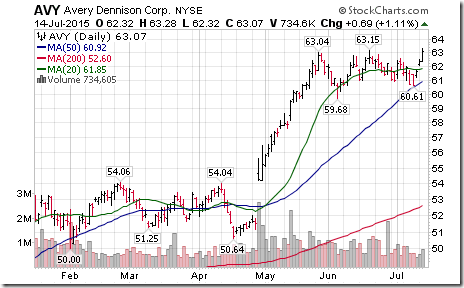

A move by the Medical Devices ETF to an all-time high also added to strength in the health care sector.

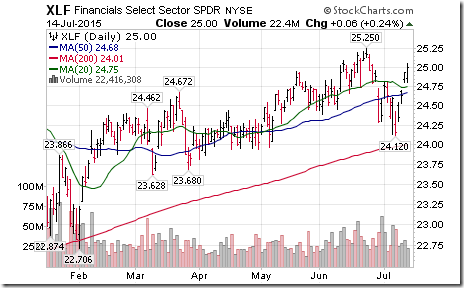

Financial stocks and related ETFs recorded encouraging gains following release of second quarter results from JP Morgan and Wells Fargo.

Ooops!

StockTwits Released Yesterday @equityclock

Quiet technical action by S&P 500 stocks to 10:45 AM! Breakouts: $HAS, $KO, $ENDP. Breakdown: $FAST

$IBB broke to an all-time high on a move above $384.96.

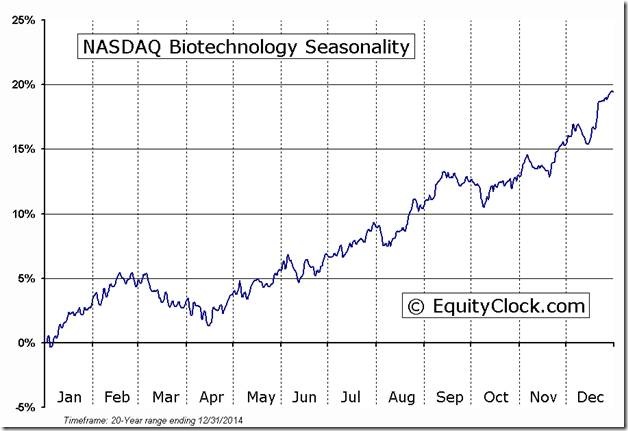

‘Tis the season for strength in the NASDAQ Biotech ETF until mid-September

Technical Action by Individual Equities Yesterday

After 10:45 AM EDT, another 12 S&P 500 stocks broke resistance and none broke support

Trader’s Corner

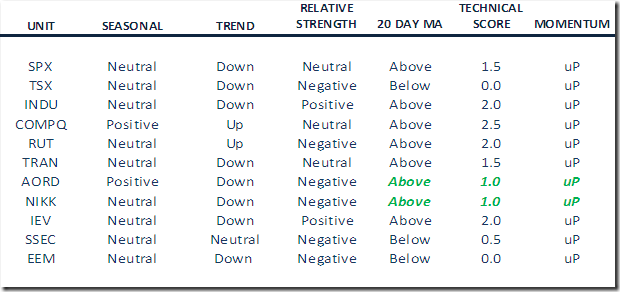

Daily Seasonal/Technical Equity Trends for July 14th 2015

Green: Increase from previous day

Red: Decrease from previous day

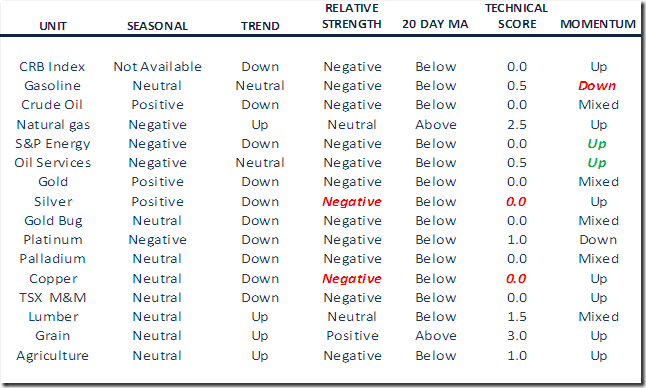

Daily Seasonal/Technical Commodities Trends for July 14th 2015

Green: Increase from previous day

Red: Decrease from previous day

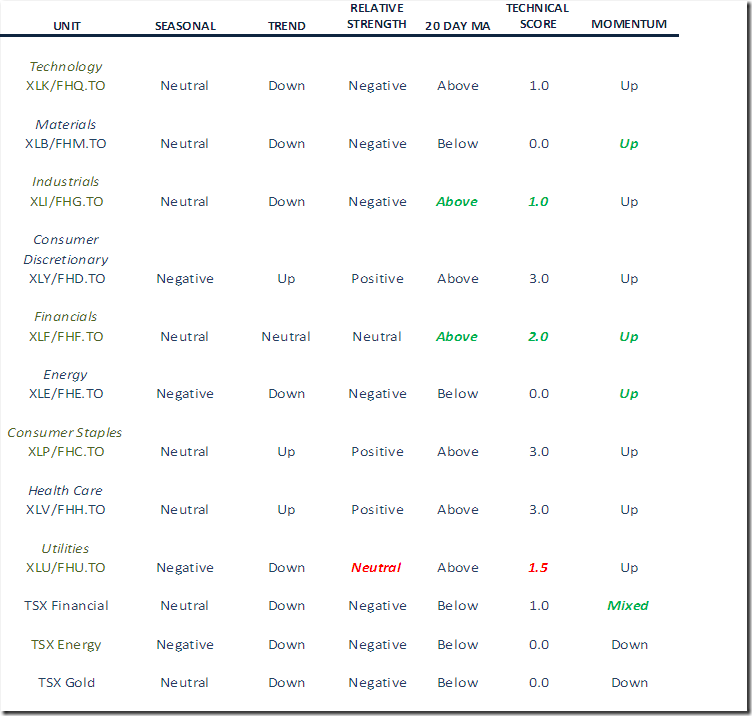

Daily Seasonal/Technical Sector Trends for July 14th 2015

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

AMGN Relative to the S&P 500 |

AMGN Relative to the Sector |

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

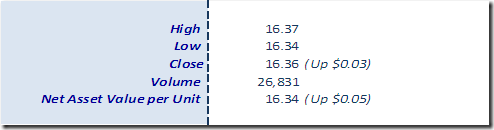

Horizons Seasonal Rotation ETF HAC July 14th 2015

Copyright © Don Vialoux, EquityClock.com