by Ben Carlson, A Wealth of Common Sense

Watching the drama unfold over the past couple of weeks in the Greece should make a few things clear to investors. First of all, no one really knows what’s going on in the markets.

I remember listening to a very well-respected European hedge fund manager give a talk in 2011 about the potential for a Greek exit from the European Union. He put the odds at close to 95% and even gave a specific date for when it would happen. It sure sounded like an intelligent take at the time based on the reasoning he laid out. It didn’t matter.

If you’ve been following the Greek saga from the start you begin to realize that even the experts on the situation are pretty much just making it up as they go. How often do the economists change their odds for the probability of a Grexit? Maybe stop guessing since your forecast is worthless in a matter of hours? Trying to place odds on the likely outcomes of these types of political scenarios is like trying to count cards in blackjack when the dealer re-shuffles all six decks after each hand.

Some of the most brilliant people I’ve met are terrible investors because they’re constantly seeking out ways to explain why things happen the way they do in the markets. Even when you’re right about the way something transpires in the macro picture, you may come to the wrong conclusion about how the markets will react to that event.

When you’re constantly looking for a catalyst to explain every single move in the markets you start to see signals and correlations that just don’t exist. Most of the time we won’t know exactly why the markets moved a certain way until much later. Sometimes even with the benefit of perfect hindsight, investors still can’t agree on the specifics of the cause and effect. But to some the ‘why’ in the markets will always seem easy after the fact, so they keep searching for the answers.

Of course, there will always be focus on the ‘why’ because people crave a good story. And many of the intelligent people who work in the industry are overconfident in their abilities. It becomes an ego thing, which is why so many investors take the markets personally when it goes against them and their chosen catalysts.

Long ago I decided to let go of the ‘why.’ It’s not worth it to constantly try to play the guessing game about how things will work out with every single headline event. There’s no need to add unnecessary stress to an already complex market construct. I don’t know if the Greece situation will lead to a correction in the markets. Maybe it’s a catalyst. Maybe it’s just an excuse for investors to sell who have earned large gains over the past few years. Maybe it passes with no market damage like it has for the past few years.

Either way, investors have to ask themselves the following question when preparing for the eventual correction in the stock market: Do I want to be right about the reason for the fall or do I want to have a plan in place to deal with the inevitable losses when they occur? The two don’t have to be mutually exclusive, but trying to outguess the markets doesn’t constitute much of a plan when losses start to pile up.

Someone will end up being the hero and stick the landing when all is said and done with this situation. In my experience, heroes don’t last too long in the markets.

Further Reading:

Don’t Take This Personally

Why It’s So Hard to Change Your Mind About the Markets

Pop Quiz Hotshot: What’s the Line in the Sand?

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

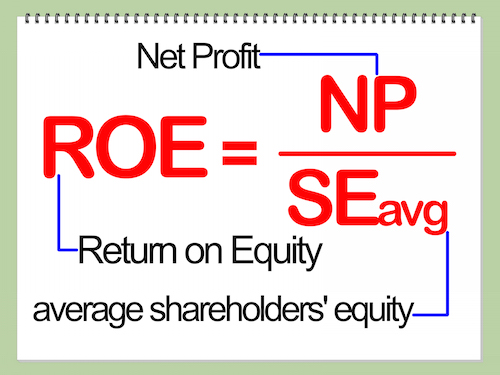

My new book, A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan, is out now.

Copyright © A Wealth of Common Sense