by Ben Carlson, A Wealth of Common Sense

Forbes wrote a nice profile on financial planner and blogger Michael Kitces last week. In the piece, I thought Kitces made a very important point about how the need for financial planning can vary based on where you’re at in your life-cycle:

When you’re young, don’t obsess over investment returns. Worry about career and saving instead, and buy a few low-cost index funds, including Vanguard Total Stock Market (VTSMX). Ten years before retirement, get serious about asset allocation. “The amount of return you get then actually starts to matter a lot, but the risk you’re taking matters a whole lot more, too.”

There are obviously exceptions to this rule as there are some young people who hit it big and find themselves in need of more financial guidance. But in general, the importance of financial planning ramps up as you get closer to retirement. Wealth accumulation is actually much easier to advise people on than wealth preservation.

I get questions from young people all the time when it comes to retirement planning. Usually these questions are very vague and rarely do I get much follow-up after my initial advice. My basic advice is always the same — save as much money as you can in a tax-deferred retirement account, invest in yourself so you can earn more money and never carry a credit card balance. Start there and you’re doing better than the majority of your peers. But young people don’t want to hear this kind of advice, so it’s much easier for them to ignore it and assume they’ll start planning for retirement at a later date.

It’s once you start closing in on retirement age that people really get serious about financial planning. I get plenty of questions from this group too, but you can tell they mean business because they ask very specific questions: What’s my ideal asset allocation in retirement? Best withdrawal strategies for distributions? Tax deferral options? Will my portfolio last in retirement or should I keep working? Do I need my mortgage paid off before I retire? When should I start taking Social Security?

This is why it’s funny to me when people say that robo-advisors are going to take over the financial planning business. I say that’s nuts without a number of actual financial advisors available for people to talk to when all of these baby boomers retire or start to think about retirement.

Giving long-term asset allocation advice to young people is the (relatively) easy part, which is an under-served market that the robo-advisors have smartly tapped into. Young people need a simple solution and no one has ever really paid attention to that demographic when it comes to investment advice. But once you approach that 10 year mark that Kitces talked about? That’s the point when people really start to worry. They need someone to talk to along with a strong financial plan.

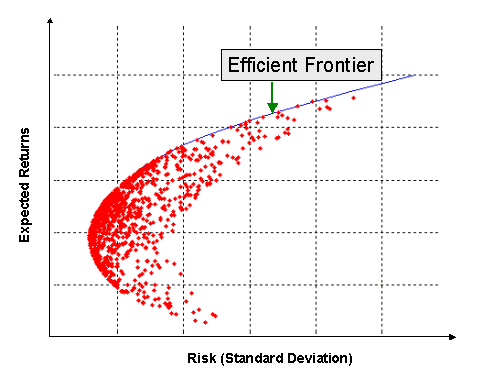

Kitces also brings up a very important point about when your returns start to matter (a topic I covered a few weeks ago, as well). What most people fail to understand when thinking about compound interest is how important it becomes later in life after you’ve built up a decent-sized nest egg. Life never plays out exactly as it does on a spreadsheet, but let’s take a simple retirement calculator example to see why those later years are often so important.

Let’s say you start saving at 30, at which time you stock away $500 a month. Each year you increase that amount by 3% to keep up with inflation. Miraculously — because this is a fake retirement calculator scenario — you earn an even 7% annual return on your money each year. By age 60 you have roughly $830,000. Not bad. But let’s say you don’t want to retire until age 65. By then you’re portfolio would grow to more than $1.2 million. That means around 35% of your ending value at age 65 would come from the last 5 year’s worth of portfolio growth. The pressure at that point can be intense if you’re not sure what you’re doing.

Since real world markets don’t give reliable returns year-in and year-out out like they do in retirement calculators, risk management and your investment policy become critical to your success in those later years. If you don’t have a solid financial plan in place or a legitimate financial advisor to keep you on track it could be nearly impossible to recover from a huge mistake at that point. At that stage in your life there’s not as much time to make up for a poor investment decision and your human capital is basically tapped out, so new savings aren’t going to bail you out.

Thousands of baby boomers are retiring every single day in the coming years. Color me bullish on the financial planning business over the next couple of decades.

Source:

The New Money Masters: Financial Planning Guru Michael Kitces (Forbes)

Further Reading:

Four Questions

Do Young Investors Need a Financial Advisor?

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

My new book, A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan, is out now.

Copyright © A Wealth of Common Sense