You might have guessed that after five years and countless volleys of eurozone crisis flares and resolutions, the euro would callous to an ever-shortening and hyperbolic news cycle. And yet, here, on the precipice of another crisis benchmark along the EU's stormy and tumultuous timeline, the euro rallies over 3 percent on whiffs that a deal with Greece's creditors would soon be presented to Athens.

You might have guessed that after five years and countless volleys of eurozone crisis flares and resolutions, the euro would callous to an ever-shortening and hyperbolic news cycle. And yet, here, on the precipice of another crisis benchmark along the EU's stormy and tumultuous timeline, the euro rallies over 3 percent on whiffs that a deal with Greece's creditors would soon be presented to Athens.

Although we're not surprised and have expected as much (see Here), it's still worth noting that after all that has come before, the existential threat to the euro and EU is still very much alive in the markets. This maintenance of kinetic uncertainty is testament to the inherent design flaws within the current structure of the EU, that continues to provide a perennial bouquet of weeds to be pulled and treated by the ECB each year. Make no mistake about it, the fact that the euro still reacts with such sensitivity to rumor and innuendo reveals the complexity and underlying fragility of the EU and the importance of avoiding a possible Grexit - even if the broader union has been fire-walled from such consequence.

This is in stark contrast to the US side of the pond, where over the same timeframe the litany of political and economic travails have been greatly qualified and absorbed without any real lasting effect in the markets. Although it's certainly more complicated and nuanced than just one factor, the differential in policy affects between what the Fed widely prescribed in the US after the financial crisis and the "take it one crisis at a time" mentality that the ECB had towed up until this year, lies squarely at the feet of the glaring structural flaw that exists within the European monetary union.

There is no political union.

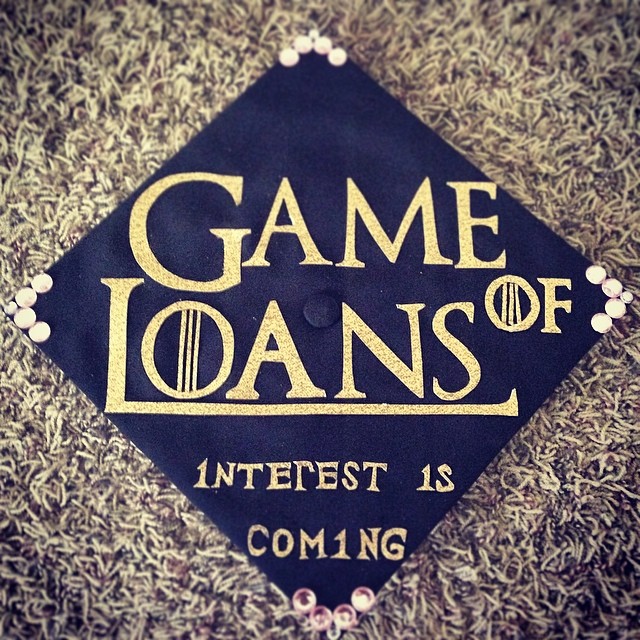

All things and animosities considered, that reality appears increasingly unlikely these days, as the rise of leftwing anti-austerity parties in southern Europe has been met by the ascension of rightwing nationalist parties in the north. Game of Loans - anyone? Nevertheless, it is a dangerous echo and potentially self-fullfilling cycle, emblematic of the significant economic and political chasms that were grossly ignored at the euro's conception - then heighten during and after the financial crisis and which continue to greatly motivate the euro today.

If Greece decides to leave or is forced out, who's to say Spain won't follow suit in the years to come as the political winds shift further to the left. As much as the German's posture their resistance to QE or reluctance to concessions with Greece, their fates are invariably entangled. By pushing Greece off the cliff it would flame and entrench the dangerous political divisions within Europe, ultimately broadly hurting the German economy that has benefited the most from its flawed structure and impressionable currency.

Pragmatically speaking, the significant actions finally enacted by the ECB this year could provide another window for deflationary conditions to subside and for political extremes to weaken from. The economic data in Europe has mostly surprised to the upside this year, with figures released Tuesday showing eurozone consumer prices had risen for the first time in six months in May. Do the German's really want to roll the dice here as fresh tread from ECB policy begins to find traction? As much as the German's don't see eye to eye with Draghi on many things, the fallout in confidence alone would be irreparable.

Whether by design, coincidence or convenience, the prolonged uncertainty towards Greece and the broader EU economic and monetary policy debate, has disproportionately benefited the export driven German economy, as the anchor around the euro's neck has maintained a strong existential correlation to future expectations of the union. Where do you think the deutschmark would trade today without Greece's baggage? Spain's? Italy's? France's? Needless to say it would be substantially higher, given Germany's considerable trade surplus.

Contrary to earlier crises where certain acute market stresses forced reluctant participant hands, the slow boil in Athens over the past year has primarily been a consequence of a patient sous chef holding up the meal's final presentation. Boil the meat to remove the fat, marinate for a spell - then slow roast to perfection. While many things in the economy and markets are indomitable to influence, German officials have seemingly chosen to push the limits of extending concessions to Greece, contributing to the euro's burden which was already under significant pressures from recessionary and deflationary forces swirling the continent. While those winds appear to be subsiding and the deadline for payment from Greece to the IMF awaits the markets this Friday - let's just hope they didn't overcook the roast. From our perspective, that would be more than just a Greek tragedy.

Copyright © Market Anthropology