by Jeff Macke, Less Filtered

When I ask people to describe their investment style “I’m a contrarian” is by far the most common response. It usually comes with an air of pride and chest swelling, perhaps even a slight hand wave of disdain in reference to the unseen masses and their group-thinking silliness.

It’ll come as a shock to many you but the truth is you’re probably not a contrarian. Quite the opposite. It’s actually a wonder that so many people think of being a contrarian as a goal. Standing alone in your views and actions is much more difficult than going with the flow. It makes you a target and an outcast. It’s dangerous, if not physically than at least emotionally. Being anti-consensus makes a person less likable. You may say you don’t care what people think but you do. It’s impossible not to.

As a practical matter the only question is whether or not the profits are greater than the social and emotional strain. Put simply, would perfect Contrarian Investing actually make money?

Not only is it odd that there isn’t much research on this topic but it’s harder to measure than you think. It’s inaccurate to use market peaks and dips as a retroactive measure. It’s circular to judge the collective euphoria by the stock market alone. Market sentiment is wildly volatile and strongly correlated with how stocks did in the prior month.

A true contrarian is someone unerringly capable of being in the exact opposite mindset as the majority of the population at any given time. To test the profitability of betting against the crowd I needed a longitudinal data set measuring America’s mojo.

Happily I found one.

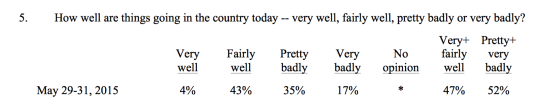

Since March of 1974 CNN/ORC (and their corporate ancestors) have been asking Americans a simple question: How well are things going in the country today? The possible answers are “Very well”, “Fairly well”, “pretty badly” and “Very badly”.

Here’s today’s poll. For the record, 47% of those polled think things in America are either Good or Very Good.

Reading through the poll it struck me that this survey was a terrific measure of sentiment in America for the last 40 years. It’s a deceptively simple question measuring the mood of the nation without explicitly bringing investments into the picture at all.

It seems a safe presumption that the economy is buried somewhere in the mental calculation that goes into a person’s view of how things are going in the country but it’s only part of the equation. Supporting this theory, the polls greatest market timing triumph of sorts was nailing the tip-top of the bubble in 2000 when 81% of the country regarded things as going well or very well 2 months prior to the 15-year Nasdaq top. The dot-com bubble bursting was not a good direction for the country to be going.

Irrational exuberance indeed.

Building the perfect outcast

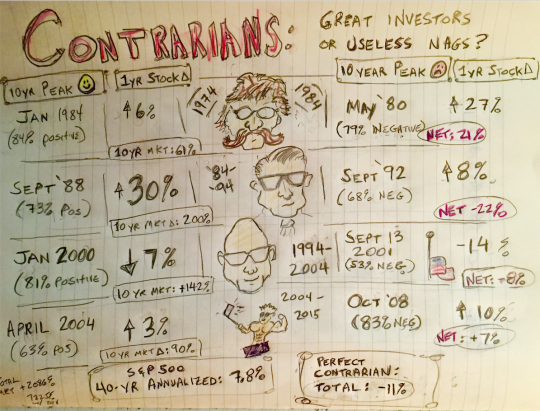

From CNN et al’s data I was able to build the perfect contrarian beast. Not a market timer per se (everyone on Finance Twitter is already a perfect timer) but someone with an infallible ability to identify exact extremes in societal mood.

Starting in March 1974 my imaginary trader took the other side of whatever way the country was leaning at the precise emotional extreme for each decade. At the exquisite moment of maximum national pessimism of every decade my icy trader swept in like Mr. Potter gutting Bedford Falls during the run on George Bailey’s savings and loan.

I imagined just 4 trades every decade, each of them timed perfectly in regards to the country’s mood. At peak happiness he went 100% short the S&P 500. When the country’s mojo was at its lowest points he got 100% long. 12 months later he closed the position and waited for the next decade.

This isn’t a day trader but an emotional savant investor, able to perfectly sense and act on 10 year extremes.

How did he do?

In a word, terrible.

Through Nixon, Carter, Iran-Contra, Lewinsky, Hanging Chads and 20 years of slog in Iraq the S&P 500 just kept cranking out gains. In addition to offending the majority with his smug anti-group think my hypothetical contrarian was simply a terrible investor. At least when it comes to the country’s overall sense of how things are going sentiment is a lousy timing device. My trader bought too early in 2008, shorted stocks in 1988 and generally made a mess of his portfolio.

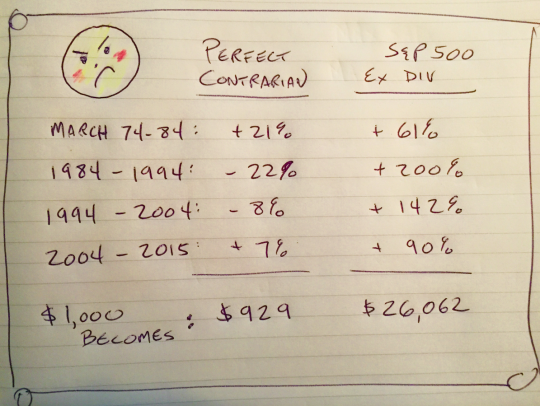

After 41 years the perfect Contrarian had turned $1,000 into $929. That’s unadjusted for inflation so his real buying power is about 40-cents (note to self: check that calculation).

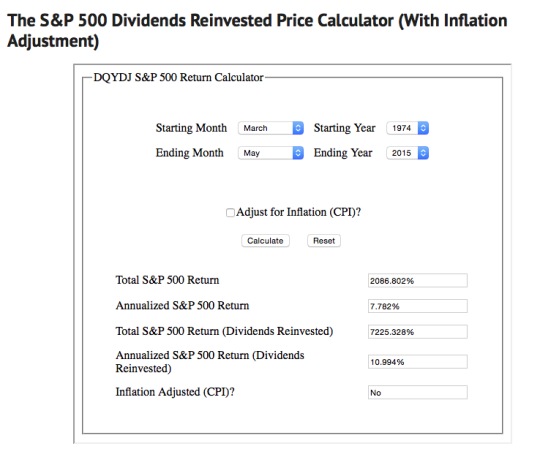

Meanwhile the crazy optimist who simply bought the S&P500 in March of 1974 and held on, not re-investing dividends and going with the flow under all circumstances saw his $1,000 grow more than 26x.

Reinvesting dividends made going with the flow even more outrageously profitable:

Conclusion

Think of this less as a trading strategy than rule of thumb. Very rarely is everyone in the world wrong except you. If you find yourself thinking otherwise you’re probably trying to justify bad decisions. That’s what brains do. We’re hardwired not to think of ourselves as stupid and will go to almost any lengths to preserve our self-esteem.

Even knowing that in advance I was surprised to see just how horribly my perfect Contrarian did over the long term. The reason fading the crowd didn’t work was the same problem traders have. Timing. While my Contrarian was right to fade the euphoria of 2000 and get long into the Great Recession he was significantly early both times in terms of price. Taking the other side of the 2008 crash was instinctively correct but it got him long about 35% before the lows of the following March.

Not that this was a useless exercise. Far from it. Your take away, and this applies to both trading and life is this: There is great value in observing rather than action. Your appraisal of other people matters less than how you comport yourself.

Above all resist the urge to dismiss the Crowd as insane. You’ll be more popular and ultimately have more money.

As it turns out the Bible was probably right about at least one thing: The sheep really do inherit the earth.

Copyright © Jeff Macke, Less Filtered