by Eddy Elfenbein, Crossing Wall Street

I get annoyed at much of the sloppy talk about the stock market incessantly being “in a bubble.” Here’s Robert Shiller making yet another noncommittal forecast. It seems sophisticated to say that stock prices are too high when in fact, true bubbles are quite rare.

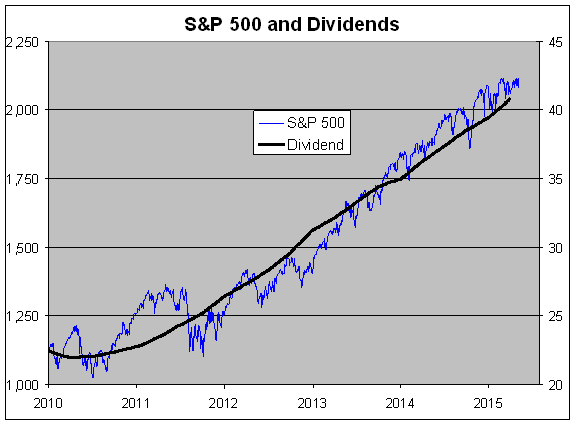

Here’s another way to look at the current market. This is the S&P 500 (blue, left) along with its dividends (black right). I scaled the two lines at a ratio of 50-to-1. In other words, whenever the lines cross, the S&P 500’s dividend yield is exactly 2%.

The chart shows that the market has tracked a 2% dividend yield for a few years. My point is that this has been a bull run in dividends as much as it’s been one in stock prices. That, it seems, rarely gets mentioned.

The stock line runs through May but I don’t have the Q2 data point yet for dividends. But I expect it will be a continuation of the trend.

Let me be clear on two points. I’m not saying that dividends are the only measure of valuation, nor am I saying that 2% is some platonic fair value. But dividends have the benefit of being steady and reliable. You’re never quite sure how much money a company has earned, but you do know exactly how much they’ve paid out in dividends.

If there’s any distortion, it may be to the low side since the Federal Reserve must approve capital allocation plans for major banks.

by Eddy Elfenbein on June 1st, 2015 at 10:54 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Copyright © Crossing Wall Street