by Scott Krisiloff, Avondale Asset Management

92% of S&P 500 companies have now reported Q1 earnings. According to Standard & Poors GAAP earnings for the last 12 months are just $99.18.

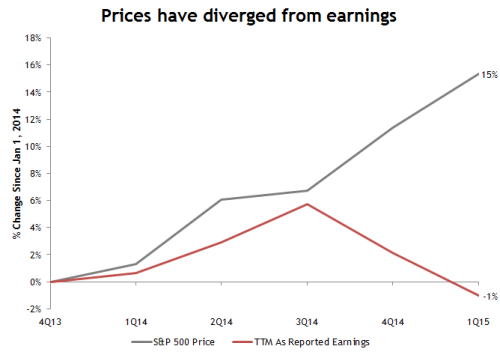

That is down 6.4% from peak earnings, which were posted after the third quarter of 2014. That is also down 1% from the earnings number posted all the way back at the end of 2013, which means that earnings have not grown since January of 2014.

Despite no earnings growth since January of 2014, the S&P 500 is up 15% since then. It has moved from an already high multiple of 18.5x to an even higher multiple of 21.5x.

A few notes:

–S&P’s numbers are “per share” which means that they factor in the effect of buybacks. So this divergence can’t be explained by corporate actions.

–It’s true that earnings have been impacted by oil prices and exchange rates. But if you own the S&P 500 you own oil fields and companies with foreign operations, so the earnings power of your property has been impaired by the environment.

–TTM earnings are expected to stay at the $99 level through 3Q15 and then jump to end the year at $106.54. Operating earnings are expected to stay at the $111 level and jump to $116 at year end. This implies 31% and 18% earnings growth in Q4 for GAAP and operating earnings respectively. When people talk about PE multiples compared to forward earnings they are factoring in this growth.

–That growth is expected to continue in 2016. EPS is projected to be up 15-17% in 2016, reaching $133 per share. Take analyst projections with a grain of salt though. At this point in 2014, analysts expected 2015 earnings to be $137.

Copyright © Avondale Asset Management