by Brooke Thackray, AlphaMountain Investments

CAD/USD HAC was fairly active in making currency adjustments in the favorable six month period for stocks. At the start of the period, HAC was already long the U.S. dollar relative to a currency neutral position. The U.S. dollar followed its seasonal trend of outperforming the Canadian dollar. The success of the trade was mainly driven by the price of energy falling rapidly.

In mid-December, HAC exited its long U.S. dollar position and went to a currency neutral position. This trade was executed as the Canadian dollar tends to outperform in the second half of December. The end result of trade adjustment was that HAC did not give up any ground on the previously strengthening U.S. dollar. At the beginning of January, HAC once again took on a long position in the U.S.dollar, as the U.S. dollar tends to strengthen in January.

At the beginning of April, HAC profited by flipping its currency trade and taking on a long position in the Canadian dollar, based upon seasonal trends. For more information on this seasonal trade, see, www.alphamountain.com, Thackray Seasonal Trade, or http://bit.ly/1IruH9m.

Oil West Texas Intermediate

At the beginning of the six month unfavorable seasonal period for stocks, HAC already had a short sell position in oil, paired with a long position in natural gas. This pair trade was once again successful, as it has been so often in the past. Towards the end of November, HAC exited the short position in oil, as the seasonal justification started to weaken at this point.

Overall, the trade was successful. Obviously, it would have been better to remain short oil into January, but there has to be a seasonal justification to do so. Sometimes HAC will hang on to a position past its seasonal end date, if the position has strong momentum. But there has to be seasonal justification. In other words, a strong countervailing seasonal trend should not exist at the time.

Energy Stocks U.S.

The first page illustrates the performance of U.S. energy stocks. A U.S. ETF was chosen as it eliminates the currency effect relative to the Canadian dollar. Broadly, energy stocks tend to have a strong performance from February 25th to May 9th. Energy stocks can start their seasonal run early, and based on technical strength, HAC started to enter energy positions in late January using Horizons S&P/TSX Capped Energy ETF (HXE). At the time there were calls for oil to fall as low as $20. Everyone seemed to be negative on oil.

Initially, HAC profited from its energy position, but patience was tried in February and early-March. The energy sector resumed its upward trend in the second half of March and into April. Overall, the energy sector performed well for HAC.

Russell 2000 Small Caps (IWM)

The seasonal period for small caps to outperform large caps starts in mid-December and ends on March 7th. This seasonal trade has worked out quite well over the last few years and HAC entered into a fairly large position for this year’s seasonal period. Once again, the seasonal trade was successful as investors increased their risk appetite. Investors also favored small caps because of the reduced exposure to foreign exchange impacts compared with large caps. As a result, small caps started to outperform in December, ahead of January earnings season.

Technical Commentary

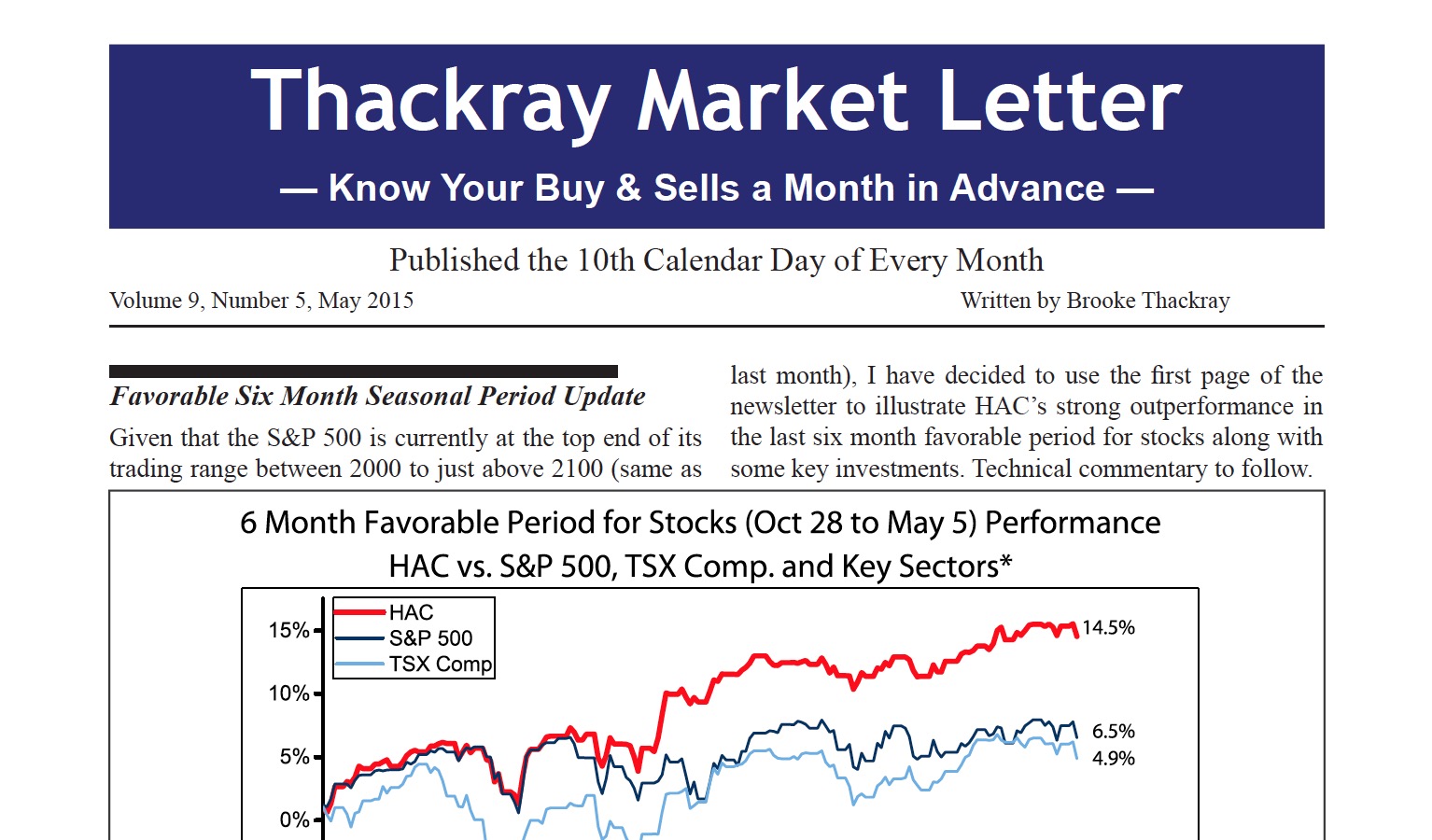

Over the last few months I have been commenting on how the S&P 500 has been trading in a range of 2000 to just above 2100. Since February, the range has tightened up at the bottom end to 2050, which is positive for the markets.

There is a saying in the technical analysis world, “the longer the base, the greater the case.” In other words, when the S&P 500 is able to break out decisively, it will have support to keep its momentum moving in the same direction.

Nevertheless, we have entered the six month unfavorable period for stocks and the risk-reward relationship favors being conservative. It is possible that a rally may ensue from here, but there are risks in trying to follow it up.

HAC prefers to look for seasonal opportunities in different sectors and will invest for short periods of time into broad market positions such as the S&P 500 when it is seasonally justified.

Seasonal Map for the next six months

The following is a summary of possible seasonal trades over in the next six months. It is not an exhaustive list. Consumer staples– Expensive, but worth it Over the years, I have advocated the Consumer Switch trade, investing in the consumer discretionary sector for the six months from October 28th to April 22nd and then fl ipping the trade to the consumer staples sector for the next six months. The rationale behind the switch trade is that during the six month unfavorable period for stocks, consumers favor more defensive sectors such as the consumer staples sector.

Currently, the sector is expensive, supporting a P/E ratio of 20. A lot of investors will claim that it is too expensive for a slow growth sector. What they are missing is that investors are willing to pay a premium for the defensive characteristics of the consumer staples sector during volatile times. Investors should know that despite its seasonal attractiveness, if the stock market has a major correction, the consumer staples sector would be expected to correct as well, but not by as much.

Read/Download the complete report below:

Thackray Market Letter 2015 May by dpbasic on Scribd

Copyright © AlphaMountain Investments