by David Templeton, Horan Capital Management

In a post last month we highlighted the fact value strategies and dividend paying strategies were lagging both the S&P 500 Index and the S&P 500 Growth Index over the past twelve months. Frequently the value type stocks have a dividend component that provides additional return for investors.

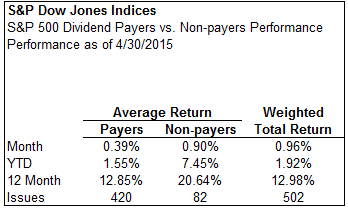

Further confirmation that dividend paying strategies have been underperformers can be seen below. S&P Dow Jones Indices reports the average performance of the dividend payers in the S&P 500 Index have lagged the non payers by a wide margin, both year to date and over the course of the past twelve months as of April 30, 2015. For the one year period the payers return of 12.85% falls far short of the non-payers return of 20.64%.

Source: S&P Dow Jones Indices

This difference in return for the average or equal weighted return versus the cap weighted return noted above has carried over to the the performance of the Guggenheim S&P 500 Equal Weight ETF (RSP) return versus the capitalization weighted S&P 500 Index. As the below chart shows, the equal weight index has outperformed the capitalization weighted S&P 500 Index for the past year and a half.

As the dividend paying stocks have been significant laggards relative to the non-payers, the recent outperformance of large value versus large growth since April, and noted in the below chart, may carry over to the dividend payers. Dividend focused investors would certainly relish an environment the closes the gap between the payers and non-payers returns.

Copyright © Horan Capital Advisors