by Michael Batnick, The Irrelevant Investor

What Do You Want From Your Bonds?

From 2010 through the end of 2014, assets in the ten largest funds in what Morningstar refers to as “nontraditional bond funds” ballooned from $16 billion to over $80 billion.

With interest rates sinking lower and lower, investors are venturing into different areas of the bond market. From Emerging Market Debt, to bank loans to shorting treasuries, these managers are freed from the shackles that traditional bond managers wear.

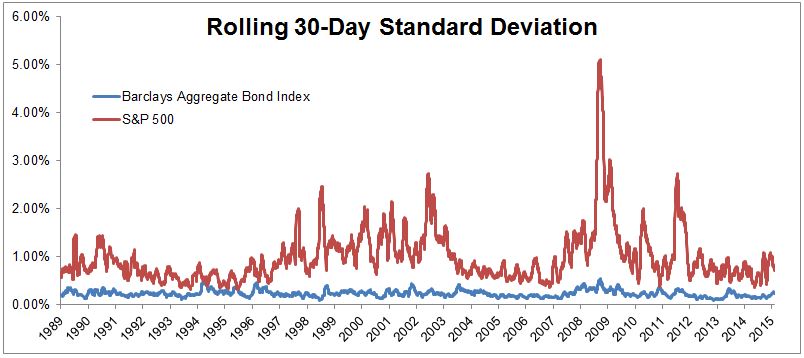

The problem with these unconstrained bond funds is not their performance, in fact many have delivered excellent returns. The thing many investors would do well to focus on is the other side of the ledger, i.e risk. Most people hold bonds not to to juice returns but to minimize risk so when stocks are under pressure you want to know your bonds will act like bonds.

When there is stress in the equity markets, investors rush to safety, regardless of how low rates are. Take a look at how the S&P 500 futures and 30-Year Bond futures responded to Friday’s selloff.

It’s been 517 trading days since the S&P 500 experienced a ten percent correction. When that streak finally ends, I suspect that a lot of people will be wishing they held more plain vanilla bonds.

Follow me on Twitter

Copyright © The Irrelevant Investor