by Michele Patri, AllianceBernstein

Euro-area stock markets have rebounded as the ECB has launched its QE program. In our view, investors should take a pragmatic approach that aims to capture the gains—but with eyes wide open to reality.

The US, the UK and Japan all witnessed sharp equity market rallies when they launched quantitative easing (QE) programs. The exact same thing has happened in the euro area. The Euro Stoxx 600 Index is up by well over 15% since the start of the year in euro terms as the European Central Bank (ECB) has ushered in ECB-style QE.

But is it sustainable? Given the euro area’s lackluster growth, deflationary pressures and vulnerability to periodic political and economic crises, investors must be vigilant. In our view, there are reasons to be (cautiously) optimistic about the long-term outlook for select euro-area equities. However, the speed and the extent of the recent rebound mean that it’s prudent to balance a strategic position with tactical short-term defense mechanisms.

Cheaper Oil, Easy Money and a Weaker Euro

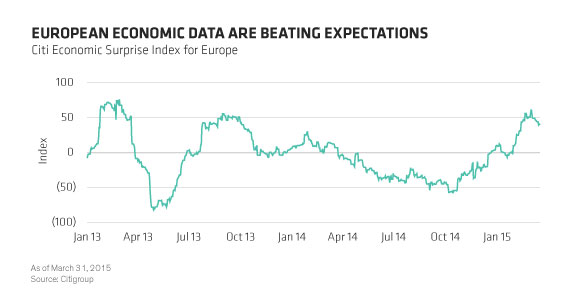

The ECB implemented QE to combat deflation and encourage economic growth. Regional growth dynamics are improving (Display) and big-picture political and macroeconomic risks are receding, given policymakers’ clear commitment to ensuring that Europe’s currency union survives.

Moreover, European businesses look set to benefit from the healthy convergence of several cyclical tailwinds in coming months. In euro terms, oil is currently about 30% below its average price in the first half of 2014. This is a boon for many euro-area businesses, which should see their profit margins rise as their costs fall. Key beneficiaries include not just transport-oriented businesses, but also other high energy users, like the steel industry and food producers. At the same time, consumer-facing businesses could see stronger demand for their goods and services when consumers have more money in their pockets because of cheaper oil.

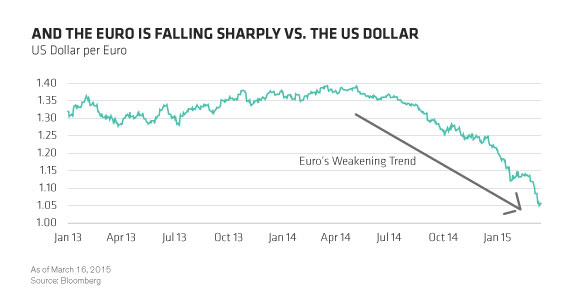

The ECB’s provision of easy money as part of its QE program is a further big positive. This should allow euro-area corporates to borrow money very cheaply via banks or directly in capital markets. In addition, QE is leading to a weaker euro currency (Display), which makes euro-area exports more competitively priced in global markets, while also boosting the value of revenues earned overseas when they’re translated back into euros. This is significant because euro-area exports account for a big share (around 44%) of the region’s GDP, more than in either the US or Japan. A weaker euro also helps domestically focused businesses, whose prices look increasingly attractive as imports become more expensive.

So, plenty of positives are starting to feed through. But the question is whether these should be so fully priced into euro-area stocks today. Valuations in parts of the market are looking pretty stretched given that aggregate earnings remain depressed by historical standards. Some cyclical stocks have seen their earnings bounce, but this seems largely attributable to currency gains—as opposed to a big upturn in demand.

Better Safe than Sorry?

Euro-area equities may no longer be cheap. But we believe they still look relatively attractive when compared with regional sovereign bonds, which increasingly offer zero or negative yields. In this environment, it’s worth being a participant in European equity markets—even if short-term volatility is likely. But it’s also sensible to put strategies in place that seek to minimize any potential equity market drawdowns—particularly given the extent to which regional stocks seem to be pricing in future earnings growth.

So what kind of strategies might afford good protection against potential equity market upsets down the line? One approach might be to offset exposure to cyclicals that should benefit from better economic conditions with more defensive stocks whose earnings should hold up even when times get tough. However, this kind of balance is hard to achieve right now because intense investor appetite for stocks offering attractive free-cash-flow and dividend yields has left the valuations of many high quality “bond proxy” stocks in traditionally defensive sectors looking punchy.

Instead, consider a more nuanced approach that taps into a variety of different investing themes and drivers. When combined with beta hedging overlays, investors can enjoy protection from potential damage when equity markets fall, while benefiting from the euphoria while it lasts.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Michele Patri is Portfolio Manager, European Flexible Equities, at AB (NYSE:AB).

Copyright © AllianceBernstein