Market’s March Madness

KEY TAKEAWAYS

· With the NCAA Final Four set, we share our own Final Four for stock market investing: economy, earnings, technicals, and valuations.

· With valuations above average and the economy slowing during first quarter of 2015, our championship game comes down to earnings and technicals.

· Based on our assessment of these four factors, we expect stock market investors will be “cutting down the nets” due to potential mid- to-high-single-digit stock market gains in 2015.

by Burt White, CIO, LPL Financial

The Final Four of the 2015 NCAA College Basketball Tournament is set with Kentucky, Wisconsin, Duke, and Michigan State headed to Indianapolis to determine this year’s college hoops champion. In that spirit, we share our own Final Four for stock market investing: the economy, earnings, valuations, and technicals. Based on our assessment of these four factors, we expect stock market investors may be “cutting down the nets” due to potential high-single-digit stock market gains in 2015.

SEMIFINALIST #1: ECONOMY

The U.S. economy has slowed during the first quarter of 2015 due to a combination of factors, chief among them the spillover effects of plunging oil prices and the booming U.S. dollar. Cheap oil has led energy producers to cut spending. The strong U.S. dollar has reduced the attractiveness of U.S. exports, contributing to a slower pace of growth. In addition, record snowfall and bitter cold throughout regions of the country during February and the West Coast port slowdown negatively impacted economic activity. Despite these impediments, U.S. gross domestic product (GDP) remains on track to grow at a 1 – 2% pace during the first quarter of 2015.

We expect the reversal of some of these factors should help GDP growth return to 3%-plus in the coming quarters. Better weather should be a given. Consumer spending is beginning to benefit from lower fuel prices, while transportation costs have come down. We are seeing a bit of a pickup in growth overseas, particularly in Europe, which is benefiting from the weak euro, while China is poised to enact more stimulus to achieve the 7% growth target for its economy. These positive factors are reflected in the solid gain in the Conference Board’s Leading Economic Index (LEI) discussed in the March 23, 2015, Weekly Economic Commentary, “Forecast For Clear Skies: LEI Shows Low Odds of Recession.” Bottom line, we see continued economic expansion in 2015 after the first quarter dip and do not yet see evidence of excesses building up in the economy that might suggest an impending recession.

SEMIFINALIST #2: EARNINGS

Earnings growth has stalled in early 2015, but we continue to see earnings as a key driver of our positive stock market view. Earnings are expected to drop 3% year over year during the first quarter of 2015 (according to Thomson Reuters), with the weakness driven almost entirely by two factors: the drop in oil prices and the strong U.S. dollar. Falling oil prices have led to a roughly 30% reduction in S&P 500 energy sector estimates during each of the past two quarters, and consensus estimates currently reflect a 63% year-over-year drop in energy sector earnings during the first quarter of 2015. We estimate the drag on overall S&P 500 profits from energy sector earnings during the first quarter of 2015 to be roughly 4 – 5%.

S&P 500 companies generate roughly 35 – 40% of revenue overseas overall, so the drag on revenue earned in foreign currencies when the dollar is strong can be significant (companies’ hedging activities and costs incurred overseas help mitigate some of this impact). We estimate that currency represented a roughly 3% drag on S&P 500 earnings during the fourth quarter of 2014, based on a 9% rise in the dollar during that quarter versus the year-ago period (Q4 2013). The first quarter of 2015 is not yet over, but the increase in the dollar during this quarter versus the prior-year period could end up at about twice the amount of last quarter’s move, should the dollar remain at its March 27, 2015, level for the last two days of the quarter. As a result, a 6% drag on earnings from currency in the first quarter of 2015 is a reasonable expectation.

We expect market participants to see these two earnings drags as mostly temporary and look beyond them to better earnings growth later this year. A slower U.S. dollar ascent (or even a pullback), potentially higher oil prices (our expectation), reduced costs for energy producers, and additional fuel cost savings all combine to provide what we believe represents potential upside to significantly lowered earnings estimates. (Look for a first quarter 2015 earnings preview in the April 6, 2015, edition of the Weekly Market Commentary.)

SEMIFINALIST #3: TECHNICALS

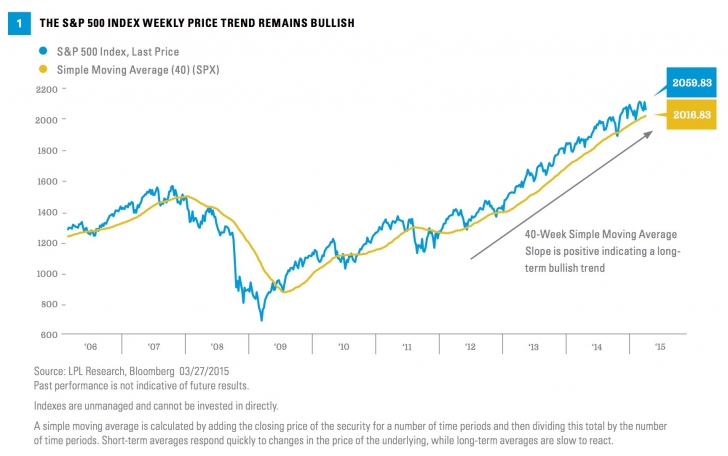

Stocks, as represented by the S&P 500 Index (SPX), have remained in a solid uptrend and support our positive technical view. We use technical analysis as a way to gauge stock market direction and investor sentiment. One simple way to identify trends is by using the slope of the 40-week (or 200-day) simple moving average: If it is positive, the long-term trend indicates bullishness; if it is negative, the long-term trend indicates bearishness. Another way to assess trends is by identifying if the index is forming a series of higher highs and higher lows (a bullish trend) or a series of lower highs and lower lows (a bearish trend). Since January 2012, the S&P 500 Index weekly price chart has exhibited an upward-sloping 40-week simple moving average and made a series of higher highs and higher lows, indicating a long-term bullish trend may remain in place for U.S. equities [Figure 1].

We do not believe investor sentiment is overextended based on the American Association of Individual Investors bull-bear survey from March 27, 2015. The latest reading of 38% bulls is right in-line with the long-term average. Investors’ margin balances are on the high side and could suggest a bit of overenthusiasm, but margin debt as a percentage of total stock market value remains reasonable at about 2% (based on New York Stock Exchange data as of January 31, 2015), in-line with the five-year average, and is cheap to service because of low borrowing rates. This amount of margin debt has not derailed this bull market in recent years and we do not expect to do so this year.

SEMIFINALIST #4: VALUATIONS

Valuations are above average and a reason to approach the stock market with some caution after such a powerful six-year bull market. Based on Thomson Reuters data, the S&P 500 trailing price-to-earnings ratio (PE) ratio is 17.5, whereas the forward PE based on the next year of estimates is 17.0. At these levels, valuations are slightly rich, but not high enough for us to change our positive outlook for U.S. stocks for 2015. Valuations have historically not been a reliable predictor of shorter-term stock market performance over periods such as a year, while low interest rates, low inflation, and a lack of attractive investment alternatives help justify a modest valuation premium.

Semifinal Matchup #1

Economy vs. Earnings

Key Factor: Earnings

Earnings are poised to improve later this year from the temporary energy- and dollar-related weakness. The earnings signal from the Institute for Supply Management (ISM) Manufacturing Index remains positive and estimates appear achievable. The U.S. economy may potentially improve along with earnings, but we think the underlying earnings power of corporate America after stripping out temporary factors is pretty good. Excluding the energy sector, based on Thomson data, the average earnings growth for the other nine S&P sectors is 2.7%, despite the significant drag from the strong dollar. For those concerned that the first quarter softness in earnings may spell trouble for stocks, similar periods of earnings weakness in 1986, 1998, and 2012 came during strong years for S&P 500 performance.

Semifinal Matchup #2

Valuations vs. Technicals

Key Factor: Technicals

Valuations are above average and a reason for some caution, so they lose the matchup against strong technicals. Momentum for the S&P 500 remains strong, and until we see technical evidence to the contrary, we would prefer a “buy-the-dip” strategy.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes.

Championship

Earnings vs. Technicals

Key Factor: Earnings

This is a very close call but reflects our belief in the classic investing adage that earnings drive stock prices. The ongoing bull market has been supported by a 133% increase in S&P 500 profits since 2009. The technical picture remains positive in our view, but the underlying earnings power of corporate America should carry the day. As we wrote in our Outlook 2015: In Transit, we expect earnings to do much of the heavy lifting in driving stock market gains in 2015. Although earnings growth may be back-end loaded, we expect improving earnings throughout 2015 as some of the temporary drags reverse, and prospects for accelerating growth entering 2016 to keep this bull market going.

Read/Download the original report below or here:

Weekly Market Commentary 03302015

Copyright © LPL Financial