by Don Vialoux, EquityClock.com

Pre-opening Comments for Monday February 23rd

U.S. equity index futures were lower this morning. S&P 500 futures were down 4 points in pre-opening trade.

Valeant has reached an agreement to purchase Salix for $158 cash per share. Value of the deal is US $14.5 billion. Valeant gained $12.75 to $186.01. Salix slipped $1.45 to $156.40.

Boeing slipped $3.31 to $155.00 after Goldman Sachs downgraded the stock to Sell.

Quest Diagnostics dropped $0.92 to $70.85 after Bank of America downgraded the stock to Underperform.

Enerplus dropped $0.21 to $10.58 after Bank of America downgraded the stock to Neutral.

Intel added $0.03 to $34.44 after BNP Paribas initiated coverage with an Outperform rating.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2015/02/22/stock-market-outlook-for-february-23-2015/

Economic News This Week

January Existing Home Sales to be released at 10:00 AM EST on Monday are expected to slip to 4.95 million units from 5.04 million units in December

December Case/Shiller 20 City Home Price Index to be released at 9:00 AM EST on Tuesday is expected to remain unchanged from November with a year-over-year gain of 4.3%.

February Consumer Confidence to be released at 10:00 AM EST on Tuesday is expected to slip to 99.3 from 102.9 in January.

Federal Reserve Chairman Janet Yellen testifies before the Senate Finance Committee at 10:00 AM EST on Tuesday and before the House Committee at 10:00 AM on Wednesday.

January New Home Sales to be released at 10:00 AM EST on Wednesday are expected to slip to 471,000 from 481,000 in December

Weekly Initial Jobless Claims to be released at 8:30 AM EST on Thursday are expected to increase to 290,000 from 283,00 last week

January Consumer Prices to be released at 8:30 AM EST on Thursday are expected to fall 0.4% versus a drop of 0.6% in December. Excluding food and energy, CPI is expected to increase 0.1% versus no change in December.

January Durable Goods Orders to be released at 8:30 AM EST on Thursday are expected to increase 1.8% versus a 3.3% decline in December. Excluding transportation, January Orders are expected to increase 0.6% versus a 0.8% decline in December.

Canadian January Consumer Prices to be released at 8:30 AM EST on Thursday are expected to drop 0.7% versus a 0.3% decline in December.

Second estimate of fourth quarter real GDP to be released at 8:30 AM EST on Friday is expected to drop to an annualized rate of 2.1% versus a 2.6% first estimate.

February Chicago PMI to be released at 9:45 AM EST on Friday is expected to slip to 58.0 from 59.4 in January.

February Michigan Sentiment Index to be released at 10:00 AM EST on Friday is expected to improve to 93.8 from 93.6 in January.

January Pending Home Sales to be released at 10:00 AM EST on Friday are expected to increase 2.2% versus a 3.7% decline in January.

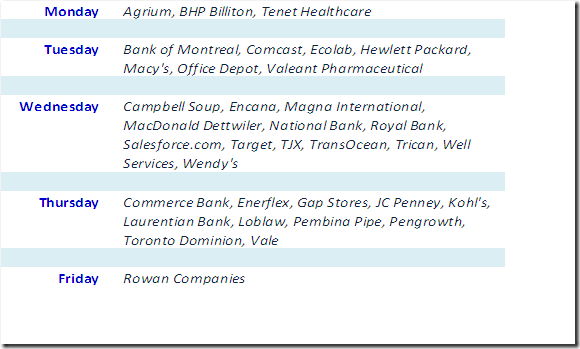

Earnings News This Week

The Bottom Line

Investor sentiment following virtual completion of the fourth quarter earnings report season remains positive. Equity prices are moving higher and flow of funds moves from bonds and interest sensitive equities to economic sensitive equities and equities outside of North America. Weather and labour disputes are short term negatives that will increase volatility in North American equity markets. However, they too will pass by spring. The stage is set for a volatile, but positive move in economic sensitive North American and international equity prices into this summer.

Equity Trends

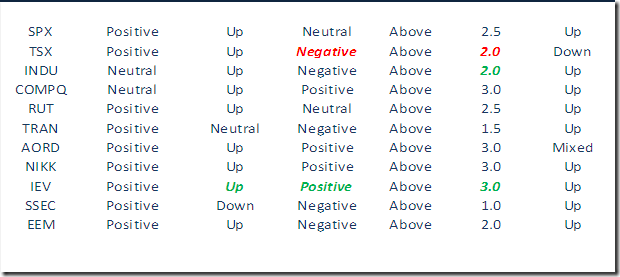

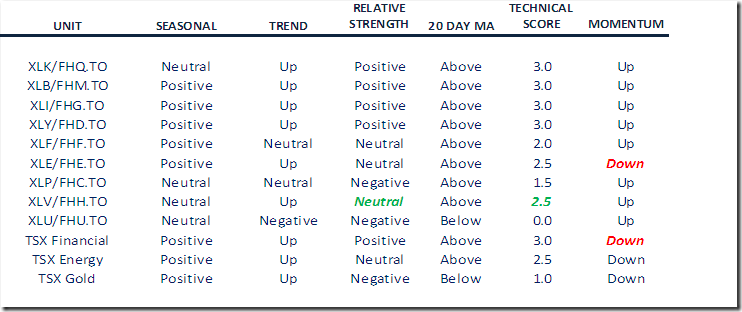

Daily Seasonal/Technical Equity Trends for February 20th

Green: Increase from the previous day

Red: Decrease from the previous day

The S&P 500 Index gained 13.31 points (0.63%) last week with virtually all of the gain coming late Friday on news of an extension of agreement between Greece and the Eurozone. Intermediate uptrend was confirmed on Friday when the Index closed at an all-time high. The Index remains above its 20 day moving average. Short term momentum indicators are trending up, but are overbought.

Percent of S&P 500 stocks trading above their 50 day moving average increased last week to 77.40% from 72.80%. Percent is trending up, is intermediate overbought, but has yet to show signs of peaking.

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 78.00% from 76.20%. Percent continues to trend higher, is intermediate overbought, but has yet to show signs of peaking.

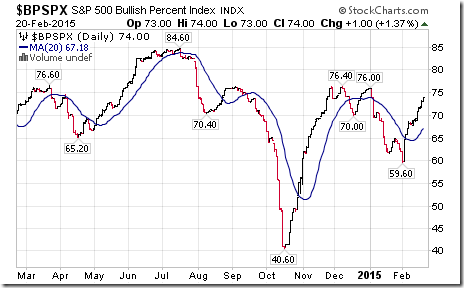

Bullish Percent Index for S&P 500 stocks increased last week to 74.00% from 70.80% and remained above its 20 day moving average. The Index continues to trend higher, is intermediate overbought, but has yet to show signs of peaking.

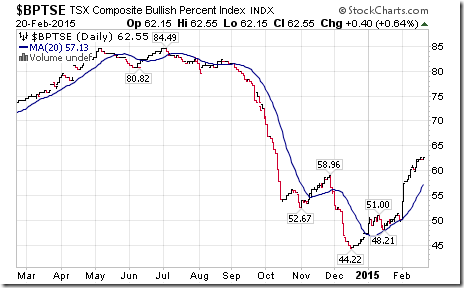

Bullish Percent Index for TSX Composite stocks increased last week to 62.55 from 62.15 and remained above its 20 day moving average. The Index continues to trend higher, is intermediate overbought, but has yet to show signs of peaking.

The TSX Composite Index slipped 92.57 points (0.61%) last week. Intermediate trend remains up (Score: 1.0). The Index remains above its 20 day moving average (Score: 1.0). Strength relative to the S&P 500 Index changed to Negative from Neutral (Score: 0.0). Technical score slipped to 2.0 from 2.5 out of 3.0. Short term momentum indicators are trending down.

Percent of TSX Composite stock trading above their 50 day moving average slipped last week to 73.60% from 77.60%. Percent is trending up, is intermediate overbought and showing early signs of peaking.

Percent of TSX Composite stocks trading above their 200 day moving average slipped last week to 46.80% from 47.20%. Percent remains in an intermediate uptrend, but showing early signs of stalling.

The Dow Jones Industrial Average added 121.09 points (0.67%) last week. Intermediate trend changed on Friday to Up from Neutral on a move above 18,103.45 to an all-time high. The Average remains above its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score improved to 2.0 from 1.5 out of 3.0. Short term momentum indicators are trending up, but are overbought.

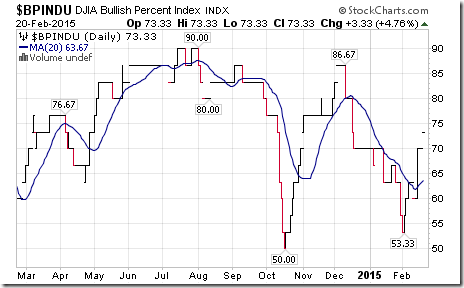

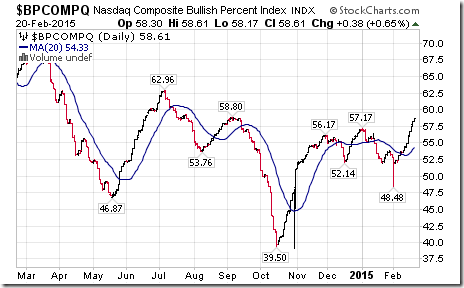

Bullish Percent Index for Dow Jones Industrial Average stocks increased last week to 73.33% from 70.00% and remained above its 20 day moving average. The Index remains intermediate overbought.

Bullish Percent Index for NASDAQ Composite stocks increased last week to 58.61% from 56.13% and remained above its 20 day moving average. The Index is trending higher, is intermediate overbought, but has yet to show signs of peaking.

The NASDAQ Composite Index gained another 121.09 points (1.27%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are trending up, but are overbought.

The Russell 2000 Index added 8.66 points (0.71%) last week. Intermediate trend is up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index remains Neutral. Technical score remains at 2.5 out of 3.0. Short term momentum indicators are trending up, but are overbought.

The Dow Jones Transportation Average gained 97.10 (1.07%) last week. Intermediate trend remains neutral. The Average remains above its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 1.5 out of 3.0. Short term momentum indicators are trending up, but are overbought.

The Australia All Ordinaries Composite Index added 10.13 points (0.17%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are mixed.

The Nikkei Average added 419.14 points (2.34%) last week. Intermediate trend changed to up from neutral on a move above 18,030.83. The Average remains above its 20 day moving average. Strength relative to the S&P 500 Index changed to positive from neutral. Technical score improved to 3.0 from 2.0. Short term momentum indicators are trending up and are overbought.

iShares Europe 350 units gained $0.81 (1.82%) last week. Intermediate trend changed to up from neutral on Friday on a move above $45.01. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index changed to positive from neutral on Friday. Technical score improved to 3.0 from 2.0 out of 3.0. Short term momentum indicators are trending up, but are overbought.

The Shanghai Composite Index added 43.08 points (1.34%) on Monday and Tuesday last week. Chinese equity markets are closed for the Chinese New Year until next Wednesday. Intermediate trend remains down. The Index moved above its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score improved to 1.0 from 0.0 out of 3.0. Short term momentum indicators are trending up.

iShares Emerging Markets was unchanged last week. Intermediate trend remains up. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 2.0 out of 3.0. Short term momentum indicators are trending up.

Currencies

The U.S. Dollar Index added 0.21 (0.22%) last week. Intermediate trend remains up. The Index remains below its 20 day moving average. Short term momentum indicators are trending down.

The Euro slipped 0.23 (0.20%) last week. Intermediate trend remains down. The Euro remains above its 20 day moving average. Short term momentum indicators are trending up.

The Canadian Dollar fell US 0.47 cents (0.59%) last week. Intermediate trend remains down. The Canuck Buck remains below its 20 day moving average. Short term momentum indicators are trending up, but showing early signs of rolling over.

The Japanese Yen slipped 0.21 (0.25%) last week. Intermediate trend remains down. The Yen remains below its 20 day moving average. Short term momentum indicators are mixed.

Commodities

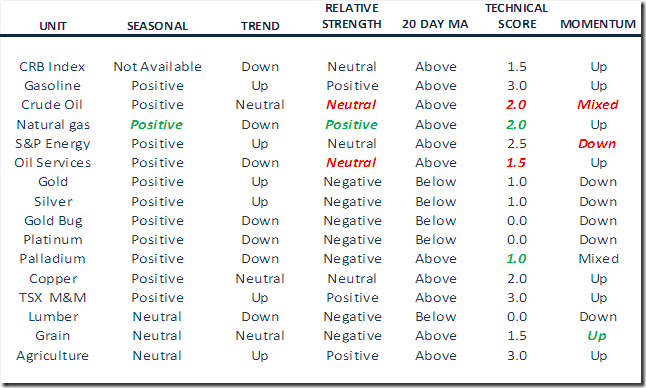

Daily Seasonal/Technical Commodities Trends for February 20th

The CRB Index fell 2.72 points (1.20%) last week. Intermediate trend remains down. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index remains neutral. Technical score remains at 1.5 out of 3.0. Short term momentum indicators are trending up

Gasoline added $0.01 per gallon (0.61%) last week. Intermediate trend remains up. Gas remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are trending up.

Crude Oil fell $1.97 per barrel (3.73%) last week. Intermediate trend remains neutral. Crude remains above its 20 day moving average. Strength relative to the S&P 500 Index changed to neutral from positive. Technical score slipped to 2.0 from 2.5 out of 3.0. Short term momentum indicators are mixed.

Natural Gas gained $0.15 per MBtu (5.36%) last week. Intermediate trend remains down. “Natty” remains above its 20 day moving average. Strength relative to the S&P 500 Index changed to positive from neutral. Technical score improved to 2.0 from 1.5 out of 3.0. Seasonal influences on a real and relative basis turn positive this week. Short term momentum indicators are trending up.

The S&P Energy Index fell 14.33 points (2.37%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index changed to neutral from positive. Technical score slipped to 2.5 from 3.0 out of 3.0. Short term momentum indicators have just rolled over from overbought levels and are trending down.

The Philadelphia Oil Services Index slipped 0.42 (0.21%) last week. Intermediate trend remains down. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index remains neutral. Technical score remained at 1.5 out of 3.0. Short term momentum indicators are trending up.

Gold fell $22.20 per ounce (1.81%) last week. Intermediate trend remains up. Gold remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 1.0 out of 3.0. Short term momentum indicators are trending down.

Silver dropped $1.02 per ounce (5.90%) last week. Intermediate trend remains up. Silver remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 1.0 out of 3.0. Short term momentum indicators are trending down. Strength relative to gold remains negative.

The AMEX Gold Bug Index dropped another 6.59 points (3.45%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are trending down. Strength relative to Gold remains negative.

Platinum dropped $38.00 per ounce (3.15%) last week. Intermediate trend changed to down from up on a move below $1175.60. PLAT remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Relative to Gold: negative.

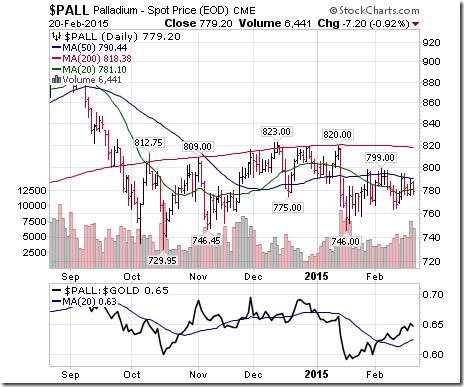

Palladium dropped $15.25 per ounce (0.77%) last week. Trend is down. PALL fell below its 20 day MA. Strength relative to the S&P 500 Index: negative. Relative to Gold: positive.

Copper slipped $0.02 per lb. (0.77%) last week. Intermediate trend remains neutral. Copper remains above its 20 day moving average. Strength relative to the S&P 500 Index remains neutral. Technical score remained at 2.0 out of 3.0. Short term momentum indicators are trending up

The TSX Metals & Mining Index added 6.08 points (0.88%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are trending up.

Lumber dropped $8.70 (2.79%) last week. Trend remains down. Lumber remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Score: 0.0.

The Grain ETN slipped $0.43 (1.12%) last week. Intermediate trend remains neutral. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 1.5 out of 3.0. Short term momentum is mixed.

The Agriculture ETF added $0.68 (1.23%) last week. Intermediate trend remains up. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index changed to positive from neutral. Technical score improved to 3.0 from 2.5 out of 3.0. Short term momentum indicators are trending up.

Interest Rates

The yield on 10 year Treasuries increased 11.2 basis points (5.54%) last week. Intermediate trend remains down. Yield remains above its 20 day moving average. Short term momentum indicators are trending up, but are overbought.

Conversely, price of the long term Treasury ETF dropped $1.65 (1.29%) last week. Price remains below its 20 day moving average.

Other Issues

The VIX Index fell 0.39 (2.65%) last week. Intermediate trend remains up. The Index remains below its 20 day moving average.

Economic news this week is expected to show a slowing in U.S. economic growth.

Economic focus is on Janet Yellen’s testimonies on Tuesday and Wednesday. When will U.S. administered rates start to normalize?

Earnings reports this week will focus on U.S. retailers and Canadian banks.

Short term momentum indicators (mainly momentum, but also breakouts late last week by the Dow Jones Industrial Average and selected sectors) are overbought for most equity indices and sectors, but have yet to show signs of peaking.

Ditto for intermediate technical indicators (e.g. Percent of stocks trading above their 50 day moving average)!

The last week in February historically has been one of the weakest weeks in the year. It is followed by the strongest two month period in the year.

International uncertainties remain on the radar screen, most notably in Ukraine and Greece. News late on Friday of a four month extension between Greece and the Euro Group was mildly encouraging. Flash PMI reports from China at mid-week could impact markets.

Seasonal influences turn positive for economic sensitive sectors (Consumer Discretionary, Financials, Industrials, Materials) late in February and remain positive until early May, particularly during U.S. President Pre-election years.

Colder than average weather in eastern North America and the U.S. port strike on the West Coast are slowing North American economic activity in the first quarter. Both are temporary and set the stage for a rebound in economic activity in spring.

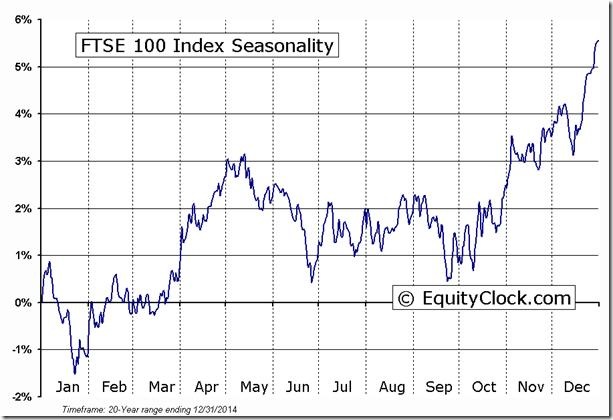

Technical evidence of an intermediate peak in the U.S. Dollar Index in mid-January and an intermediate peak in U.S. Treasury prices at the end of January continue to grow. Both encourage a flow away from Treasuries and a flow into equities (particularly equities outside of the U.S. : European and Far East equity markets continue to substantially outperform North American equity markets).

Sectors

Daily Seasonal/Technical Sector Trends for February 20th

StockTwits Released on Friday @equityclock

Despite build in Gasoline inventories, days of supply suggests that supply and demand may be converging $RB_F

Technical action by S&P 500 stocks to 10:15 AM: Quiet. Breakouts: $LH, $INTU, $NEM. Breakdown: $IRM

Selected gold stocks: $NEM and $ABX.CA are breaking intermediate resistance levels this morning.

Technical Action by Individual Equities and ETFs on Friday

After 10:15 AM and near the close, the following S&P 500 stocks broke above intermediate resistance levels: JWN, ROST, ANTM, ZMH, DG, GD, MMM and EBAY. None broke support.

No TSX 60 stocks other than Barrick broke resistance on Friday.

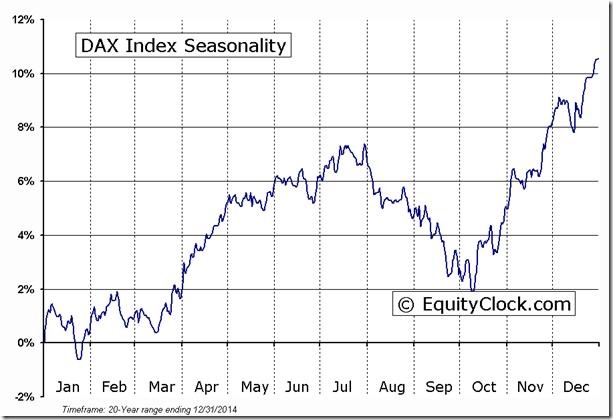

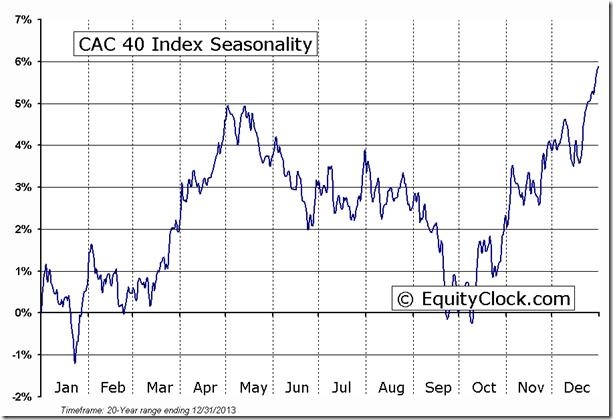

European ETFs trading in U.S. Dollars were notable on the list of breakouts in late trading on Friday: iShares EMU (EZU), iShares Europe 350 (IEV), iShares Germany (EWG) and iShares Italy (EWI).

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Below are examples:

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

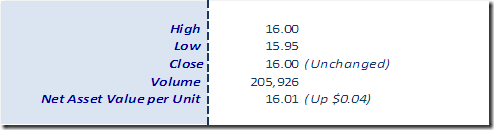

Horizons Seasonal Rotation ETF HAC February 20th 2015

Copyright © Don Vialoux, EquityClock.com