by Don Vialoux, EquityClock.com

U.S. equity index futures were mixed this morning. S&P 500 futures were down 2 points in pre-opening trade. Investors are waiting for FOMC meeting minutes to be released at 2:00 PM EST today.

Index futures were virtually unchanged following release of economic news at 8:30 AM EST. Consensus for January U.S. housing starts was a decline to 1,073,000 from 1,087,000 in December. Actual was a drop to 1,065,000. Consensus for January Producer Prices was a fall of 0.4% versus a drop of 0.3% in December. Actual was decline of 0.8%. Excluding food and energy, consensus for January PPI was an increase of 0.1% versus a gain of 0.3% in December. Actual was a drop of 0.1%.

Bank of Montreal launched coverage on the oil services sector. Stocks with an Outperform rating include Baker Hughes, Cameron International, Halliburton and Schlumberger.

Valero (VLO $58.73) is expected to open higher after Credit Suisse upgraded the stock to Outperform.

Northrop Grumman fell $1.50 to $166.10 after Bernstein downgraded the stock to Market Perform.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2015/02/17/stock-market-outlook-for-february-18-2015/

Note comments on the Euro, 30 year Treasuries and possible rotation from bonds to equities.

Interesting Charts

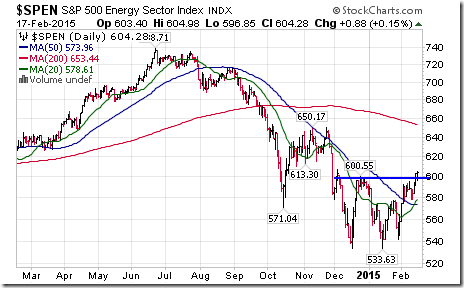

The S&P Energy Index completed a double bottom pattern yesterday.

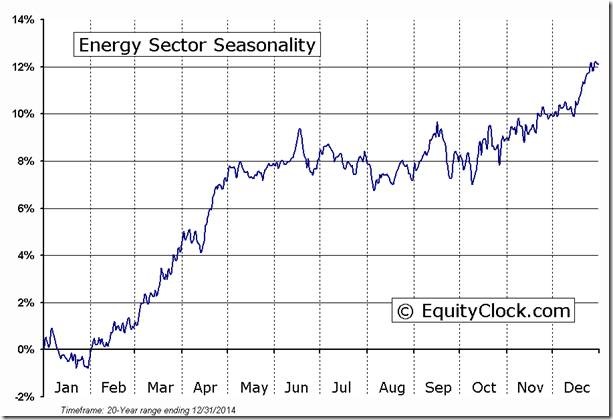

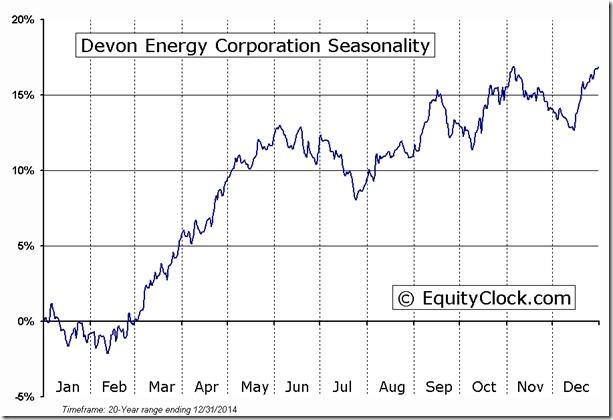

‘Tis the season for strength in the U.S. energy sector!

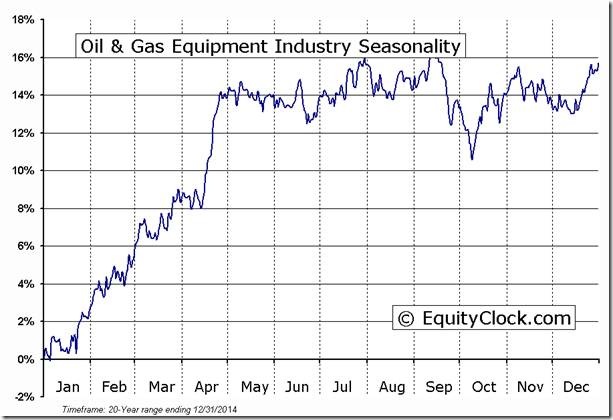

The U.S oil services sector (i.e. the U.S. energy sector on steroids) has a similar technical profile and is outperforming the U.S. Energy sector:

‘Tis the season for the oil services sector!

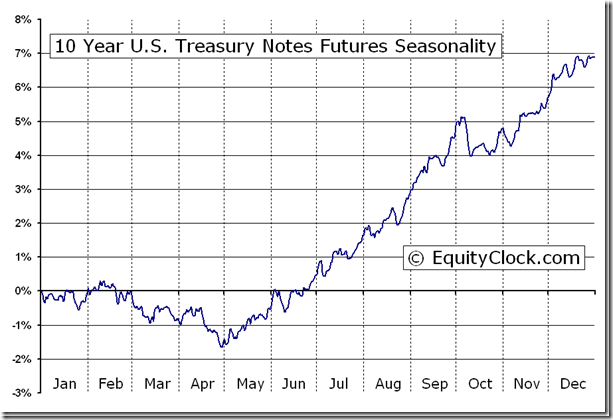

More technical evidence that the U.S. interest rates have passed their peak! The price of 7-10 year Treasuries remains under pressure. Yesterday, price fell below its 50 day moving average.

‘Tis the season for weakness in U.S. Treasury prices!

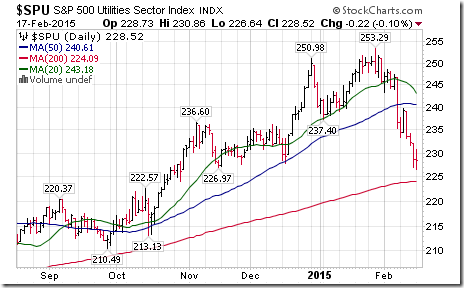

U.S. utility stocks are responding to higher interest rates. CMS and EIX joined the list of S&P Utilities that broke support yesterday. Yesterday, the S&P Utilities Index broke another support level at 226.97.

StockTwits released yesterday @equityclock

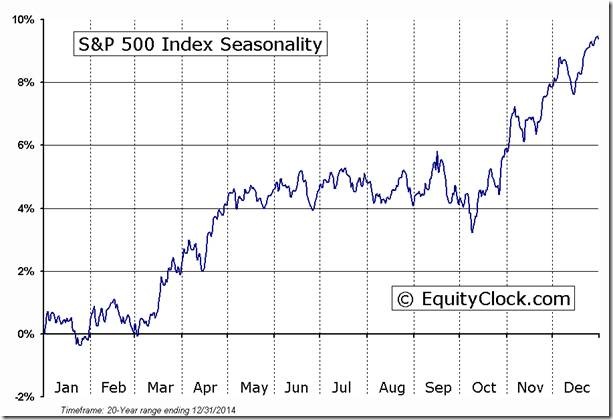

Over the last 20 years the S&P 500 Index has dropped an average of 1.15% between February 16th and March 2nd

Technical action by S&P 500 stocks to 10:15: Bullish. Breakouts: $COH, $HOT, $MAR, $MDT, $WM, $CSC. Breakdowns: $CMS, $EIX

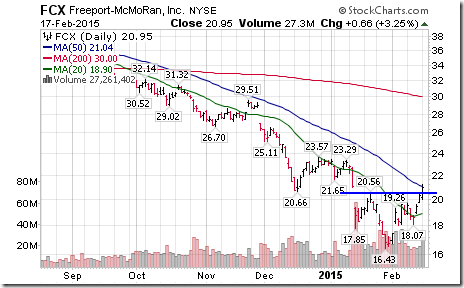

Nice breakout above a double bottom pattern by base metal stocks and related ETFs: $ZMT.CA. ‘Tis season for strength!

Editor’s note: Freeport McMoran Copper and Gold led the advance.

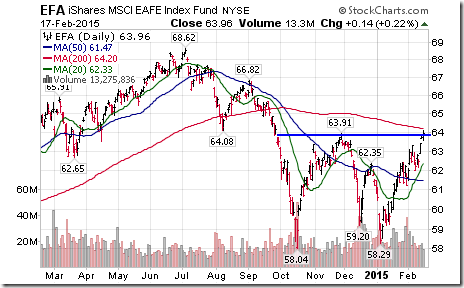

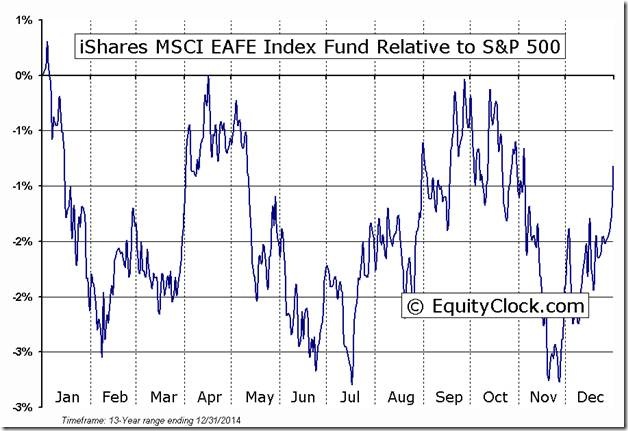

$EFA completed at double bottom pattern by moving above $63.91.

‘Tis the season for EAFA relative to the S&P 500 Index!

Technical Action by Individual Equities Yesterday

After 10:15 AM another seven S&P 500 stocks broke resistance: IGT, ABT, WM, FCX, SYK, LNC and ADI. None broke support.

Among TSX 60 stocks, Loblaw touched an all-time high. Silver Wheaton led precious metal stocks on the downside by breaking below support.

Trader’s Corner

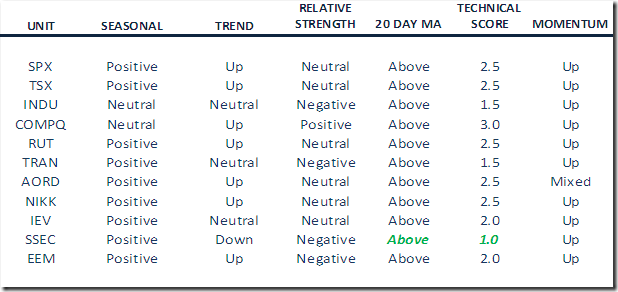

Daily Seasonal/Technical Equity Trends for February 17th

Green: Increase from the previous day

Red: Decrease from the previous day

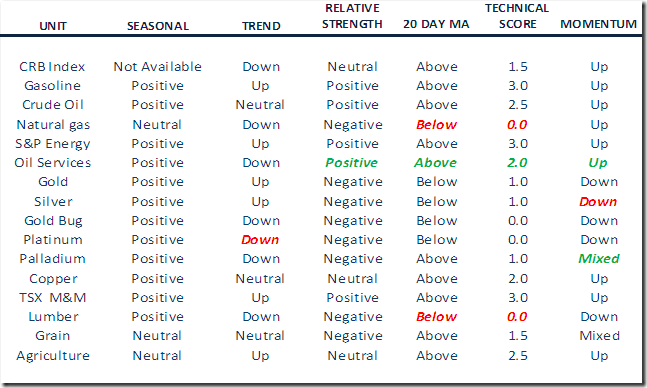

Daily Seasonal/Technical Commodities Trends for February 17th

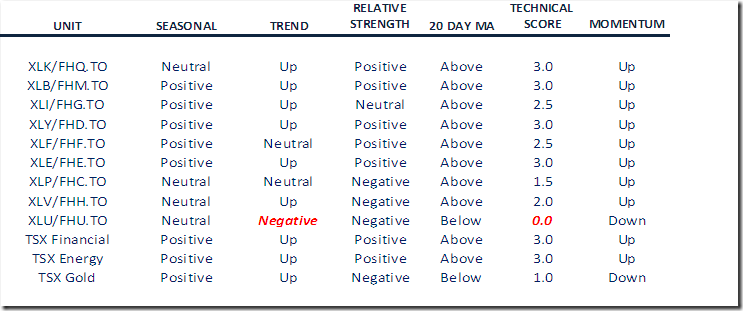

Daily Seasonal/Technical Sector Trends for February 13th

FP Trading Desk Headline

FP Trading Desk headline reads, “Unwinding of U.S. Dollar Trade should boost oil prices”. Following is a link:

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Below is an example:

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

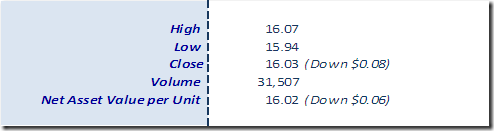

Horizons Seasonal Rotation ETF HAC February 17th 2015

| Sponsored By... |

2 Responses to “Tech Talk for Wednesday February 18th 2015”

Leave a Reply

Copyright © Don Vialoux, EquityClock.com

February 18th, 2015 at 9:54 am I see Don commenting on BMO starting coverage on the Oil and Gas service sector. Does this mean they will have a O & G service sector ETF?

February 18th, 2015 at 10:58 am Dave/AB,

Re #1 – That would be nice. I don’t know of any Canadian ETF like that.